Ripple, the company behind the third-largest cryptocurrency XRP, will be reportedly expanding its presence in Brazil. Just months after it launched new operations in the country, Ripple is expected to announce new partnerships with other major institutions, such as digital banks.Ripple Expands Brazilian InfluenceRipple is planning to expand its presence in Brazil with new significant partnerships next year, according to a recent report. It states that after signing previous deals with large banks in the country such as Santander, Bradesco, and Rendimento, Ripple wants to start utilizing XRP for remittance payments.Luiz Antonio Sacco, the company’s managing director in Brazil, spoke about the country’s potential for substantial growth in the next few years:“With successive advances in

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Ripple, the company behind the third-largest cryptocurrency XRP, will be reportedly expanding its presence in Brazil. Just months after it launched new operations in the country, Ripple is expected to announce new partnerships with other major institutions, such as digital banks.

Ripple Expands Brazilian Influence

Ripple is planning to expand its presence in Brazil with new significant partnerships next year, according to a recent report. It states that after signing previous deals with large banks in the country such as Santander, Bradesco, and Rendimento, Ripple wants to start utilizing XRP for remittance payments.

Luiz Antonio Sacco, the company’s managing director in Brazil, spoke about the country’s potential for substantial growth in the next few years:

“With successive advances in Brazilian banking regulation to facilitate financial transactions, including international, opportunities here will grow greatly in the coming years.”

Earlier this year, Ripple launched operations in Brazil intending to expand further not only in the country but in the whole South American region. At that point, Sacco noted that Brazil is among the leads in fin-tech innovations, and RippleNet’s introduction would allow for “excellent, efficient cross-border payment experiences for their customers.”

Ripple’s Recent Evolvement

The South American expansion is just a part of Ripple’s improvements and news from this year.

Back in June, the company made a major announcement for a strategic partnership with money transfer giant – MoneyGram. When it comes down to foreign exchange settlement using digital assets and cross-border payments, Ripple will be a key partner for MoneyGram according to the initial two-year agreement. Furthermore, the blockchain-based company will provide a $50 million capital commitment in exchange for equity within this period.

More recently, Ripple managed to secure a $200 million Serious C funding investment in a round led by large investment companies, such as Tetragon, SBI Holdings, and Route 66 Ventures. The company said that the money will be used to broaden further the utility of its cryptocurrency, XRP, and for improving the blockchain technology – the XRP ledger.

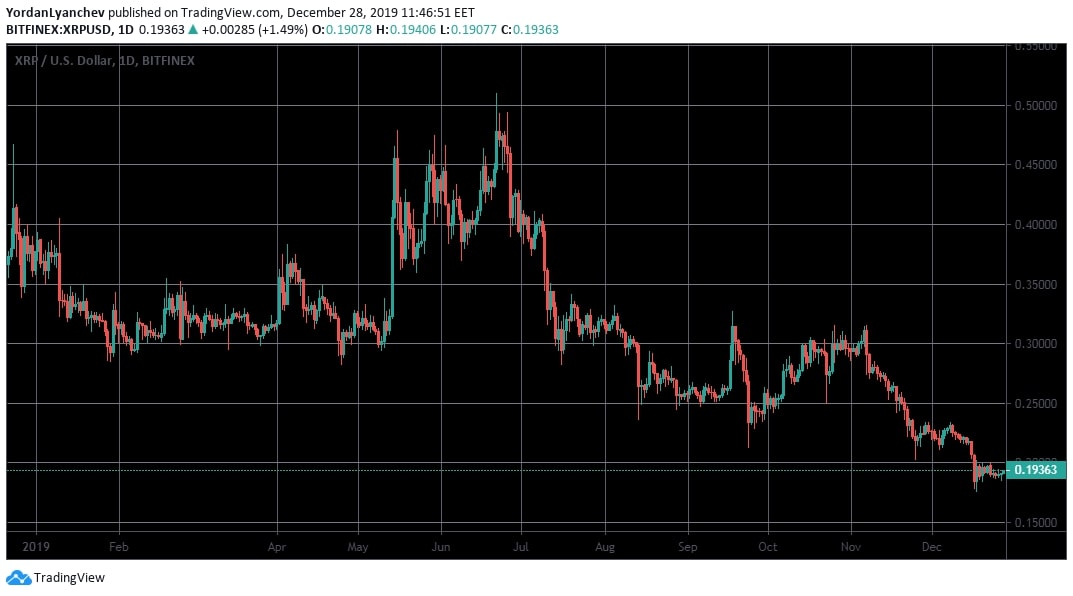

Speaking of XRP, despite the positive news from the company behind it, its price appears to be on a declining trend. After reaching the yearly high of over $0.50 back in June, XRP is mostly on the downturn and is currently trading at $0.193, which is a 65% drop in several months.