Revolut, the UK-based neobank, announced on April 1 that over one million private customers in Switzerland are now using its services.

The company opened a local office in Switzerland just last year, which now allows it to engage directly with clients in the country.

To date, Revolut has attributed its growth to organic factors, driven by referrals and word of mouth rather than large-scale marketing campaigns.

As finews.com reported, the company’s expansion has been primarily through this organic approach.

Roughly one in six Swiss residents between the ages of 20 and 64 has signed up with Revolut.

For comparison, local banking group Postfinance has approximately 2.5 million customer relationships in Switzerland, though the number of actively used accounts is unclear.

As recently as

Articles by Fintechnews Switzerland

discovermarket Launches Evento Seguro to Simplify Event Insurance

April 2, 2025Switzerland-based insurtech company, discovermarket, has partnered with Sympla, a Brazilian event platform, to introduce Evento Seguro, a new event insurance solution designed to simplify access to Public Liability Insurance for event organisers.

The fully digital platform streamlines the process, making coverage more accessible and removing the need for complex policy comparisons.

Marco Kamerling, Chief Commercial & Marketing Officer at discovermarket, explained that this is the first time event organisers can secure Public Liability Insurance by answering just two simple questions.

This simplifies the process, eliminating the need for lengthy questionnaires and complex policy comparisons.

Marco Kamerling

“In just a few minutes, they gain access to a comprehensive and transparent coverage

Visa Offers Apple $100M to Take Over Credit Card Partnership from Mastercard

April 2, 2025Visa has offered Apple approximately US$100 million to take over the technology giant’s credit card partnership from Mastercard, The Wall Street Journal reported on April 1, citing sources familiar with the matter.

Visa has made a significant push to secure the Apple Card, offering an upfront payment typically reserved for the largest card programmes.

American Express is also attempting to displace Mastercard to win the Apple Card, with plans to become both the card’s issuer and network.

Goldman Sachs and Apple, which launched their credit card partnership in 2019 with Mastercard as the payment processor, have ended their alliance, according to a report from November 2023.

Several financial firms are now competing to replace Goldman as Apple’s credit card partner.

Reuters reported in

Media Capital Gains Momentum as VC Funding Slows and Digital Advertising Cost Increases

April 2, 2025Media capital is rapidly becoming an essential tool for both media companies and consumer brands. It allows media companies to access emerging advertisers and potential financial returns, while enabling high-growth consumer brands to scale effectively without significant upfront marketing expenditures.

This approach has gained popularity over the past years, driven by a shift in the investment landscape marked by declining venture capital (VC) funding and rising digital marketing costs. A new report by MediaforGrowth (MFG), an investment firm based in London, delves into this growing trend, examining the key developments and the factors currently shaping the sector.

Media capital, also known as media for equity, is a model in which media companies exchange advertising space for equity

9fin Acquires Bond Radar to Expand Debt Market Intelligence

April 1, 20259fin, the AI-powered analytics platform for debt capital markets, has announced its acquisition of Bond Radar, a provider of intelligence and data for the international bond and loan markets.

The move strengthens 9fin’s offering by integrating Bond Radar’s historical data and market reach, particularly in investment grade debt and emerging markets.

Steven Hunter

“This acquisition is a step towards our ambitious vision of being the number one provider of debt market intelligence,”

said Steven Hunter, CEO and co-founder of 9fin.

“By combining Bond Radar’s market reach, client relationships, and historical transaction data, we’re solidifying our position as the go-to platform for debt market professionals, offering the tools and insights they need in today’s complex financial landscape.”

9fin

Gartner Forecasts AI-Driven Hardware to Propel GenAI Spending in 2025

April 1, 2025Worldwide spending on GenAI is projected to reach US$644 billion in 2025, marking a 76.4% increase from 2024, according to a forecast by Gartner.

John-David Lovelock, Distinguished VP Analyst at Gartner, noted that expectations for GenAI’s capabilities are diminishing due to high failure rates in initial proof-of-concept (POC) work and growing dissatisfaction with current GenAI outcomes.

However, foundational model providers continue to invest billions each year to enhance the size, performance, and reliability of GenAI models. This paradox is expected to persist through 2025 and 2026.

In 2025, ambitious internal projects initiated in 2024 will face increased scrutiny as Chief Information Officers (CIOs) shift towards more predictable commercial off-the-shelf solutions to drive

Backbase Partners with Salt Edge to Streamline Open Banking Compliance

April 1, 2025Backbase, an engagement banking platform provider, has partnered with Salt Edge, an Ontario-based open banking solutions provider, to help banks meet compliance requirements and integrate open banking solutions more efficiently.

