Traditional financial markets are plunging today amid fears of the spreading coronavirus. While indices and stocks tumble across the globe, gold is increasing as investors turn to it as a safe haven. It reached its highest point since 2013. Amid this uncertainty, it’s interesting to see where Bitcoin’s price will go next.Stock Markets PlummetThe coronavirus outbreak continues to expand with almost 79,000 confirmed cases globally. The death toll has risen to over 2,450, and 23 are outside of mainland China.The effect of the deadly virus spreads among the financial markets as well. For instance, South Korea has reported over 600 cases, and its most popular index noted its worst trading day since late 2018. The Korea Composite Stock Price Index (KOSPI) decreased by almost 4% today.The

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, nasdaq, s&p 500

This could be interesting, too:

Wayne Jones writes Beyond Hacks: Vitalik Buterin Calls for Wallet Solutions to Address Crypto Loss

Chayanika Deka writes Internal Conflict at Thorchain as North Korean Hackers Leverage Network for Crypto Laundering

Chayanika Deka writes Consensys and SEC Reach Agreement to Dismiss MetaMask Securities Case

Chayanika Deka writes Meme Coins Do Not Qualify as Securities: SEC Confirms

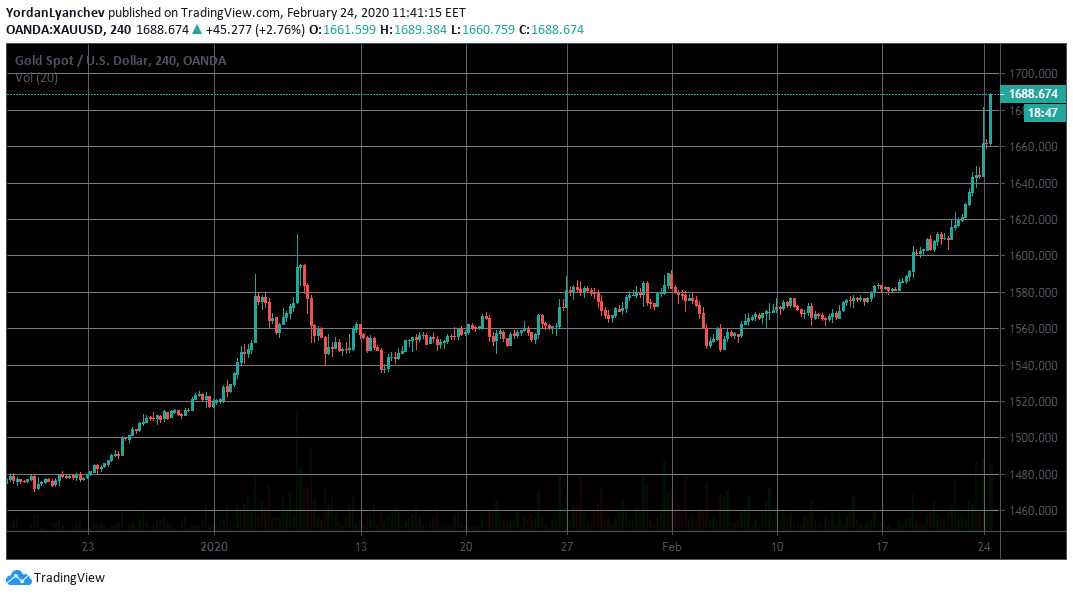

Traditional financial markets are plunging today amid fears of the spreading coronavirus. While indices and stocks tumble across the globe, gold is increasing as investors turn to it as a safe haven. It reached its highest point since 2013. Amid this uncertainty, it’s interesting to see where Bitcoin’s price will go next.

Stock Markets Plummet

The coronavirus outbreak continues to expand with almost 79,000 confirmed cases globally. The death toll has risen to over 2,450, and 23 are outside of mainland China.

The effect of the deadly virus spreads among the financial markets as well. For instance, South Korea has reported over 600 cases, and its most popular index noted its worst trading day since late 2018. The Korea Composite Stock Price Index (KOSPI) decreased by almost 4% today.

