Bitcoin’s eye-popping run beyond the psychological $20,000 level has turned profits for almost everyone who invested in the cryptocurrency to date. Also, BTC has appreciated by more than 500 percent this year since the March lows. It is currently among the top investable assets across all financial markets. But what exactly fuelled bitcoin’s rally past the 2017 top? What’s the force behind BTC’s parabolic spurt this year?Death Of The Dollar (Not Yet But The Writing’s On The Wall)The 1D YTD chart of the U.S. Dollar Currency Index below confirms the greenback’s road to perdition and reaffirms the fact that it’s time as the world reserve currency is about to get over.YTD U.S. Dollar Currency Index ChartRuchir Sharma, Morgan Stanley Investment Management’s chief global strategist, also talked

Read More »Articles by Himadri Saha

Is Blockchain The Answer To COVID-19 Led Misinformation and Rumor Mongering?

December 20, 2020In the past 10 months, COVID-19 literally brought the world to its knees. But the pandemic, as it turns out, has been less of a pandemic and more of an infodemic. The internet was teeming with a deluge of news reports, stories, blog articles, and ‘guidelines’ on ‘how to stay safe out there’.And what percentage of this content is actually worth relying upon? Which source to trust, and which one to shun? Why has this global catastrophe become a breeding ground for misinformation and rumor peddlers? Why is it painstaking to absolutely genuine information? Is blockchain technology the answer to this endless barrage of coronavirus misinformation?The ‘COVIMisinformation Virus’ And How It Came To LifeThe practice of rumor-mongering has been in existence since time immemorial. We human beings have

Read More »6 Reasonable Bitcoin (BTC) Price Predictions For 2021 Explained

December 19, 2020COVID-19 and bitcoin’s face-melting rally above $20,000 are undoubtedly amongst the major events in 2020. And as it happens, the former has played a greatly significant role in the latter’s occurrence. Which, in turn, has clarified one thing. The 2017 rally was a result of retail FOMO and hysteria, while the ongoing 2020 bitcoin run is much more solid (due to institutional involvement). And could continue well into 2021.But with current BTC prices trending above $23,000, what’s the future outlook for the outgoing decade’s most profitable investable asset? Here are some predictions.deVere Group Boss Predicts 50 Percent More Upside in 2021 From Current RatesNigel Green, the founder, and CEO of leading financial advisory organization DeVere Group, thinks that bitcoin is not going to do a 2018

Read More »Morgan Stanley Exec Makes The Case for Bitcoin to Become Global Reserve Currency

December 9, 2020Bitcoin has proved itself to be a supreme store-of-value in this pandemic-ridden world. But can the world’s first cryptocurrency flip the US Dollar to become the ‘global reserve currency’?The US Dollar Has Been The Global Reserve Currency For 100 Years NowRuchir Sharma, Morgan Stanley Investment Management’s chief global strategist, went candid in his latest opinion piece on Financial Times. He talked about the ‘reserve currency’ history starting right from the 1400s.And delineated how in the last 100 years, the US Dollar has enjoyed domination as the global medium of exchange. But despite praising the greenback, Sharma didn’t mince words in criticizing US officials. How they leveraged the COVID-19 pandemic to flood the money markets with countless dollar bills.He mentioned that the US

Read More »Analyst: Bitcoin Price at $300K by 2021 End is Not Out of the Question

December 2, 2020While bitcoin remains rangebound between $18,000 and the new all-time high, calls for BTC prices making ‘moonshot’ moves in 2021 have already started coming in.Amongst scores of such predictions, on-chain analysis pioneer Willy Woo opines that a $200,000 bitcoin price is ‘conservative’ and that the top cryptocurrency stands to fly to $300,000 by the end of the next year.$300K Per BTC ‘Not Out Of The Question’Even though BTC logged a new high, the top cryptocurrency’s price hasn’t managed to jump past the crucial psychological barrier of $20,000. But that won’t be a problem in 2021. According to noted on-chain bitcoin market analyst Willy Woo’s ‘Top Model,’ BTC is heading for $300,000 by the end of next year.Views on 2021 (THREAD):My Top Model suggesting $200k per BTC by end of 2021 looks

Read More »ETH Worth $510 Million Staked in Ethereum 2.0 Deposit Contract for Tomorrow’s Launch

