Bitcoin traders have engaged in a tough battle as BTC price shoots to ,000. The Bitcoin futures open interest has shot to a seven-month high. Earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) made a strong move to ,000 levels and is currently hovering around those levels. After significant overnight gains, Bitcoin price is making a determined push towards the ,000 threshold. Surging by 6.6% in November and achieving nearly a 30% gain in October, the cryptocurrency’s robust performance is surprising some market observers. Bitcoin Price Movements However, concerns arise around trading volume, as Material Indicators, an on-chain monitoring resource, highlights a lack of strong volume support at current levels. The support rests around the ,000 mark, with

Topics:

Bhushan Akolkar considers the following as important: Altcoin News, Bitcoin News, bitcoin price, Blockchain News, BTC, btc price, btcusd, Cryptocurrency News, News, Story of the Day

This could be interesting, too:

Chayanika Deka writes Bitcoin Whales Offload 6,813 BTC as Selling Pressure Mounts

Bilal Hassan writes Coinbase Expands in Nigeria with Onboard Global Partnership

Wayne Jones writes Bitcoin Sentiment Hits 2022 Lows as Fear & Greed Index Falls to 10

Bitcoin Schweiz News writes Bitcoin für die Ewigkeit: Warum das letzte BTC-Mining erst 2140 endet

Bitcoin traders have engaged in a tough battle as BTC price shoots to $37,000. The Bitcoin futures open interest has shot to a seven-month high.

Earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) made a strong move to $37,000 levels and is currently hovering around those levels. After significant overnight gains, Bitcoin price is making a determined push towards the $40,000 threshold. Surging by 6.6% in November and achieving nearly a 30% gain in October, the cryptocurrency’s robust performance is surprising some market observers.

Bitcoin Price Movements

However, concerns arise around trading volume, as Material Indicators, an on-chain monitoring resource, highlights a lack of strong volume support at current levels. The support rests around the $33,000 mark, with resistance now positioned in the $42,000 range, a shift from the previous $40,000 resistance level. An accompanying chart illustrates BTC/USDT order book liquidity on the major global exchange, Binance. In their post, Material Indicators noted:

“There is no denying the fact that price has been challenging a number of different local top signals, but there is also no denying that something doesn’t seem right about this move. The most obvious red flag for me is that we are seeing price appreciate on declining volume. That typically doesn’t end well, but we are going to have to watch to see if this time is different.”

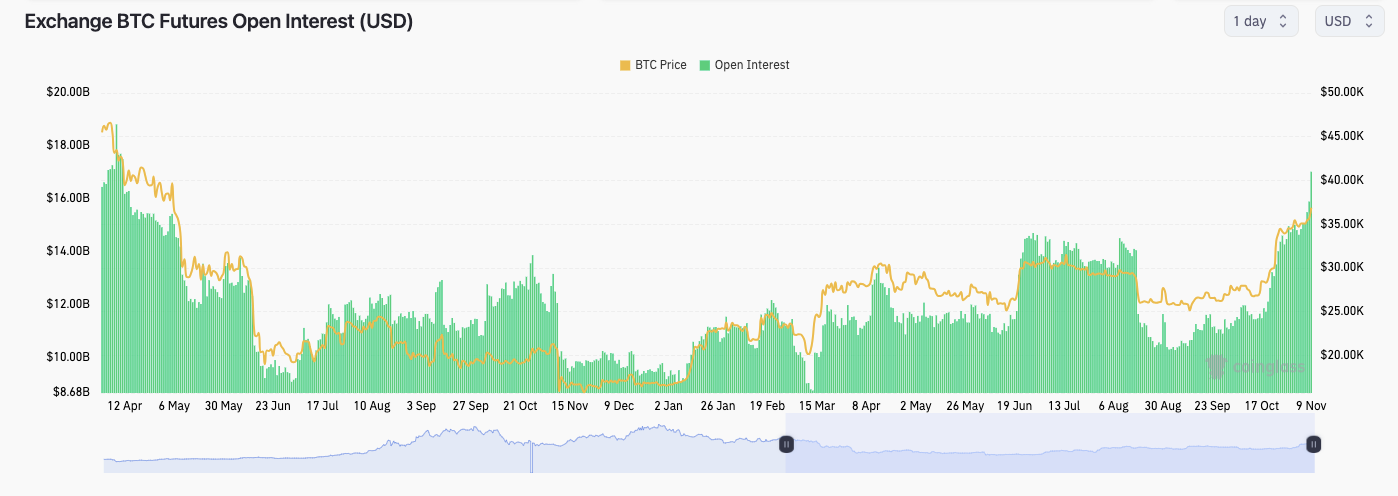

Bitcoin Open Interest at Seven-Month High

In other developments, financial commentator Tedtalksmacro highlighted a notable increase in open interest (OI), a factor that has been a driving force behind rapid upward movements in recent weeks and months.

