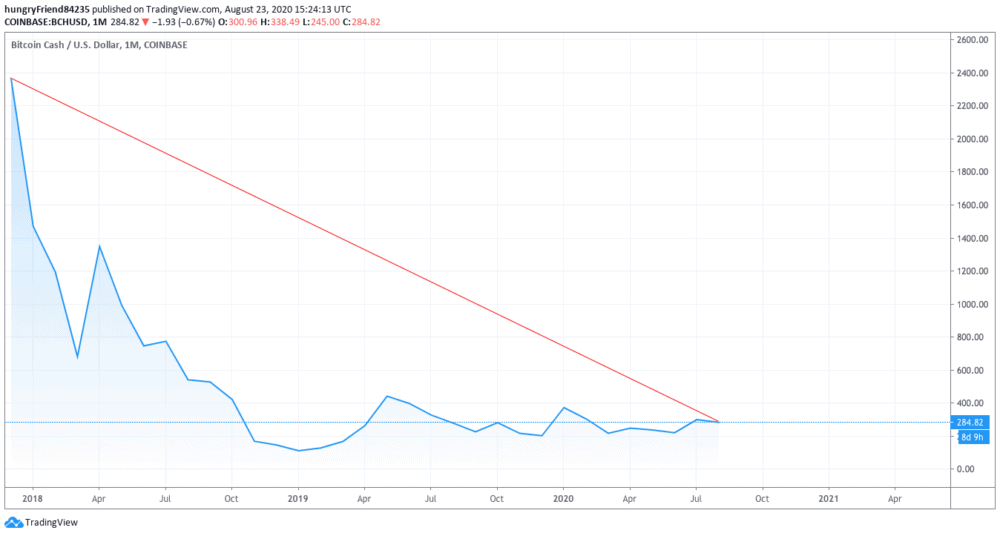

The cryptocurrency market valuation has almost doubled year to date. Then why are XRP and BCH, two of the top 10 cryptocurrencies, down by more than 90 percent since hitting ATH, while all other coins are posting high returns?Can it be attributed to diminishing investment interest and community support? Or perhaps, the increasing trust in public and genuinely decentralized blockchains like Bitcoin, Ethereum, etc.XRP, BCH Amongst Top 10 but Still Down Over 90 Percent From ATHDespite being in the top 10, XRP and BCH are still down more than 90 percent from their all-time high market prices of around and 00, respectively.XRPUSD is Down More Than 90 Percent from ATH, Source: TradingViewBCHUSD is Down More Than 90 Percent from ATH, Source: TradingViewIt is interesting to note that with a

Topics:

Himadri Saha considers the following as important: AA News, BCHBTC, bchusd, Bitcoin Cash, Bitcoin Cash (BCH) Price, Ripple (XRP) Price, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The cryptocurrency market valuation has almost doubled year to date. Then why are XRP and BCH, two of the top 10 cryptocurrencies, down by more than 90 percent since hitting ATH, while all other coins are posting high returns?

Can it be attributed to diminishing investment interest and community support? Or perhaps, the increasing trust in public and genuinely decentralized blockchains like Bitcoin, Ethereum, etc.

XRP, BCH Amongst Top 10 but Still Down Over 90 Percent From ATH

Despite being in the top 10, XRP and BCH are still down more than 90 percent from their all-time high market prices of around $2 and $2400, respectively.

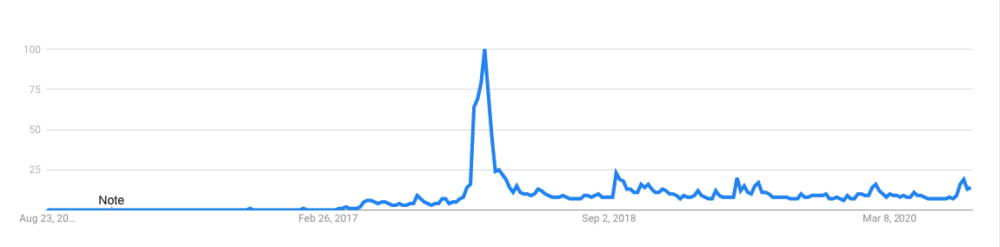

It is interesting to note that with a 32,000 percent raise and was one of the best performing cryptocurrencies of 2017. Ripple’s ‘decentralized token’ was so hot then, that CNBC hosted a show to help people buy ‘one of Bitcoin’s hottest competitors.

Bitcoin Cash (BCH), too, was hot out of a Bitcoin hard fork, and investors lapped up Roger Ver’s coin based on lofty promises made by the Bitcoin Jesus.

But then why were both these hotshot large-cap bluechip ‘cryptos’ unable to continue the rally or at least spike upwards in unison with the market recovery this year?

Fundamental Factors Have Been Forming Bearish ‘Ripples’ for XRP

Ex-Ripple founder Jed McCaleb has been dumping XRPs on the open market since he left Ripple. He received 5.3 billion XRP while leaving the company, and 100 billion XRP in September. This has caused a very unpleasant sentiment amongst investors in the XRP community.

In response, a significant portion of the community has jumped ships abandoning all support for XRP. According to recent data, around 64 percent of the ‘Ripple’ Telegram have left since June 2018.

Community Capitulation

(Whaleclub went private so it’s the most accurate number for existing members after 2017 bull run)

Member loss is from June 2018 till April 2020 pic.twitter.com/Cy19Nz0PoS

— Aztek_Ƀtc (@Aztek_btc) April 15, 2020

Also, in January this year, Ripple CEO Brad Garlinghouse hinted at an upcoming IPO for the company. This has left investors confused about the value of the XRP token.

Apart from this, XRP’s equivocal status as security (or not) has left investors disillusioned. Although, US Congressman Tom Emmer recently remarked about XRP not being a security, the same is not official.

Online interest regarding XRP has ceased to exist. Almost. Data from Google Trends show that search interest in XRP peaked during the asset’s market bullish stance from December 2017 – January 2018. But after that, it’s a lackluster show.

And What Went Wrong With Bitcoin Cash? Why is BCH Price Limping?

When Bitcoin Cash hard forked from Bitcoin, to improve upon and fulfill the former’s ‘original objective,’ just a few numbers of BCH could have been exchanged for one whole BTC. Those days are long gone.

Gradually the Bitcoin Cash ecosystem has depreciated in market value as well as overall health. Yassine Elmandjra, a crypto asset analyst, tweeted in May about the same.

Bitcoin Cash is not looking healthy:

-Hashrate down 30% since halving (& only accounts for ~2% of SHA256 hash)

-Economic throughput at all time lows

-Fees are .05% of miner rev (<$100/day)

-Theoretical 51% attack costs <$10k/hrSurprised we haven’t seen a large scale attack yet

— Yassine Elmandjra (@yassineARK) May 23, 2020

However, the cost/hour of a 51 percent attack has increased to $14,005 according to the latest data. Miners have been leaving the BCH mining system and switching over to Bitcoin.

This may have been accelerated by a 12.5 percent tax proposal put forward by a BCH ecosystem member. The proposal was annulled, but again it showed dissonance amongst the core administrative and developer teams.

Over the last three years, the altcoin has become heavily centralized and has not seen any significant development activity nor can be logically scaled to boost use cases, as per Adamant Capital founder, Tuur Demeester.

With XRP and BCH having lost more than 90 percent of their prices since 2017, is there still hope left for the two crypto coins in the future? Only time will tell. Holders of both cryptocurrencies should keep an eye out.