One of the most widely used decentralized exchange Uniswap has raised million in a Series A funding round led by Andreessen Horowitz (a16z). Uniswap’s market share has been growing rapidly in the past several months, and the team behind it indicated that they will utilize the funds for the third version of the platform.Uniswap Raises MIn April 2019, the DEX raised .8 million in a seed round. Over a year later, a filing submitted to the US Securities and Exchange Commission (SEC) suggested that the company has sold million in securities on June 5th. Uniswap confirmed the Series A funding round yesterday on its blog.“We are thrilled to announce that we have raised million in Series A funding led by Andreessen Horowitz with additional investments from USV, Paradigm, Version

Topics:

Jordan Lyanchev considers the following as important: AA News, andreessen horowitz, defi

This could be interesting, too:

Wayne Jones writes Beyond Hacks: Vitalik Buterin Calls for Wallet Solutions to Address Crypto Loss

Chayanika Deka writes Internal Conflict at Thorchain as North Korean Hackers Leverage Network for Crypto Laundering

Chayanika Deka writes Consensys and SEC Reach Agreement to Dismiss MetaMask Securities Case

Chayanika Deka writes Meme Coins Do Not Qualify as Securities: SEC Confirms

One of the most widely used decentralized exchange Uniswap has raised $11 million in a Series A funding round led by Andreessen Horowitz (a16z). Uniswap’s market share has been growing rapidly in the past several months, and the team behind it indicated that they will utilize the funds for the third version of the platform.

Uniswap Raises $11M

In April 2019, the DEX raised $1.8 million in a seed round. Over a year later, a filing submitted to the US Securities and Exchange Commission (SEC) suggested that the company has sold $11 million in securities on June 5th. Uniswap confirmed the Series A funding round yesterday on its blog.

“We are thrilled to announce that we have raised $11 million in Series A funding led by Andreessen Horowitz with additional investments from USV, Paradigm, Version One, Variant, Parafi Capital, SV Angel, and A.Capital.” – reads the statement.

The funds will be allocated towards developing the third version of the decentralized trading platform, dubbed Uniswap V3.

The V2 launched earlier this year on the Ethereum mainnet, which had multiple new “features and technical improvements compared with Uniswap V1.” The company markets the upcoming V3 as a platform that will “dramatically increase the flexibility and capital efficiency of the protocol.”

