A Russian businessman has reportedly taken a loan from a bank using the WAVES token as collateral. With the nation’s unclear regulation status regarding digital assets, local lawyers argued on whether such transactions could legally proceed in the future.The First Cryptocurrency-backed Bank Loan In RussiaAlexander Ivanov, Waves founder and CEO, confirmed the news earlier today. He outlined the local report, which reads that for the first time in Russia, a bank has approved a loan secured by a digital asset.Headquartered in Prague, Czech Republic, Expobank issued the loan “through the conclusion of an individual bank loan agreement secured by Waves tokens.” Tanzila Yandieva, the head of the bank’s legal department, described the transactions as a “precedent in nature for both the legal and

Topics:

Jordan Lyanchev considers the following as important: AA News, Banks, russia, waves

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

A Russian businessman has reportedly taken a loan from a bank using the WAVES token as collateral. With the nation’s unclear regulation status regarding digital assets, local lawyers argued on whether such transactions could legally proceed in the future.

The First Cryptocurrency-backed Bank Loan In Russia

Alexander Ivanov, Waves founder and CEO, confirmed the news earlier today. He outlined the local report, which reads that for the first time in Russia, a bank has approved a loan secured by a digital asset.

Headquartered in Prague, Czech Republic, Expobank issued the loan “through the conclusion of an individual bank loan agreement secured by Waves tokens.” Tanzila Yandieva, the head of the bank’s legal department, described the transactions as a “precedent in nature for both the legal and the banking community.”

Mikhail Uspensky, the local businessman who received the loan, said that he doesn’t plan to sell his tokens; instead, he will find them further utilization. He noted that cryptocurrencies “should not be dead weight in my pocket.”

Although Russia has yet to introduce clear regulations regarding digital asset usage, local lawyer Yuri Brisov said that “Waves tokes can be absolutely legally used in Russia.” He and a few other attorneys believe that similar transactions could soon be structured under local legislation.

However, Denis Durashkin, a senior lawyer at BGP Litigation, asserted that the lack of “adequate legal regulations and the necessary organizational infrastructure” prevents large institutional players from taking part in such transactions.

Waves’ Recent Developments And Price Performance

As CryptoPotato reported recently, the blockchain-based company Waves partnered with Tron to enhance mass adoption in the decentralized finance (DeFi) sector. The two firms plan to utilize a third-party to connect their respective DLT networks.

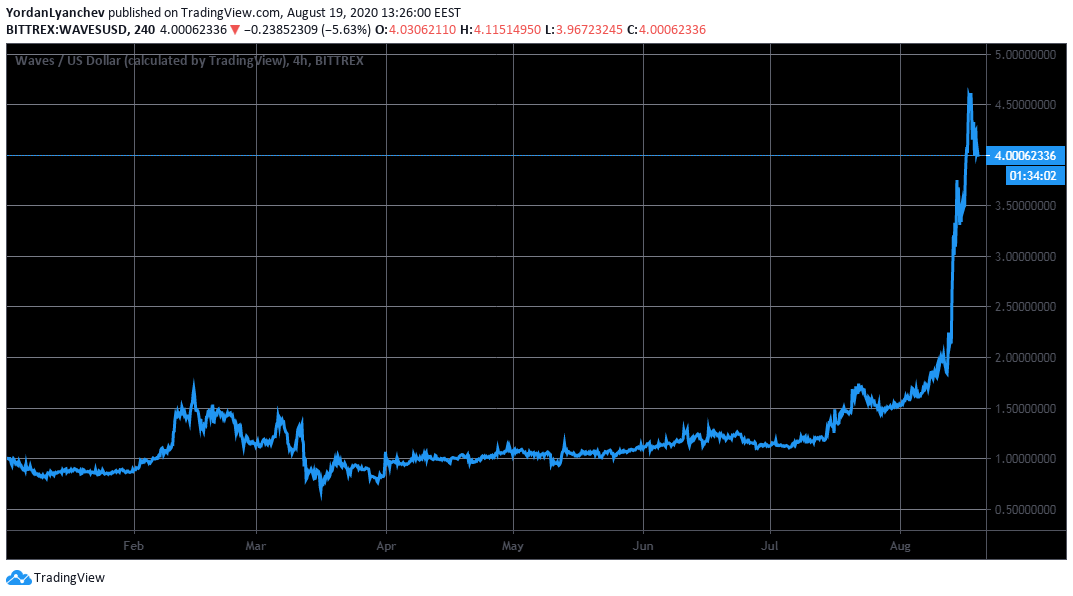

The native cryptocurrency (WAVES) has been on a massive bull run in 2020, and especially in the past few weeks. The asset entered the new century at about $1, jumped by 80% by mid-February, but the most intense days of the COVID-19 pandemic brought it down to its yearly low of $0.60.

WAVES managed to recover its losses rather quickly to reach $1,50 at the end of July. In the following weeks, and after the Tron partnership, WAVES went on a tear to a two-year high of $4,60. Although it has retraced slightly to $4, this still marks a 300% YTD price pump.