November 30, 2020The hype around Ethereum 2.0’s launch is pretty hot at the moment. It can be seen from the enormous amount of ETH staked in the upcoming proof-of-stake network’s deposit contract. Data shows a balance that is upwards of 853,000 Ether (worth more than $500 million) in the Ethereum 2.0 deposit contract.ETH Worth $500 Million+ Deposited In The Ethereum 2.0 Deposit ContractEthereum blockchain activity tracking website etherscan.io has been keeping a record of all Ethereum 2.0 developments since the test net launch. According to the latest data, depositors have staked more than $510 million worth of ETH (853,248 ETH and counting) in the ETH2 deposit contract.Ethereum 2.0 Deposit Contract Sees $510 MIllion+ Worth ETH Stakes, Source: EtherscanETH stakes crossed the 524,288 deposit threshold last

Read More »Bitcoin and Crypto Worth $4 Billion Seized From PlusToken Ponzi Group

November 28, 2020Chinese authorities seized around $4 billion worth of bitcoin and other cryptocurrencies from the notorious crypto Ponzi group PlusToken. This comes after the Chinese police arrested the core team running the scheme in July.Around $4 Billion Worth Of Bitcoin And Crypto Assets SeizedAccording to CryptoPotato’s previous report on the PlusToken saga, the crypto shysters (27 key operators) were arrested by the Chinese police in July earlier this year. Along with them, the police also arrested 82 other members.Now according to the latest reports, Chinese authorities have confiscated close to $4 billion worth of bitcoin and cryptocurrency holdings from PlusToken operators. Estimates say that they duped much more than this amount by beguiling investors.Cryptocurrencies collected from users as a

Read More »Bitcoin Whales Thronged Crypto Exchanges And Supposedly Sold The Recent $19,600 Top

November 27, 20202018-like vibes came to haunt bullish bitcoin holders when whales showed up at cryptocurrency exchanges looking to take profits for a ‘filling’ Thanksgiving. Data shows that more than 93,000 BTC (around $1.56 billion) made their way to centralized exchanges after the primary cryptocurrency topped at $19,600.Bitcoin Whales Throng Cryptocurrency Exchanges With 93,360 BTCFrom November 25-26, it was a bloodbath for turkeys and the global cryptocurrency market. But why? Data from blockchain analytics firm IntoTheBlock shows that deep-pocketed bitcoin holders offloaded a record 93,360 BTC on numerous exchanges around the world. This amounts to around $1.6 billion.Whales have been moving $BTC into exchanges.#Bitcoin has faced a steep correction since Wednesday’s highs of $19,600This drop started

Read More »Bitcoin Worth $500 Million Withdrawn From OKEx as Users Look for Other Alternatives

November 27, 2020Users withdrew a record 29,300 BTC from OKEx after the Malta-based cryptocurrency exchange resumed withdrawals yesterday. This comes after bitcoin (BTC) price kickstarted its epic freefall dropping to levels near $16,500 before bouncing back up again. But what is the reason behind the massive bitcoin exodus out of OKEx?OKEx Sees Significant BTC Withdrawals And DepositsAs per the latest update from on-chain and market analysis firm Glassnode, OKEx users have withdrawn a record 29,300 bitcoins after the exchange gave the green signal for resuming withdrawals yesterday. These BTC transactions amount to roughly $5 billion (considering the current spot rates).Since yesterday’s announcement from #OKEx to resume withdrawals, we have seen an outflow of 29,300 $BTC from the exchange.In the same

Read More »Bitcoin Open Interest and Futures Volume on Binance at ATH As BTC Price Eyes $20,000

November 24, 2020Bitcoin price just surged past the $19,000 mark and is looking to retake the previous all-time high of $20,000. This spike in volatility has caused all BTC markets to experience some serious trading traffic – especially the bitcoin futures market. And how? Well, open interest in the Binance futures market just topped $1.2 billion.Binance Bitcoin Futures Market Register Record Open Interest And Daily VolumesAccording to the crypto market and on-chain analysis firm Glassnode, the bitcoin futures market on Binance just logged an all-time high open interest of more than $1.2 billion. This comes as BTC flipped the $19,000 price level into support for a move towards its previous ATH of $20,000.All-Time High Bitcoin Futures Open Interest on Binance, Source: SkewWhat’s even more interesting is

Read More »PayPal CEO: 28 Million Merchants Will be Able to Use Cryptocurrency for Transactions in 2021

