As per the latest statistics, around million was paid as fees to conduct transactions on the Ethereum network. That works out to be approximately 18,300 ETH. What is driving this humongous spike in gas fees? Research shows that it is due to the booming ‘yield farming’ craze.Gas Fees Tops Million Led By Massive Transaction DemandAs per data from Glassnode, transaction fees paid on the Ethereum network topped million recently (read August 13, 2020).This is a new all-time high level for daily fees on the world’s second-largest cryptocurrency network. The last gas spike happened more than two years back in January 2018, the peak of 2017’s bull market.Daily Transaction Fees: Bitcoin vs. Ethereum, Source: GlassnodeOne may wonder about the supposed reason that’s catalyzing the

Topics:

Himadri Saha considers the following as important: AA News, COMPBTC, COMPUSD, defi, ETHBTC, ethusd, MKRBTC, MKRUSD, uniswap

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

As per the latest statistics, around $8 million was paid as fees to conduct transactions on the Ethereum network. That works out to be approximately 18,300 ETH. What is driving this humongous spike in gas fees? Research shows that it is due to the booming ‘yield farming’ craze.

Gas Fees Tops $8 Million Led By Massive Transaction Demand

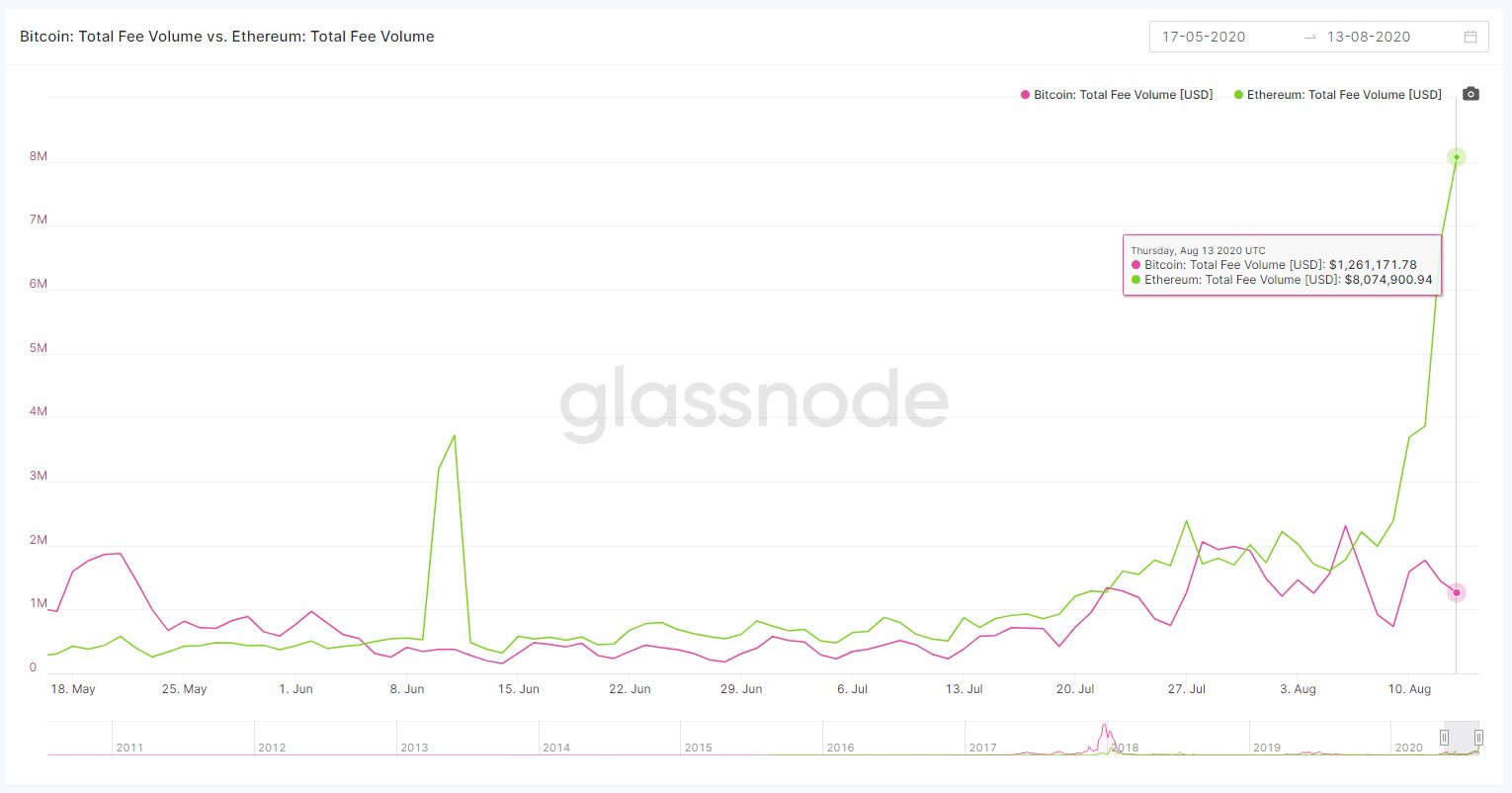

As per data from Glassnode, transaction fees paid on the Ethereum network topped $8 million recently (read August 13, 2020).

This is a new all-time high level for daily fees on the world’s second-largest cryptocurrency network. The last gas spike happened more than two years back in January 2018, the peak of 2017’s bull market.

One may wonder about the supposed reason that’s catalyzing the exponential surge in gas fees. The latest Glassnode Insights piece has revealed that it’s Ethereum’s huge transactional demand that’s pushing transfer cost numbers higher. But what’s the source of this demand?

Tether (USDT) Transactions

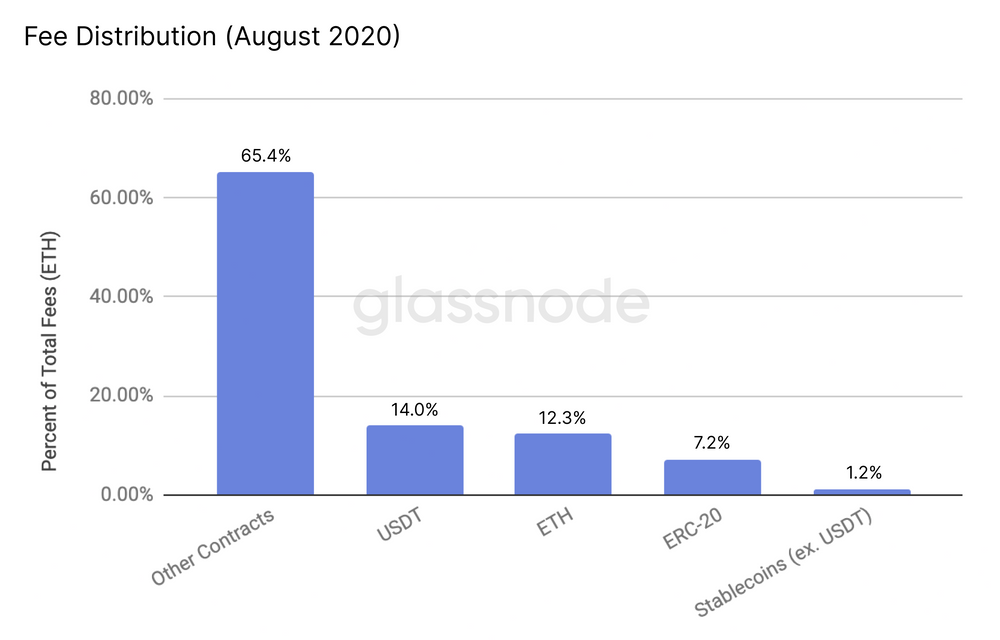

From the beginning of the year to date, US Dollar pegged stable coin, USDT’s market cap has grown threefold from $4 billion to a little above $12 billion. Tether holds the lead in Ethereum’s stablecoin space. And USDT transfers have accounted for 14 percent of all transaction fees in August.

All other stable coin transfers have just contributed to 1.2% of the gas fees. However, together this is less than than the quarter of the fees generated. Glassnode notes that “other contracts” (other than ERC-20 tokens and stablecoins) accounted for the lion’s share of transaction fees this month.

