XRP saw a 1.5% price drop over the past week as the bulls failed to defend the %excerpt%.2 level, and failed to close above over the past three consecutive daily candlesAgainst Bitcoin, XRP continues its recovery attempt from the 2-year lows as it edges toward the 2200 SAT levelKey Support & Resistance LevelsXRP/USD:Support: %excerpt%.192, %excerpt%.18, %excerpt%.175.Resistance: %excerpt%.207, %excerpt%.215, %excerpt%.225.XRP/BTC:Support: 2100 SAT, 2070 SAT, 2022 SAT.Resistance: 2200 SAT, 2300 SAT, 2360 SAT.XRP/USD: XRP Losing The %excerpt%.2 LevelThe break beneath %excerpt%.2 has caused XRP to lose its long-lasting number 3 rank on the top cryptocurrencies by market cap to the USDT stablecoin. XRP currently holds an .79 billion market cap value while Tether is holding an .8 billion market cap as it takes over XRP. The battle is still

Topics:

Yaz Sheikh considers the following as important: Ripple (XRP) Price, XRP Analysis, xrpbtc, xrpusd

This could be interesting, too:

Dimitar Dzhondzhorov writes Is a Major Ripple v. SEC Lawsuit Development Expected This Week? Here’s Why

Mandy Williams writes Ripple Releases Institutional DeFi Roadmap for XRP Ledger in 2025

Dimitar Dzhondzhorov writes Ripple Whales Go on a Selling Spree: Is XRP Headed for a Further Correction?

Jordan Lyanchev writes ChatGPT and DeepSeek Analyze Ripple’s (XRP) Price Potential for 2025