Through this partnership, Backbase customers can access Salt Edge’s compliance solutions via the Backbase Marketplace, ensuring seamless integration with their existing systems.

Banks often face challenges in developing secure authentication flows between third-party providers (TPPs) and their digital platforms, leading to high IT costs for development and maintenance.

By combining Backbase’s banking platform with Salt Edge’s compliance solutions, banks can provide a ready-to-use solution for TPPs without additional infrastructure costs.

The solution includes an

Adnovum Announces Board Changes: Adrian Koch Steps Down, David Brodbeck and Reto Isenegger Join

April 1, 2025Adrian Koch, a member of the Board of Directors of Swiss software company Adnovum since 2014, will step down from his position on 31 March 2025.

Over the years, he has played a crucial role in establishing Adnovum’s presence in Singapore and supporting its growth into an international company.

Chairman of the Board of Directors, Adrian Bult, expressed his gratitude:

Adrian Bult

“On behalf of the Board of Directors and the Executive Board, I would like to thank Adrian Koch for his valuable commitment and his many years of support. His understanding of Asian business culture and his proximity to IT were invaluable to us.”

Although stepping down from the main Board, Adrian Koch will remain a member of the Board of Directors of Adnovum Singapore.

Effective 1 April 2025, David Brodbeck and Reto

How DeepSeek Could Propel the AI Agent Crypto Market Beyond Meme Coins to Sustainable Business Models

March 31, 2025In the rapidly evolving cryptocurrency space, a new sector has emerged: the artificial intelligence (AI) agent crypto token market. This industry has grown significantly over the past year, reaching a market capital capitalization of US$13.5 billion by early 2025.

Though the sector’s early days were dominated by token speculation and hype, the sector is now entering a phase of maturity grounded in real value validation, data-backed achievements and sustainable revenue models. According to HTX Ventures, the investment arm of crypto exchange HTX, the sector’s next growth phase could be propelled by technological innovations from Chinese AI company DeepSeek.

AI agent crypto tokens are a novel concept that combines elements of blockchain technology and AI. These tokens are typically associated

Top 10 Fastest-Growing Fintechs in Europe for 2025

March 27, 2025The Financial Times (FT) has released its annual FT1000: Europe’s Fastest Growing Companies ranking, showcasing the continent’s fastest-expanding businesses. Among the 1,000 companies on the 2025 list, 64 operate within the fintech, financial services, and insurance sectors.

Compiled with data research company Statista, FT1000 ranks companies based on the highest compound annual growth rate (CAGR) in revenue from 2020 to 2023.

To qualify, companies needed to meet several criteria, including generating at least EUR 100,000 in revenue in 2020 and at least EUR 1.5 million in 2023, with revenue growth being organic. They had to be an independent company, and be headquartered in an European country.

In this year’s FT1000 edition, the IT and software category represents a fifth of the list. When

Though Switzerland’s Fintech Sector Faces Saturation, Opportunities Still Exist in B2B and International Markets

March 26, 2025Switzerland’s fintech industry is showing signs of saturation, with the number of companies comprising the market stabilizing. However, growth opportunities remain, particularly in international markets and emerging verticals such as sustainable finance, according to the latest IFZ Fintech Study by the Institute of Financial Services Zug (IFZ).

Switzerland’s fintech industry stagnates

The 2025 IFZ Fintech Study, released in March 2025, shares the latest advancements in the Swiss and Liechtenstein fintech sector, sharing emerging trends and key developments.

According to the report, the Swiss fintech industry has reached a plateau in terms of the total number of companies. At the end of 2024, the market comprised 483 fintech companies, the same number as a year earlier. Although new players

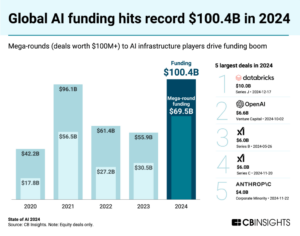

Billion-Dollar Transactions Drive Global AI Funding to New Heights

March 25, 2025In 2024, artificial intelligence (AI) venture funding reached a new record, surpassing the US$100 billion mark for the first time, according to a new report by CB Insights, a business analytics platform.

This surge in funding was driven by mega-rounds of US$100 million and more, which accounted for 69% of total funding. Within this category, four deals exceeded US$1 billion, primarily targeting AI models and infrastructure.

These investments reflect several trends: first, the high cost of AI development; and second, that investors are confident that the economic benefits of the upcoming AI boom will be captured by the builders.

These four transactions involved:

Databricks: A cloud-based platform that provides tools for data engineering, machine learning (ML), and analytics. Databricks

Read More »