November 23, 2020It is now a well-known fact that payments giant PayPal is knee-deep in the Bitcoin market. In today’s interview with CNBC, CEO Dan Schulman explained his rationale behind the world’s top cryptocurrency value. He also elucidated on why his company is placing giant buying bets on BTC.The Utility Surrounding Bitcoin And Cryptocurrencies Is What Imparts Them ValueUpon being asked to explain the inherent value of bitcoin, PayPal CEO Dan Schulman immediately said that BTC and the aggregated class of crypto assets derive value from their utilities.Mr. Schulman pointed out a scenario where dependability on cash has dropped 40 – 70 percent due to the ongoing coronavirus pandemic. Central banks, he said, will eventually go digital, converting paper fiat into their electronic counterparts.“As paper

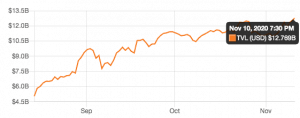

Read More »Top DeFi Tokens Explode as TVL Nears $14 Billion

November 20, 2020It’s an all-around green day in crypto land. Bitcoin price has surged beyond $18,000, closing the gap with its previous all-time high of $20,000. ETH just rocketed past $500 for the first time in two years.But apart from the usual cryptocurrencies, decentralized finance (DeFi) tokens are sitting on gains as a majority of them exploded in valuations over the past couple of days.Top 100 DeFi Coins Register Explosive Weekly GainsA bull market pulls every asset out of the bearish rut. The same is true for cryptocurrency markets as well. However, the scenario here is a lot more dramatic than traditional financial markets. And even within the digital currency markets, while the mainstream crypto section comprising of bitcoin, ether (ETH), and other usual coins have logged decent gains, the DeFi

Read More »Ethereum at $500 For the First Time Since July 2018: Interest Increasing

November 20, 2020After failing to tap the $500 mark two days ago, ETH woke up from its slumber with jetpacks mounted on its back. The cryptocurrency rallied vertically and just smashed the $500 resistance against the US Dollar after more than 2 years of trading at the said rates. This comes amid a rising trend of Ethereum searches on Google.Ethereum’s ETH Soars Straight Up To $500It seems ETH bulls are no longer in the mood to remain in the sub-$500 zone, as a bout of galvanizing price action pushed the cryptocurrency to top the $500 mark a few minutes ago. This marks a 6 percent rise for Ethereum’s native token and an almost 200 percent gain year to date.ETH price is trading at $500 after more than two years. The last time the crypto asset changed hands at this price was July 2018. Many in the community

Read More »Ethereum 2.0 Deposit Contract Stakes Cross 100,000 ETH as Dubai Firm Invests $10 Million

November 18, 2020Ethereum bulls are busy pumping the network’s native cryptocurrency ETH as if there’s no tomorrow. So much so that the asset almost tested the $500 resistance today. But what’s even more interesting is the gradual progress on the staking front for Ethereum 2.0’s launch.

Depositors have already staked more than 100,000 ETH in the ETH2 deposit contract. Also, a Dubai based conglomerate is looking to support Ethereum 2.0’s launch by plugging in $10 million.

More Than 100,000 ETH Staked In Ethereum 2.0 Deposit Contract

As per the latest update on Ethereum 2.0, the upcoming upgrade to the original network has already secured a deposit of more than 100,000 ETH for its launch. This makes up roughly 20 percent of the 524,288 ETH target.

The #Ethereum 2.0 deposit contract has

Read More »Bitcoin Price Swings $1,000 in Minutes Following a Shot at $18,000

November 18, 2020SpaceX’s Crew-1 spaceship flew 4 astronauts to space yesterday. But it seems the shuttle also dragged the bitcoin and cryptocurrency market along with it. As in what happens to be a revisit of 2017, BTC smashed past the $18,000 price mark pushing the total digital asset market cap north of $500 billion.

The excitement was short-lived, however, as the cryptocurrency took a u-turn and decreased by more than $1,000 moments after touching its intraday high.

Bitcoin Price Blasts Past $18,000 Again After 3 Years, $100,000 Possible

Bitcoin seems ready for the moon mission and may have, in fact, already left the base. The top cryptocurrency just blew past the $18,000 resistance with a 10 percent jump after exactly 3 years.