According to data from monitoring resource CoinGlass, the total open interest in Bitcoin futures has surpassed $17 billion, marking the highest value since mid-April. Tedtalksmacro observed that during bearish periods, the market tends to resist these OI impulses, leading to a predatory and ranging environment.

He suggests that a full bullish trend would emerge when the market starts trending higher despite rising OI, indicating a noteworthy aspect to monitor.

Photo: CoinGlass

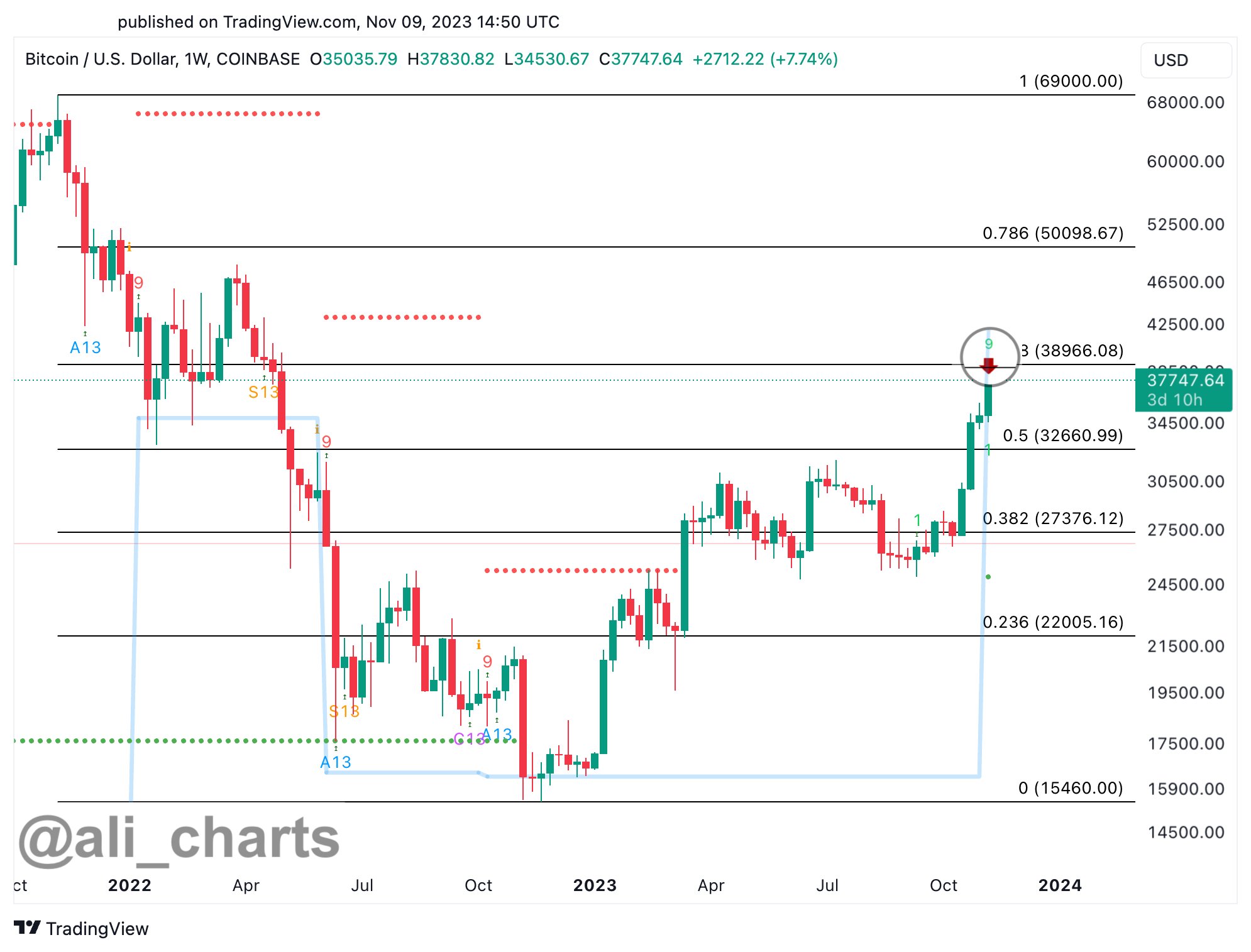

But popular crypto analyst Ali Martinez noted that the BTC price flashes a sell signal as per the technical chart. The TD Sequential is signaling a sell on the weekly chart as #BTC nears a crucial resistance zone ranging from $38,500 to $42,000.

Anticipating the impact of this resistance barrier, I foresee a potential correction towards $33,000, presenting a buying opportunity for the dip before the upward trend resumes. The scenario would be invalidated if there is a weekly candlestick close above $42,500.

Photo: Ali / X

On the other hand, amid the recent price rally, Bitcoin miners have also started offloading their BTC holdings. Following the late October surge that propelled Bitcoin beyond $34,000, miners of $BTC have been actively selling. More than 5,000 BTC, equivalent to approximately $175 million, have been divested since that period.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.