What ‘Other Contracts’?

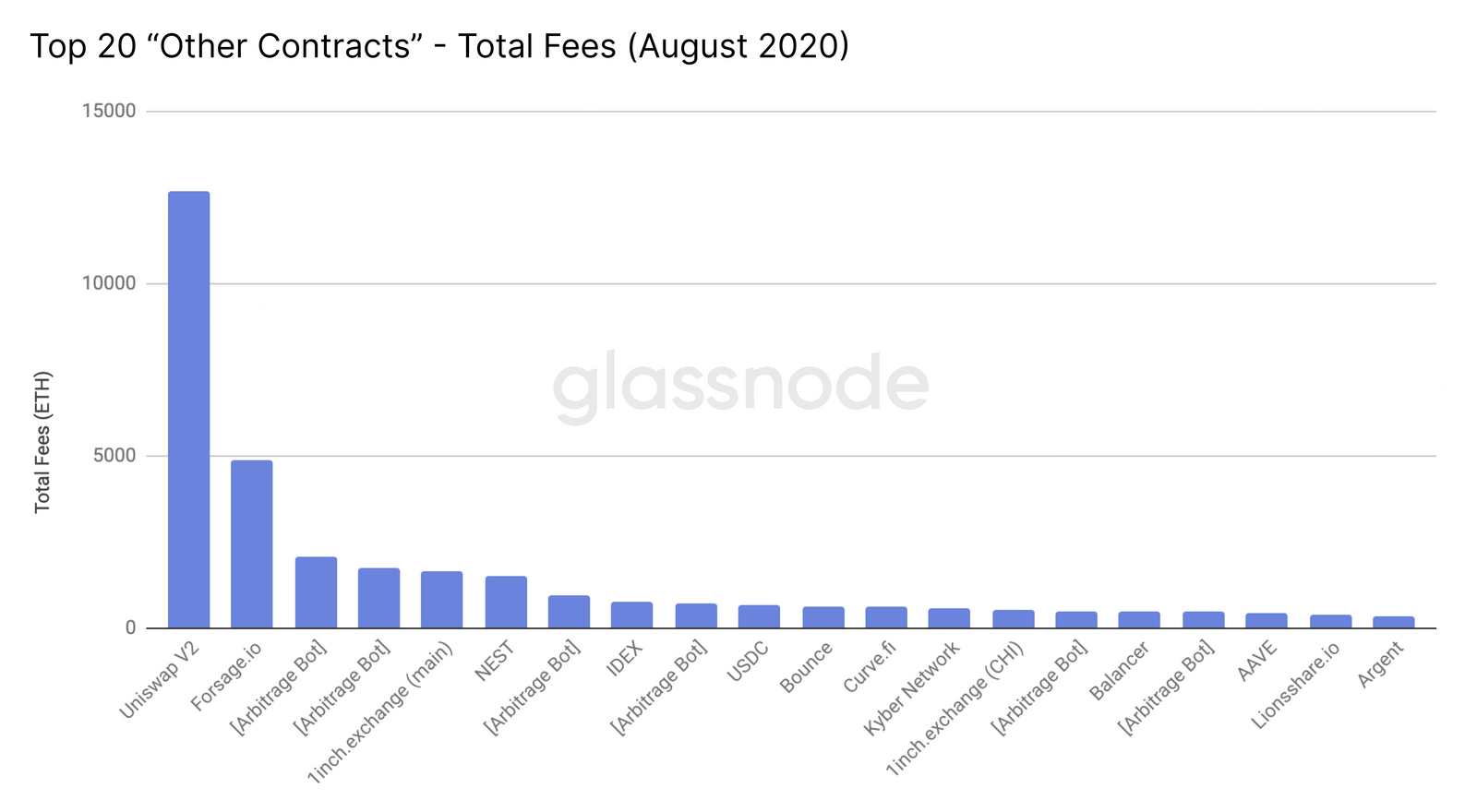

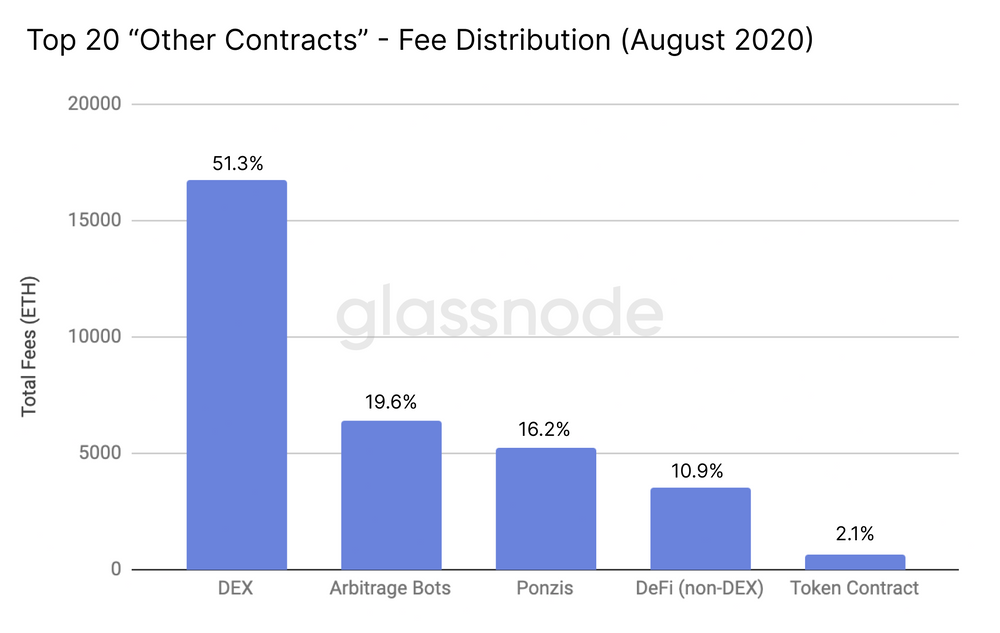

Amongst “other contracts” are all DeFi applications that have taken the cryptocurrency industry by storm. And amongst these DeFi applications are decentralized exchanges or DEXs that are the major ‘gas guzzlers’ in the Ethereum ecosystem. Most notably, Uniswap.

As per Glassnode’s observations, the spike in gas fees is not just because of token transfers. Smart contract applications such as staking, lending, and pooling require a massive amount of fees for performing their intended actions.

More Gas Guzzlers Other Than DeFi DEXs

Some Ethereum smart contract running applications are helping traders make money through arbitrage opportunities.

Their makers have not made the source code public. Still, from the similar patterns that the applications are displaying, they are most likely arbitrage bots buying and selling tokens mostly between Uniswap and Balancer. And how ‘gas-intensive’ ar these bots?

Glassnode notes that:

“… of the top 20 contracts this month, arbitrage bots make up for almost 20% of fees.”

Adding that:

“These suspected arbitrage bots in the top 20 have spent around USD$2.5 million worth of ETH on gas this month alone.”

Apart from this, Galssnode has found that trading opportunists are gaming the DeFi ecosystem by leveraging arbitrage opportunities in different stable coins to make insane profits, while nonchalantly paying high gas fees.

And ‘Ponzi Scheme’ Contracts

Ethereum based Ponzi schemes Forsage and Lionsshare are gas-intensive smart contracts that have contributed to around 16 percent of transaction fees paid.

As per Glassnode’s observations:

“Forsage.io was already the second-highest contract in terms of fees paid in 2020. At the time, however, it had contributed towards less than 3000 ETH in fees in the first 6 months of 2020. Now, it has contributed to nearly 5000 ETH in fees in the first 2 weeks of August alone, illustrating the sheer extent to which gas prices have increased.”

While the majority of the demand for Ethereum network usage may be coming from DeFi elements, default ‘account-to-account’ ETH transfers have also been observed to consume gas significantly.

Overall Glassnode observed that the surge in Ethereum transaction fees is because traders, investors, and yield farmers are anticipating the next bull market. This anticipation is, in turn, paving way for the massive demand in all Ethereum niches.