Amid the spread of the COVID-19 pandemic, world governments and central banks should focus on launching CBDCs, a BIS report suggested. By using digital currencies, people could avert cash, credit card terminals, or PIN pads – which may transmit the novel virus.Coronavirus And MoneyThe COVID-19 outbreak took the world by storm. Over 1.2 million confirmed cases and 65,000 deaths since the start of the year. What’s even more threatening is the speed in which the virus spreads.Some reports implied that even paper cash could transfer it. Several governments took precautionary measures by quarantining, disinfecting, and also destroying banknotes.The large international institution – the Bank for International Settlements – recently compiled a report on the manner. It reaffirmed the growing fears

Topics:

Jordan Lyanchev considers the following as important: AA News, Banks, CBDC, Coronavirus (COVID-19)

This could be interesting, too:

Bitcoin Schweiz News writes Das ist die Digital Euro Association: Die Zukunft des digitalen Geldes

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Amid the spread of the COVID-19 pandemic, world governments and central banks should focus on launching CBDCs, a BIS report suggested. By using digital currencies, people could avert cash, credit card terminals, or PIN pads – which may transmit the novel virus.

Coronavirus And Money

The COVID-19 outbreak took the world by storm. Over 1.2 million confirmed cases and 65,000 deaths since the start of the year. What’s even more threatening is the speed in which the virus spreads.

Some reports implied that even paper cash could transfer it. Several governments took precautionary measures by quarantining, disinfecting, and also destroying banknotes.

The large international institution – the Bank for International Settlements – recently compiled a report on the manner. It reaffirmed the growing fears amongst people:

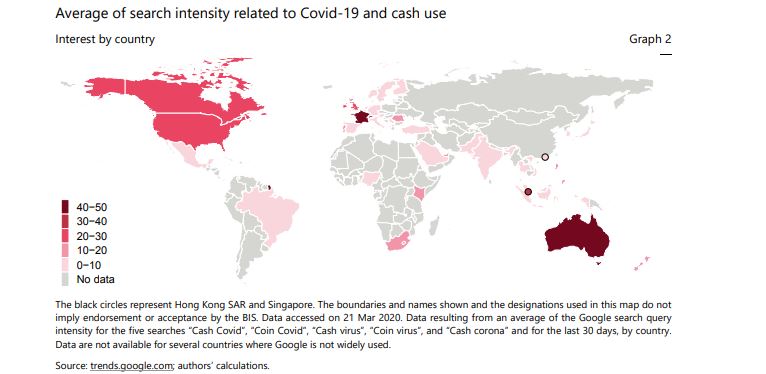

“Central banks report a large increase in queries from the media on the safety of using cash. The number of internet searches pertaining to both “cash” and “virus” is at record highs.”

The document also referred to a few studies claiming that forms of viruses, bacteria, fungi, and parasites can survive on banknotes and coins. A 2020 research revealed that the COVID-19 could survive for three hours in the air, 24 hours on cardboard, and even more on other hard surfaces.

Scientists concluded that the probability of transmitting the coronavirus via banknotes is low when compared to other frequently-touched objects. For instance, those can be credit cards or PIN pads:

“The fact that the virus survives best on non-porous materials, such as plastic or stainless steel, means that debit or credit card terminals or PIN pads could transmit the virus too.”

Are CBDCs The Solution?

A previous report by BIS outlined that 80% of central banks are currently developing central bank digital currencies (CBDC). The new one brought CBDCs as a potential solution to avoid touching physical subjects when operating with money.

According to the paper, such digital currency would have to possess several vital qualities to cope with the current situation in the world:

“Such infrastructures would need to withstand a broad range of shocks, including pandemics and cyber attacks. In the context of the current crisis, CBDC would, in particular, have to be designed, allowing for access options for the unbanked and (contact-free) technical interfaces suitable for the whole population.

The pandemic may hence put calls for CBDCs into sharper focus, highlighting the value of having access to diverse means of payments, and the need for any means of payments to be resilient against a broad range of threats.”