The long-awaited launch of Bakkt, the Bitcoin futures trading platform of the Intercontinental Exchange (ICE) has finally happened. After more than a year of waiting, Bakkt opened up for trading today, September 23rd. However, the trading volume as of yet is particularly low and the community is wondering whether it will pick up and if all the hype will be justified.Bakkt Starts Trading With Minimum VolumeBAKKT Markets, as the official venue is dubbed, is open for trading. According to the official website, the platform brings federally regulated price discovery to the bitcoin market. It also uses the same technology which powers up the global markets of ICE, which is also the owner of the New York Stock Exchange (NYSE).Now, one of the key differences between Bakkt and other existing

Topics:

George Georgiev considers the following as important:

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Emily John writes Singapore Metro Store Adopts Stablecoins for Smooth Payments

Felix Mollen writes Dogecoin Price Outlook: Should You Keep DOGE and What About BTC Bull Token?

The long-awaited launch of Bakkt, the Bitcoin futures trading platform of the Intercontinental Exchange (ICE) has finally happened. After more than a year of waiting, Bakkt opened up for trading today, September 23rd. However, the trading volume as of yet is particularly low and the community is wondering whether it will pick up and if all the hype will be justified.

Bakkt Starts Trading With Minimum Volume

BAKKT Markets, as the official venue is dubbed, is open for trading. According to the official website, the platform brings federally regulated price discovery to the bitcoin market. It also uses the same technology which powers up the global markets of ICE, which is also the owner of the New York Stock Exchange (NYSE).

Now, one of the key differences between Bakkt and other existing Bitcoin futures trading platforms is the fact that the contracts are settled physically. This means that instead of receiving the cash equivalent upon contract expiration, the traders receive an actual bitcoin. This should, in theory, help for better price discovery and for increased market liquidity.

Up until this moment, however, there are only 27 contracts traded on the platform, which is arguably rather low. Of course, it’s also the first day of the platform as it has only been launched a few hours ago.

Bakkt is seen as a gateway for institutional investors to enter the Bitcoin market mainly because of the regulated warehousing and supposedly improved price discovery. The company has reportedly received a license from the New York State Department of Financial Services (NYDFS) to hold the funds of its users.

Bitcoin Price Remains Unfazed

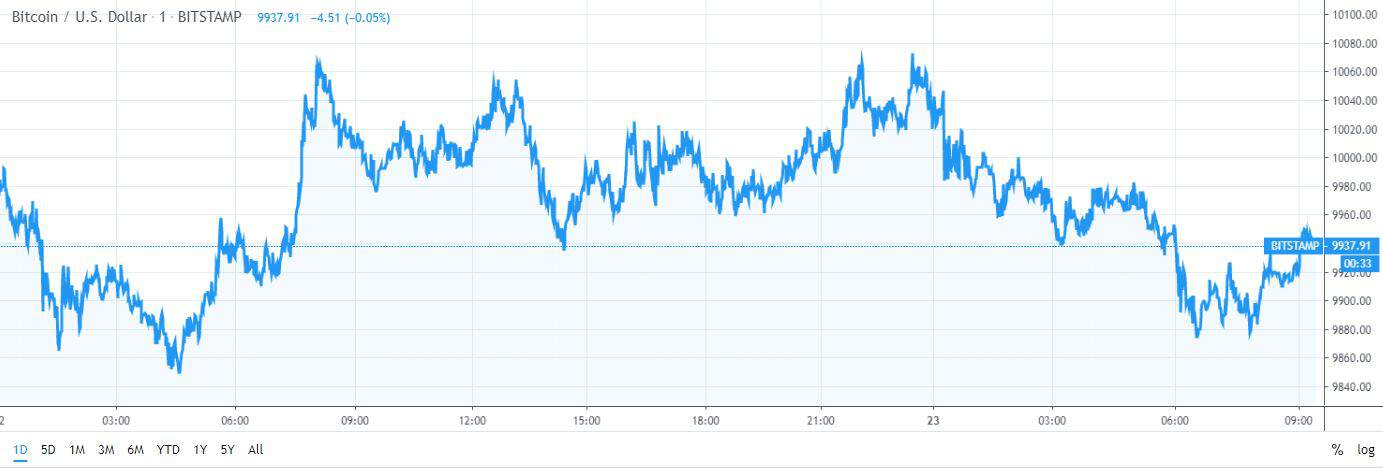

Despite today being one of the most exciting days for the cryptocurrency community, Bitcoin’s price remained relatively unfazed. BTC is down 0.5% over the past 24 hours and is currently trading slightly below the major $10,000 level.

At the time of this writing, Bitcoin is trading at $9,988 and has a total market cap of around $179 billion. Bitcoin’s dominance stands at 68% which is a decrease of around 1.5% over the past week. This means that altcoins are attempting to break out and to regain some of their former strength. However, the altcoin market is also bleeding today as the majority of the cryptocurrencies are trading in the red.

In any case, it remains very interesting to see how the entire situation will develop and whether or not Bakkt will truly attract more institutional interest in the field, as that’s what the majority seem to believe in.