The leading digital asset management company, Grayscale Investments, has purchased nearly 50% of all mined ethers in 2020.The firm outlined the increased interest from institutional investors, hinting that the upcoming Ethereum 2.0 could be the reason behind both.Grayscale On ETH Buying SpreeNew information on the matter indicated that the total number of ETHs mined from the start of 2020 to April 24th was 1,563,245.875.At the same time, the Grayscale Investments Ethereum Trust (ETHE) had issued 5,230,200 shares as of December 31st last year. And, per their website, the firm had 13,255,400 shares as of April 24th, 2020.With 0.09427052 ETH per share, that makes 756,239.777 ETH bought in the same period. Having in mind all numbers from above, it means that Grayscale has purchased precisely

Topics:

Jordan Lyanchev considers the following as important: AA News, ETH, ETHBTC, Ethereum (ETH) Price, ethereum 2.0, ethusd, Grayscale

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The leading digital asset management company, Grayscale Investments, has purchased nearly 50% of all mined ethers in 2020.

The firm outlined the increased interest from institutional investors, hinting that the upcoming Ethereum 2.0 could be the reason behind both.

Grayscale On ETH Buying Spree

New information on the matter indicated that the total number of ETHs mined from the start of 2020 to April 24th was 1,563,245.875.

At the same time, the Grayscale Investments Ethereum Trust (ETHE) had issued 5,230,200 shares as of December 31st last year. And, per their website, the firm had 13,255,400 shares as of April 24th, 2020.

With 0.09427052 ETH per share, that makes 756,239.777 ETH bought in the same period. Having in mind all numbers from above, it means that Grayscale has purchased precisely 48.4% of all mined ethers in 2020.

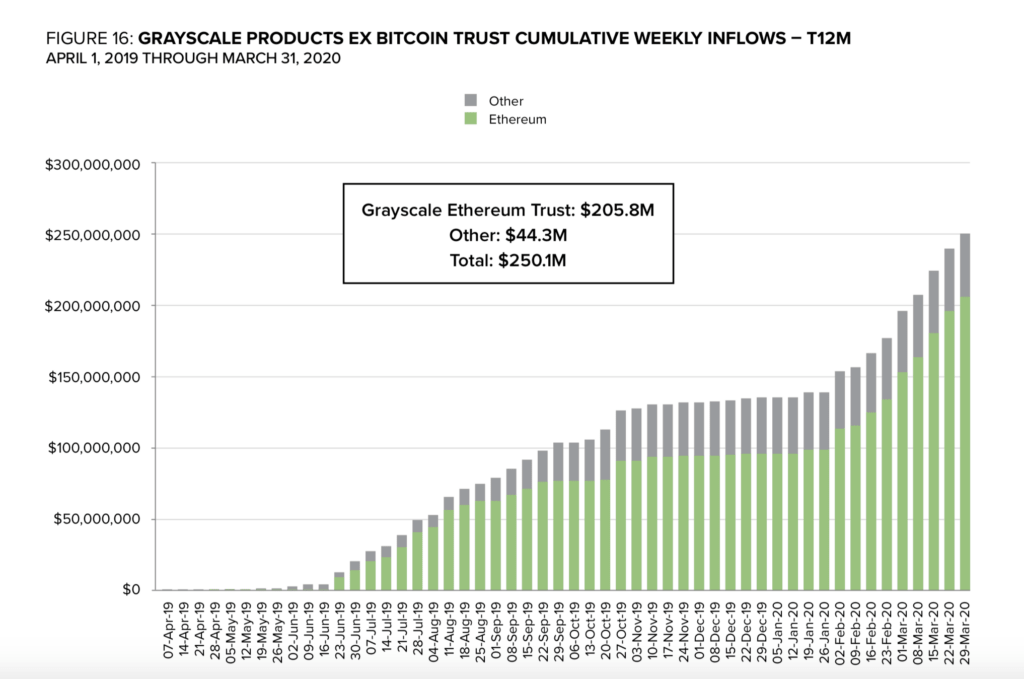

The firm’s paper regarding the Q1 performance pointed out that institutional investors have been accumulating substantial portions of the second-largest digital asset by market cap, despite the volatile market. During Q1 2020, the Ethereum Trust saw $110M of inflows, which is more than all previous inflows combined for the past two years ($95.8M).

The upcoming release of Ethereum 2.0, which will complete the migration from the current proof-of-work consensus algorithm to proof-of-stake, could be amongst the main reasons behind the high buying levels. In the annual document on Ethereum’s developments, Grayscale explicitly introduced and explained the new concept, saying that one of the benefits will be increasing the scalability of the database.

Ethereum Price And Grayscale Premium

Ethereum investors buying through Grayscale are not slowing down despite even a significant premium of about 420%. As of April 24th, one share of ETHE cost $92 to buy, while the holdings per share were worth just $17,70. In other words, institutions are happily paying a major premium as they don’t have to worry about storing, transferring, and managing the cryptocurrency on their own.

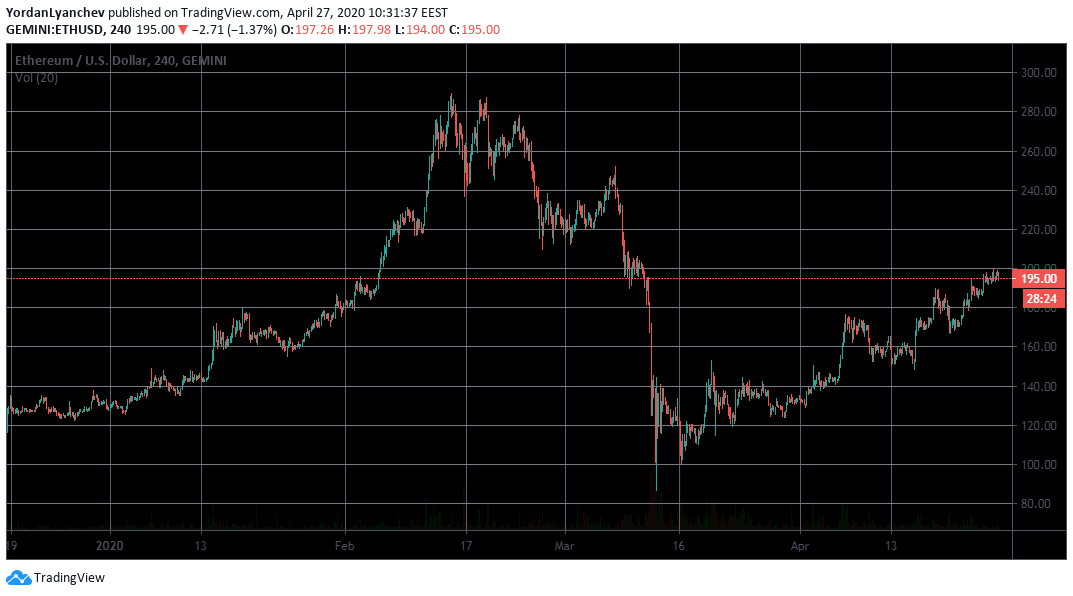

The spot price of the asset, on the other hand, has gained approximately 50% since the start of the year. ETH entered the new century at $130 and is currently trading at $195. The turbulence in the cryptocurrency market reached it as well, as Ethereum hit a yearly high of $290 in February, before plunging to $87 during the panic sell-offs in mid-March.

To continue upwards, ETH has to break the first resistance at $198, followed by $200, and $211. Alternatively, $194 and $187 stand as support levels if it’s to decrease in value.