New analysis from Goldman Sachs says America’s largest companies could spend more than $2.7 trillion of cash next year.The report predicts that cash spending will rise by around 2% in the next year amid a rise in growth investments.The bank however claims that there will be a 6% decline in spending by S&P 500 companies this year. This shrinking comes because of the 20% slump in cash acquisition spending and a 15% decrease in stock buybacks.Still, Goldman experts believe companies in the...

Read More »If Bitcoin-Avocado Price Correlation Continues, BTC May Be Toast

Bitcoin’s status as an uncorrelated asset is about to be revoked, as a scarily close relationship to the price of avocados implies that the digital currency may be about to fall off a cliff. The Bitcoin-Avocado Connection Bitcoin’s performance of late has left a little to be desired, and strangely so has the price of avocados. This relationship was pointed out in a profoundly insightful tweet by Bloomberg’s financial Journalist, Tracy Alloway. A graph depicting the price of Hass avocados...

Read More »Bitcoin Perma-Bull Tom Lee Rings Warning Bell on ‘Treacherous’ BTC Trading

Amid a volatile week for bitcoin, Fundstrat’s Tom Lee has come out urging against anyone considering trading BTC in the foreseeable future. Tuesday marked a three-month low for bitcoin as a 17% freefall weakened underlying support significantly, leading BTC to breach well into $8,000 territory. As if to pour salt in the wound, yesterday saw another critical level of support cave in, as BTC fell into the $7,000 region. BTC’s three-month low following this week’s dreary performance. | Source:...

Read More »Thomas Lee: Bitcoin Price Cannot ‘Blast Off’ Without Record S&P 500

As the bitcoin price languishes at $8,300, down more than 12% on the day, Fundstrat Co-Founder Thomas Lee has an unfortunate truth for crypto bulls. Lee does not believe bitcoin is a safe haven; in fact, quite the opposite as he forecasts that the S&P 500 will need to hit fresh highs this year before BTC can.S&P 500 May Be Bitcoin Price's Key FundamentalThe fundamental reasoning behind the strategist's claim is sound. He and his team at Fundstrat believe that retail investors, not...

Read More »Trump Impeachment Proceedings Announced, Will the Stock Market Suffer?

On the evening of Tuesday the 24th of September, Speaker of the United States House of Representatives, Nancy Pelosi, made a formal announcement of an official impeachment enquiry, opened against U.S. President Donald Trump. If the proceedings are successful and Trump gets impeached, he’ll be the third president impeached after Bill Clinton who was impeached in 1998 and Andrew Johnson, impeached in 1868. However, away from the politics and inner workings of the government, what could this...

Read More »5 Best Performing S&P 500 Stocks Since 2000

The S&P 500 is the most widely used stock market index as it takes into account 500 of the largest stocks by market capitalization. This position atop other indexes has remained constant for a long time, probably because the index captures the big stocks without taking the specific sectors into consideration.Back in July, the S&P 500 hit its all-time high of about 3,025 and even though its currently not too far from that mark (at 2,992), Fundstrat’s co-founder and managing director,...

Read More »Newsflash: Bitcoin Price Craters Below $11,000 as Trump Stuns Market

The bitcoin price slid below the $11,000 mark for the first time in more than a week on Tuesday, as the flagship cryptocurrency’s burgeoning inverse correlation with the S&P 500 came back to bite investors. Bitcoin Price Careens Below $11,000 Bitcoin had entered the day trading sideways in the low $11,000s, where it had more or less languished since the Saturday sell-off that followed BTC’s brief foray above $12,000 last week. The dam broke around 10 am ET, and the bitcoin price...

Read More »Bitcoin Research Proves Crypto Is Becoming a Stock Market Hedge

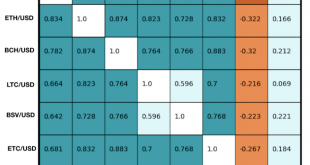

More than a decade into its existence, Bitcoin is finally maturing into a full-blown stock market hedge.That’s the conclusion of new research from crypto prime dealer SFOX, which indicates that Bitcoin and other major cryptocurrencies like Ethereum have developed a negative correlation with the S&P 500. This means that as the stock market bellwether index falls, the prices of the cryptocurrencies rise – and vice versa.Over the past 30 days, Bitcoin’s correlation with the S&P 500 was...

Read More » Crypto EcoBlog

Crypto EcoBlog