The entire crypto community was awestruck at this

Can Blockchain Technology Eradicate Voting And Election Issues? MIT Says No

November 17, 2020The world just witnessed the deeply debated (only from the ones who lost) results of the 2020 US Presidential election. More than a week ago. Republican party members, including their leader and the 45th President Donald Trump, crying foul calling the polls rigged.

Nonetheless, Joseph Biden will take up the coveted position as the leader of the nation. The election process was carried out using the good old paper ballot system. Could blockchain replace it and make the vote fast, efficient, and secure? Not according to the latest paper by a group of elite MIT researchers.

MIT Scientists: Blockchain Voting Cannot Solve Election Inadequacies

Eminent MIT scientists Ron Rivest, professor at the MIT Computer Science and Artificial Intelligence Laboratory (CSAIL), Michael

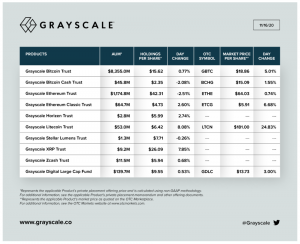

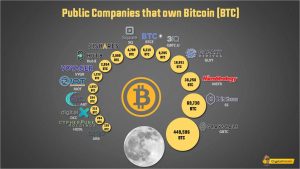

500,000 BTC Worth $8.5 Billion Currently Owned By Grayscale

November 17, 2020Amongst bitcoin and cryptocurrency fund management firms, Grayscale takes the top spot. And so it has proved again by now becoming the owner of 500,000 BTC worth $8.5 billion. This roughly equals 2.4 percent of the cryptocurrency’s total programmed supply.

Grayscale Investments Owns Bitcoin Worth $8.5 Billion

A few hours ago, Barry Silbert’s crypto fund management firm Grayscale dropped an update regarding its bitcoin stash, now amounting to a massive 500,000 BTC.

Grayscale Bitcoin Trust now holds more than 500,000 $BTC. Yes, you read that right. Learn more about the world’s largest #Bitcoin investment product. #GoGrayscale https://t.co/2sEpUdw8iN pic.twitter.com/9h8nGZ8i4t

— Grayscale (@Grayscale) November 16, 2020

As per bitcoin’s total supply that Satoshi programmed,

Cryptocurrency Crime Reduced By 60 Percent in 2020 but DeFi Hacks Exploded

November 15, 2020In 2019, cryptocurrency-related crime – thefts, hacks, fraud amounted to $4.5 billion. The latest data from blockchain forensics company CipherTrace shows that this number has fallen to $1.8 billion this year – a 60 percent reduction. Nonetheless, the DeFi space has seen an explosion in criminal activity.

Mainstream Cryptocurrency Crime Declining Says CipherTrace

In a tête-à-tête with Reuters, CipherTrace CEO Dave Jevans observed that crypto exchanges and digital asset trading facilitators had upped their security game. This comes after more than decade-long exploitation of cryptocurrency platforms by hackers and malicious actors.

This probably explains the massive 60 percent reduction in mainstream cryptocurrency crime from $4.5 billion in 2019 to $1.8 billion this year.

Coinbase To Facilitate Bitcoin Payments For Select U.S. Passport Services

November 13, 2020Bitcoin payments for passport services? You read that, right! In a first, a nearly 50-year-old U.S based passport and visa processing firm, Peninsula Visa, will now be accepting BTC for select passport services. Coinbase’s crypto payments arm, Coinbase Commerce, will be assisting the company in the same.

Peninsula Visa Is Now Accepting Bitcoin For Passport Services

In an official press release, Peninsula Visa announced its plan to integrate bitcoin payments for selected passport services. Customers will be able to avail of the company’s ‘BTC benefit’ during the course of the next 12 months. Coinbase Commerce has come out to help Peninsula Visa with secure processing of all bitcoin payments.

Speaking of specific passport services, the following have made the list. For now:

Russia Seeks Imprisonment for Undeclared Bitcoin and Cryptocurrency Transactions

November 12, 2020In the latest turn of events, the Russian Ministry of Finance has taken a harsh stance wrt cryptocurrency regulations. Crypto holders on not disclosing their digital assets (worth 45 million rubles or more) at least twice in a period of three years stand to face a jail term of up to three years. This, however, is an amendment from a previous version.

Russian BTC And Crypto Holders Could Face Jail Term

As per the latest update on Bitcoin and cryptocurrency regulation, Russia’s Ministry of Finance looks to tighten its control on folks dealing with crypto assets. And how?