Uniswap And DEX Growth

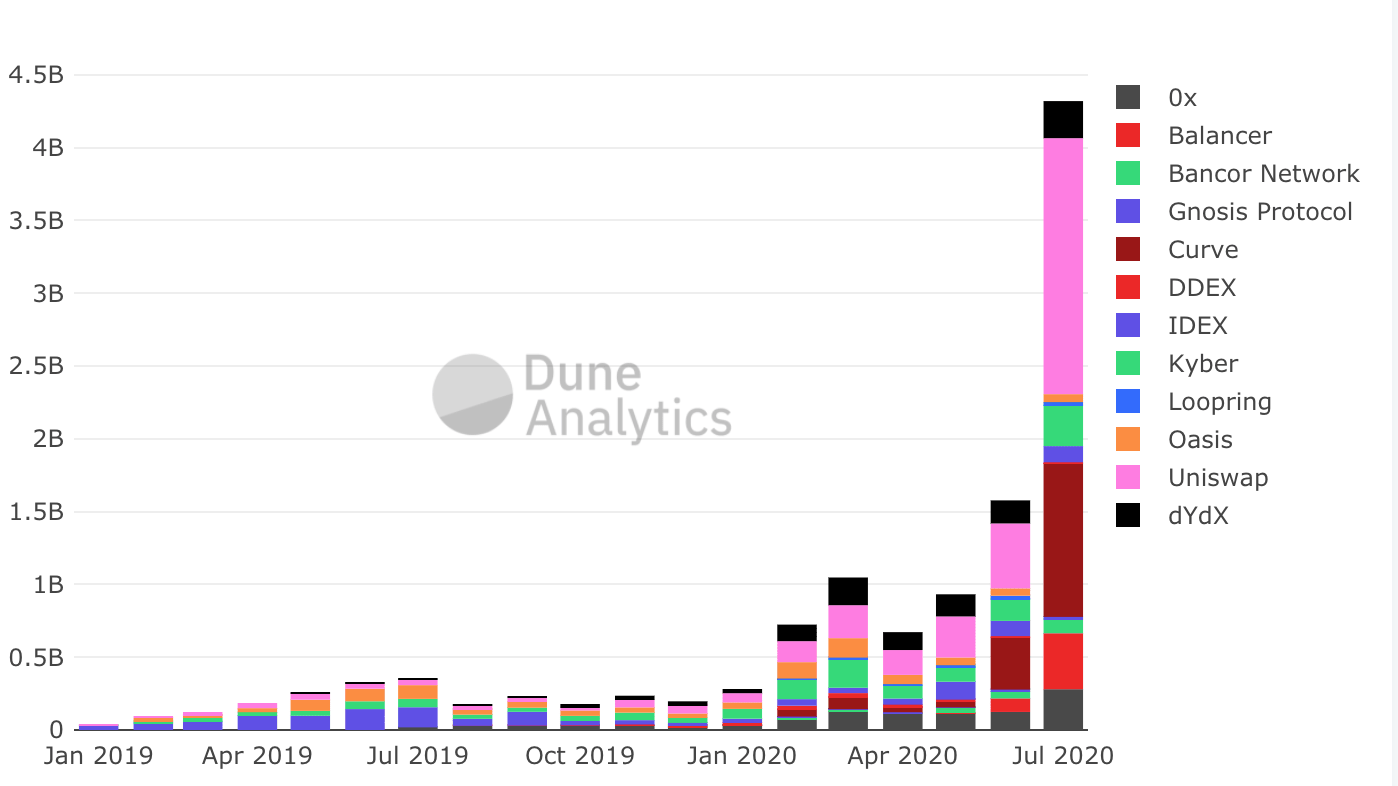

Decentralized exchanges have been enjoying a massive increase in the total trading volume throughout 2020. As CryptoPotato reported in early July, such platforms had over $5 billion in volume in the first half of 2020 (January-June), which was an impressive 400% growth compared to the 2019’s numbers.

July, however, saw even more impressive figures, according to the monitoring resource Dune Analytics. All DEX registered a 3x increase since June and a 12x from July 2019 to mark a total trading volume of about $4.3 billion, which is nearly the entire volume from January to June. The graph below reveals that Uniswap had a significant market share.

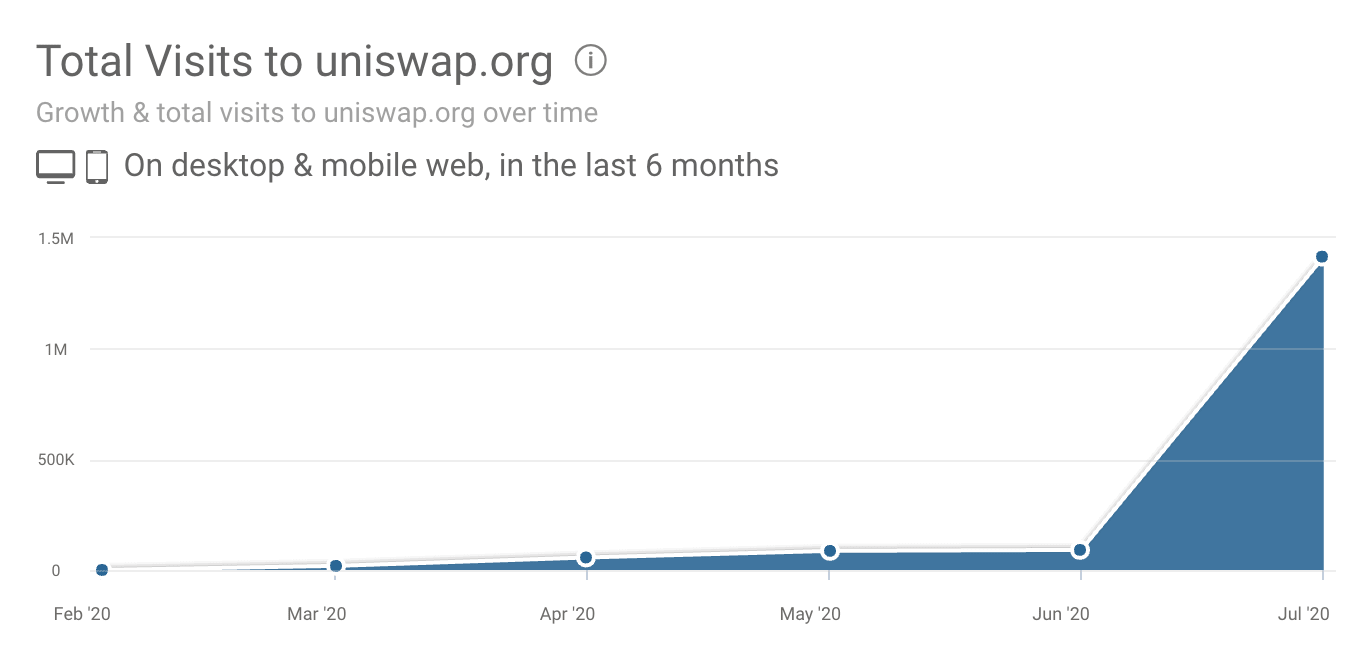

A researcher at Messari pointed out that Uniswap’s monthly visits have also soared in one month. The number went from 90,000 in June to over $1.4 million in July.

Lastly, data from defipulse indicates that Uniswap is the third most used DEX for locking funds. The DeFi monitoring website shows that Uniswap, with its $138.2 million, is far ahead from the 4th-seeded Bancor ($31 million), but it trails to Curve Finance ($257 million) and the leader – Balancer ($266 million).