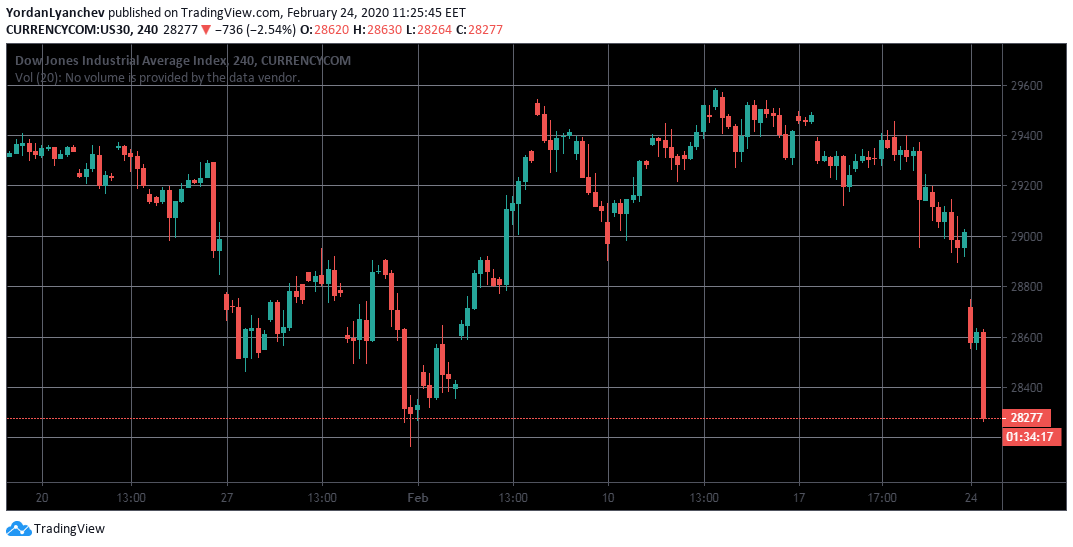

The situation is not much better across the globe. The S&P 500 (SPX) futures were down with 1.5%, and Nasdaq (COMP) futures dropped with around 1.8%.

The Dow Jones Industrial Average (DJIA), measuring the thirty leading blue-chip U.S. companies, decreased with 1.61%.

Bitcoin Reaction

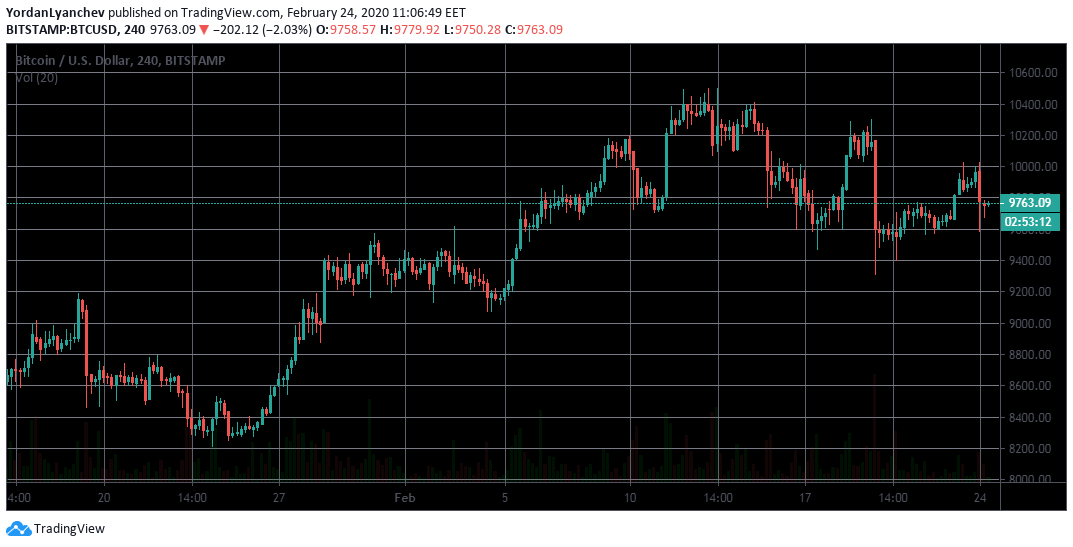

Bitcoin has traditionally demonstrated a lack of correlation to traditional financial markets. However, over the past 24 hours, its price went on a rollercoaster. It touched an intraday high of around $10,000 and a low of around $9,600. At the time of this writing, bitcoin is trading at $9,800, marking a healthy recovery.

From a technical standpoint, the $10,000 level serves as a significant resistance level. It rejected Bitcoin a few times since yesterday. In terms of support, the next measurable level is at $9,550. Should it fail to hold the price, traders should consider $9,400.

Earlier in January, when the coronavirus epidemic started to boom, both Bitcoin and gold were increasing. This led some to think that both assets were used as a hedge.

Gold and Oil

At the start of 2020, during the attacks between the U.S. and Iran, gold, oil, and Bitcoin were moving similarly. While the traditional market was plunging again, all three surged.

Despite that, the outcome so far today is somewhat different. Oil fell with 2.8% to below $57 per barrel. At the same time, gold records its highest point in over seven years.

The precious metal is regarded as the most widely-used hedge in times of uncertainty, political and economic tension, or even war. This is reaffirmed today, as gold increased with over 2.7% from $1,641 to $1,688 in just a few hours.