Let’s get it straight, Defi has exploded in the last year and it is poised to grow exponentially in the near future. Last week Uniswap’s trading volume surpassed B, yes, B. There are a handful of well-known DEXs, and to trade in those, either, users have to use their own funds or transfer funds from lending platforms and transfer for trading. It is a time-consuming, laborious and expensive process to transfer from lending platforms to DEXs. Introducing Lever Lever Network, addresses this major market issue by building a bridge between lending platforms/protocols and DEXs. Lever is the first AMM-based decentralized margin trading platform on Ethereum, where users can easily earn interest through lending and perform leveraged trading. With Lever, users can open a

Topics:

Live Bitcoin News considers the following as important: Press Release

This could be interesting, too:

Chainwire writes Over Million Raised in XYZVerse Presale as Token Generation Event Draws Closer

Chainwire writes Memeagent Is Gaining Attention – Meeting Chad, the AI Agent That’s Changing the Game

Chainwire writes Memeagent Is Gaining Attention – Meeting Chad, the AI Agent That’s Changing the Game

Chainwire writes #Memhash Now Available on Exchanges After Successful Mining Phase

Let’s get it straight, Defi has exploded in the last year and it is poised to grow exponentially in the near future. Last week Uniswap’s trading volume surpassed $10B, yes, $10B.

There are a handful of well-known DEXs, and to trade in those, either, users have to use their own funds or transfer funds from lending platforms and transfer for trading. It is a time-consuming, laborious and expensive process to transfer from lending platforms to DEXs.

Introducing Lever

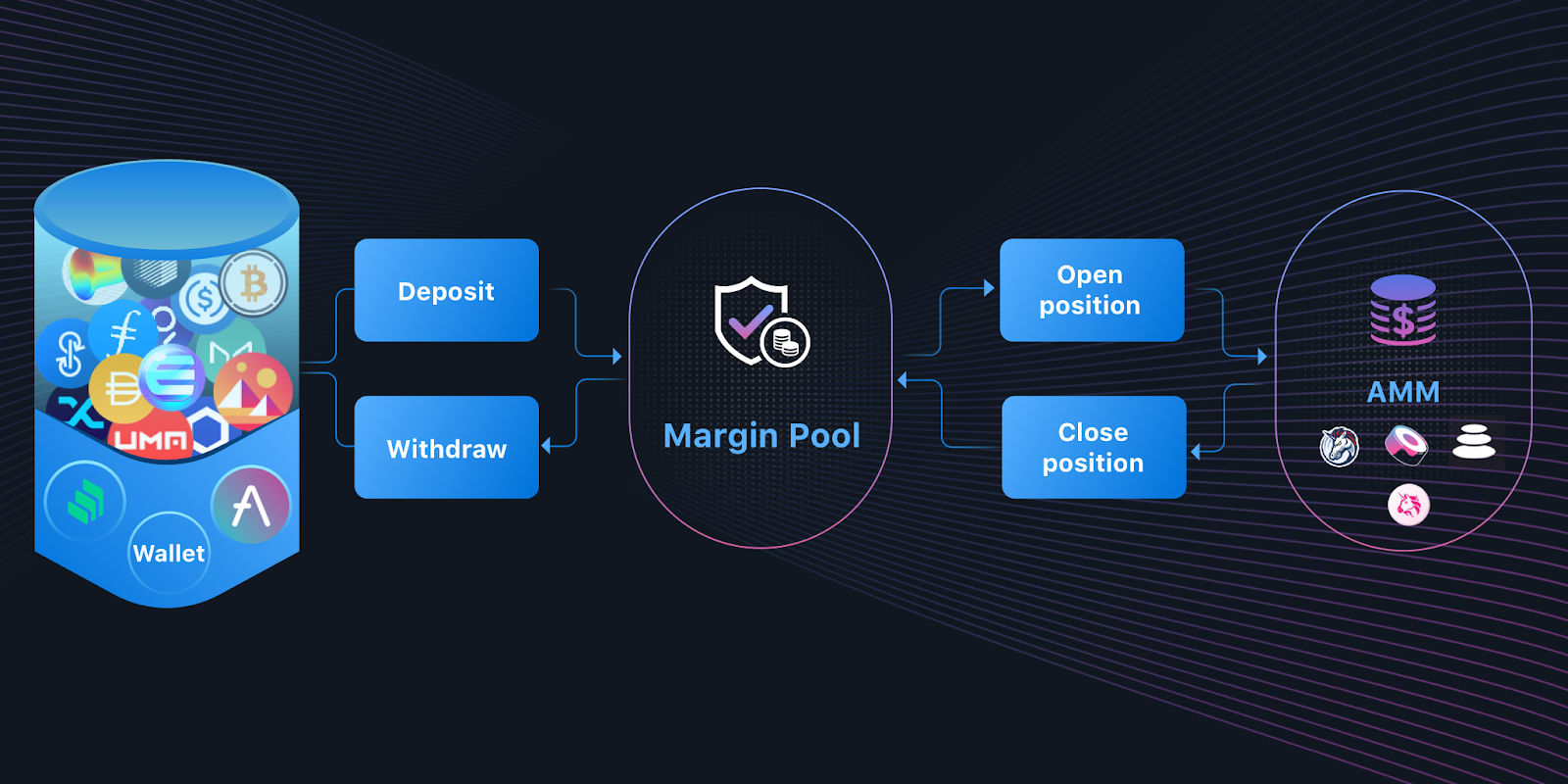

Lever Network, addresses this major market issue by building a bridge between lending platforms/protocols and DEXs. Lever is the first AMM-based decentralized margin trading platform on Ethereum, where users can easily earn interest through lending and perform leveraged trading. With Lever, users can open a position with up to 3X leverage and these margin positions are realized through a decentralized loan pool. Users can use the margin deposit as collateral and also earn interest from it. Double Bonanza !!

Lever integrates with well-known AMMs like Uniswap, Sushiswap, Pancakeswap, and 1inch to provide enormous liquidity. These many integrations means reduced slippage for large trades.

Borrowing and trading are seamlessly integrated within Lever as it offers a visualized operation interface for position management. Borrow and trade assets in one place using a user-friendly UI as seen in the testnet – nice and easy !!

Lever allows users to use aTokens from Aave and cTokens from Compound as collaterals. This will be a big advantage for large position traders who can simply get deposit certificates from the lending protocols rather than having to move funds. This also means double interest possible !!

Lever provides an option to short ERC-20 assets like Synthetix (SNX), Uniswap (UNI) and Aave (AAVE) other than Wrapped Bitcoin (wBTC) and Ethereum (ETH).

Public Sale

Lever Network has announced its public sale through DAO Maker, a launchpad for token sales. Registrations are open from 3/5/2021 12:00 UTC. Interested participants, can head down to DAO Maker website and participate in the strong holder offering (SHO). Lever Network will announce the total sale allocation and personal allocation details soon.

More details about how to participate in the SHO : bit.ly/3sKJsxo

While there are many white paper projects, Lever Network has been running its Testnet and bug bounty programs for a while now. They are well ahead of their competitors in terms of product and also have the first-mover advantage. With strong product offering and eye-catching advantages for traders, Lever is poised well to become a leader in the Defi ecosystem.

Join the Lever community for more updates:

Site: https://lever.network/

Beta: https://ropsten.lever.network

Twitter: https://twitter.com/LeverNetwork

Telegram: https://t.me/LeverNetwork

Medium: https://medium.com/@LeverNetwork