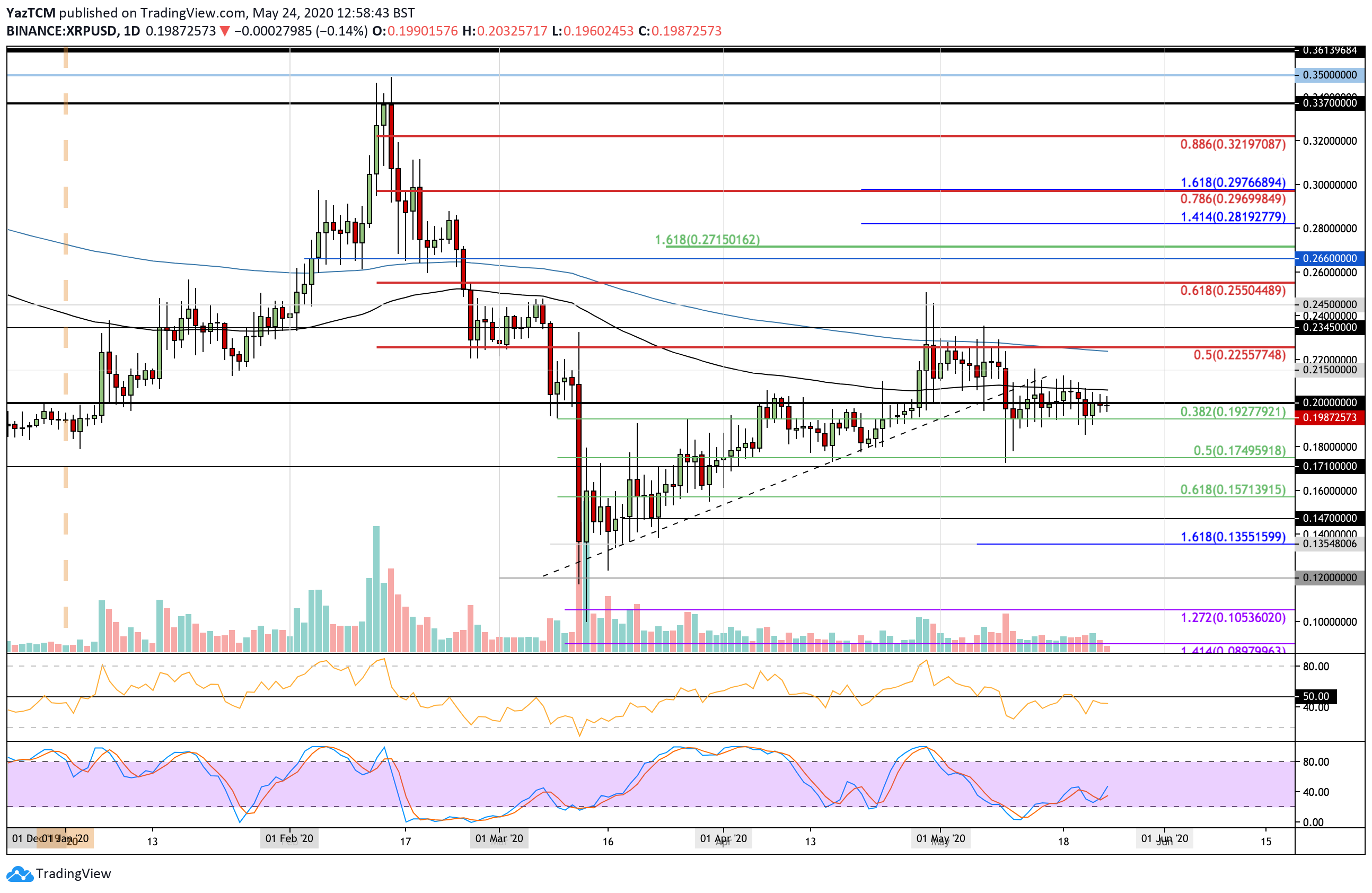

- XRP saw a 1.5% price drop over the past week as the bulls failed to defend the $0.2 level, and failed to close above over the past three consecutive daily candles

- Against Bitcoin, XRP continues its recovery attempt from the 2-year lows as it edges toward the 2200 SAT level

Key Support & Resistance Levels

XRP/USD:

Support: $0.192, $0.18, $0.175.

Resistance: $0.207, $0.215, $0.225.

XRP/BTC:

Support: 2100 SAT, 2070 SAT, 2022 SAT.

Resistance: 2200 SAT, 2300 SAT, 2360 SAT.

XRP/USD: XRP Losing The $0.2 Level

The break beneath $0.2 has caused XRP to lose its long-lasting number 3 rank on the top cryptocurrencies by market cap to the USDT stablecoin. XRP currently holds an $8.79 billion market cap value while Tether is holding an $8.8 billion market cap as it takes over XRP. The battle is still ongoing.

Since dropping beneath the 100-days EMA in May, XRP has failed to close back above the critical line for the past 14 days of trading. The coin has pretty much been trading sideways between $0.207 (100-days EMA) and $0.192 (.382 Fib Retracement) throughout this period. XRP must break this range to dictate the next direction.

XRP-USD Short Term Price Prediction

If the sellers do push lower, the first level of support can be found at $0.192 (.382 Fib Retracement). This support has prevented the coin from closing lower for the entire month of May and is considered to be quite a strong level. Beneath this, support lies at $0.18, $0.175 (.5 Fib Retracement level), and $0.171.

Further support is located at $0.157 (.618 Fib Retracement) and $0.147.

On the other hand, if the buyers can reclaim $0.2, the first level of strong resistance lies at $0.207 (100-days EMA). Above this, resistance is expected at $0.215, $0.225 (bearish .5 Fib Retracement & 200-days EMA), and $0.235.

The RSI is slightly beneath the 50 level, which shows weak bearish momentum within the market. If the RSI continues to fall, then XRP can be expected to drop into the $0.192 support or perhaps even below it.

XRP/BTC: Buyers Continue Rebound From 2-year Lows

Against Bitcoin, XRP is starting to look promising after being able to rebound from the 2-year low at the 2070 SAT level, earlier this week. The coin broke above the 2100 SAT level and has continued higher to edge toward the 2200 level as it currently trades at 2180 SAT.

A break beyond 2200 SAT should send XRP to push higher and head toward the May highs around 2500 SAT.

XRP-BTC Short Term Price Prediction

Once the buyers break 2200 SAT, resistance is located at 2300 SAT, 2360 SAT, and 2400 SAT. Further resistance is found at 2455 SAT, 2500 SAT, and 2600 SAT.

On the other hand, if the sellers push lower again, the first level of support is expected at 2100 SAT. Beneath this, support lies at 2070 SAT, 2022 SAT, and 1950 SAT.

The RSI is now trading at the 50 levels to indicate indecision within the market.