Yesterday Cryptopotato reported on one of the most impressive acquisitions within the cryptocurrency field. Binance struck a deal for an undisclosed amount of money to acquire the most popular data monitoring resource – CoinMarketCap.Naturally, given CMC’s massive userbase, a lot of members of the crypto community began to wonder how this will impact the future development of the website. Earlier today, we had the chance to speak with CoinMarketCap’s CEO, Carylyne Chan.Chan: CoinMarketCap Will Continue To Be Run IndependentlyMaybe the most interesting thing about the impressive acquisition is the involvement of Binance in CoinMarketCap onwards, and whether there will be any effect in favor of Binance and its native coin – Binance Coin (BNB).“CoinMarketCap will continue to be run

Topics:

George Georgiev considers the following as important: AA News, Binance, dogecoin, Interviews

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Yesterday Cryptopotato reported on one of the most impressive acquisitions within the cryptocurrency field. Binance struck a deal for an undisclosed amount of money to acquire the most popular data monitoring resource – CoinMarketCap.

Naturally, given CMC’s massive userbase, a lot of members of the crypto community began to wonder how this will impact the future development of the website. Earlier today, we had the chance to speak with CoinMarketCap’s CEO, Carylyne Chan.

Chan: CoinMarketCap Will Continue To Be Run Independently

Maybe the most interesting thing about the impressive acquisition is the involvement of Binance in CoinMarketCap onwards, and whether there will be any effect in favor of Binance and its native coin – Binance Coin (BNB).

“CoinMarketCap will continue to be run independently, as an independent entity, from Binance. We will make decisions that will be in the best interests of CoinMarketCap (CMC), and we will continue to develop products and services that benefit CoinMarketCap users.” According to Chan, speaking about the neutrality of CMC from now on.

“There will be zero preferential treatment, and our team has also committed to enforcing this policy. After all, it is in our interest to ensure that our users can continue to trust CoinMarketCap and the data quality that they know us for. We’ll stick to this in spite of any positive or negative financial effect this adherence to policy might have for our parent company. Binance has also publicly stated that they are fully supportive of our approach.”

COVID-19 Had No Effect On The Deal

The acquisition took place in the middle of the emerging financial crisis due to the spreading coronavirus. While many companies refrain from investing big money and back out from signed contracts, CMC’s CEO insists that the COVID-19 crisis did not affect this long-term negotiation or the final price.

“CoinMarketCap and Binance are both very focused on the long-term when it comes to major decisions, so the deal was definitely centered around the shared vision to make crypto more accessible for everyone around the world. It wasn’t affected at all by the current coronavirus crisis.” According to Chan.

And what about the effect on the crypto ecosystem? While the amount that Binance paid is not disclosed, rumors show that this might be the biggest acquisition involving crypto-related companies.

“This definitely shows that the industry is maturing,” says Chan. “As many of the crypto businesses in the industry are reinvesting back into the infrastructure providers built for the space. We can draw parallels with other tech businesses outside of crypto and see that consolidation does happen over time, as businesses become more efficient at turning the flywheel of value. It isn’t inherently bad, as long as it exists in a free market. Competitive pressures will help ensure that businesses stay honest and consumer-focused.”

The Most Awkward Moment

We couldn’t end this interview without asking this question. CoinMarketCap symbolizes the happy days of crypto between the years 2013 – 2015. At that time, it was more like a “Wild Wild West.” Coins got boosted only by the “adding” announcement by CMC.

At that time, seeing 500% next to daily performance wasn’t an odd vision. To answer this question, we called Brandon Chez, who founded CMC.

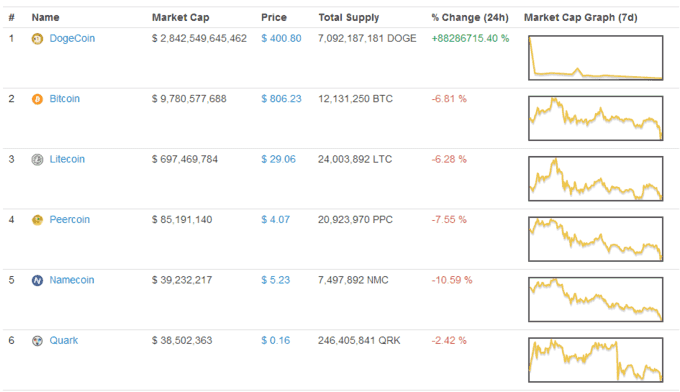

Back in the days, the DogeCoin project started developing by early 2013, but when CMC finally listed it mid-December 2013, some technical issues popped. DogeCoin was always trading by means of Satoshis – 2 or 3 digits at most.

According to Chez, “When we listed Dogecoin, there was a bug that put it on the first place on the table.” as can be seen below, DogeCoin mistakenly received a price of $400, way above Bitcoin. And no, it wasn’t an April Fool’s prank by CMC.