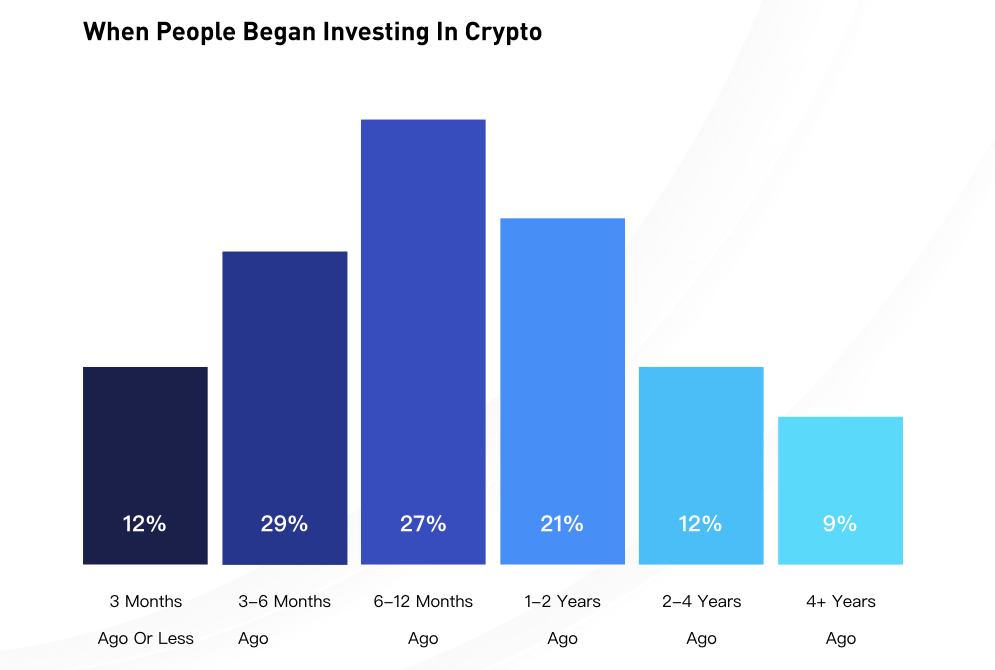

According to a research handled by the large digital asset platform Huobi Group, nearly 7 in 10 crypto holders entered the market in 2021. Despite the rising interest in the asset class, approximately 25% of the participants believe “it’s all a scam/bubble,” which is going to collapse, the survey estimated. 7 in 10 Entered The Crypto Ecosystem Last Year Huobi’s poll consisted of more than 3,000 people. The company conducted it in mid-December 2021, while the results were released on January 13. Nearly every third participant admitted they are currently crypto holders. A deeper analysis revealed that the vast majority (68%) began investing last year. In comparison, only 9% said they jumped on the crypto bandwagon more than four years ago. Huobi Chart, Source: Huobi Group46%

Topics:

Dimitar Dzhondzhorov considers the following as important: AA News, BTCEUR, BTCGBP, btcusd, btcusdt, huobi, social, Survey

This could be interesting, too:

Wayne Jones writes Beyond Hacks: Vitalik Buterin Calls for Wallet Solutions to Address Crypto Loss

Chayanika Deka writes Internal Conflict at Thorchain as North Korean Hackers Leverage Network for Crypto Laundering

Chayanika Deka writes Consensys and SEC Reach Agreement to Dismiss MetaMask Securities Case

Chayanika Deka writes Meme Coins Do Not Qualify as Securities: SEC Confirms

According to a research handled by the large digital asset platform Huobi Group, nearly 7 in 10 crypto holders entered the market in 2021. Despite the rising interest in the asset class, approximately 25% of the participants believe “it’s all a scam/bubble,” which is going to collapse, the survey estimated.

7 in 10 Entered The Crypto Ecosystem Last Year

Huobi’s poll consisted of more than 3,000 people. The company conducted it in mid-December 2021, while the results were released on January 13.

Nearly every third participant admitted they are currently crypto holders. A deeper analysis revealed that the vast majority (68%) began investing last year. In comparison, only 9% said they jumped on the crypto bandwagon more than four years ago.

46% of investors revealed they had allocated $1,000 or less in the asset class. At the same time, 25% admitted investing between $1,000 and $10,000.

Awareness about the emerging trends is also on a high level. More than 50% of participants said they had heard of non-fungible tokens (NFTs) and the Metaverse, while 25% are aware of Decentralized Finance (DeFi).

While most crypto owners from the survey support the statement that digital assets may transform the definition of money, many skeptics of the asset class outlined a gloomy future. 42% view cryptocurrencies as “too risky,” and 34% are concerned about the lack of comprehensive regulations in the space.

Interestingly, every fourth participant opined bitcoin and the altcoins are a “scam/bubble,” which is going to fall apart.

In conclusion, Jeff Mei – Director of Global Strategy at Huobi Group – said crypto still has a long way to go before becoming mainstream. If there’s more clarity on global regulations, “we can expect to see a spike in participation,” he envisioned.

More Than 25% of Americans Own BTC

Nearly a month ago, Grayscale Investments reported the results of another similar research. According to it, 26% of American investors already own bitcoin, as 55% of them entered the crypto market in the last 12 months.

In addition, almost 60% of all participants admitted they are interested in digital asset investments, hinting that the holders’ percentage could continue to increase.

“The 2021 Bitcoin Investor Study results confirm that more investors see long-term value in adding Bitcoin and digital currencies to their investment portfolios,” Michael Sonnenshein – CEO of Grayscale Investments – commented back then.