Cryptocurrency owners will face imprisonment for not reporting crypto transactions amounting to 45 million rubles or above. The proposed sentence for the same is up to three years. An earlier version of the

Bitcoin Price Climbing to $20,000 and Volatility Spike in November Very Likely: Kraken Report

November 11, 2020Kraken released it’s August Bitcoin Volatility Report 2 months ago. Then the cryptocurrency exchange sounded supremely confident about BTC registering higher highs as the year ends. In its October version of the same report, Kraken has maintained its bullish stance. November will see bitcoin log much higher price and volatility rallies. Also, BTC might as well be on the way to reclaiming the previous all-time high of $20,000.

Bitcoin Price And Volatility To Climb In November

If Kraken’s August Bitcoin Volatility Report is anything to go by, BTC has already left behind September’s crash in the rearview mirror and is on its way to register more ‘incremental volatility’.

The exchange pointed out that November has stood out to be the ‘third-best yielding month’ for bitcoin, on

Bitcoin Has a Lot of Attraction as a Store of Value: Billionaire Investor Druckenmiller

November 9, 2020It’s another bigshot score on the store of value front for Bitcoin. Billionaire hedge fund investor Stanley Druckenmiller just admitted holding BTC on national television in an interview with CNBC. The bigshot money manager also has positions in gold, but he is considerably bullish on the world’s first cryptocurrency.

“If the gold bet works, the Bitcoin bet will work better.”

In the latest interview with CNBC’s Kelly Evans, a billionaire hedge fund manager, said that he owns bitcoin and that he is betting on the cryptocurrency attaining much higher valuations in the upcoming future.

“I’m a bit of a dinosaur, but I have warmed up to the fact that Bitcoin could be an asset class that has a lot of attraction as a store of value,” says legendary investor Stanley Druckenmiller

Read More »Analysis: Bitcoin Price Can Reach $90,000 By Mid 2021

November 8, 2020Bitcoin price has eclipsed last year’s high in an explosive rally up to the $16,000 mark. The market sentiment is bullish, and predictions call for higher highs by the end of this year. However, one accomplished trader has raised the bar quite high. He thinks BTC will be worth anything in the $80,000-$90,000 range by June 2021.

Bitcoin’s Price At $20,000 Next? Yes, According To The Rising Blue Arc

A popular TradingView based chartist ‘MagicPoopCannon’ (MPC) is projecting supremely bullish vibes based on the current status of bitcoin markets. For starters, he pointed out how BTC’s Relative Strength Index (RSI) indicator has passed into the ‘overbought territory.’ This MPC stated is a scenario that has historically preceded face-melting bitcoin rallies.

It happened in July

86% Quarterly Increase: Square Reports $1.63 Bitcoin Sales In Q3

November 6, 2020Twitter founder Jack Dorsey’s payments firm Square is riding the Bitcoin wave like there’s no tomorrow. The company’s Q3 investors’ letter has just come out.

And if numbers are anything to go by, Square has registered a humongous $1.3 billion revenue in the third quarter through Bitcoin sales. This comes amid the company clocking a $3.03 billion net revenue and nearly $800 million in net profits.

Bitcoin’s Headed For The Stars Along With Square’s Q3 Earnings

While bitcoin’s busy bringing back 2017 vibes, Square’s cash registers are not staying behind either. The company’s quarterly earnings report for Q3 2020 has growth written all over it. And not just petty linear growth, the exponential kind.

For starters, the Jack Dorsey led payments firm has raked in an astronomic

The US DOJ Seizes Bitcoins Worth $1 Billion Allegedly Belonging to Silk Road

November 5, 2020The United States Department of Justice confiscated around $1 billion worth of bitcoins on Tuesday. Today it is suing for forfeiture of the BTC that federal personnel seized. The coins allegedly belong to the now-defunct darknet marketplace Silk Road.

US DOJ Wants The Forfeiture Of Bitcoin Worth $1 Billion

As per Bloomberg’s latest report, the US Justice Department wants immediate forfeiture of bitcoins worth $1 billion that it seized on Tuesday. The BTC stash belongs to Silk Road operators. And its confiscation is one of the largest to date for the country, which has been quite a lot in the news for busting digital currency-related crimes.

The bitcoins made up the 4th largest BTC wallet in the world. When coins started moving out of the stash, blockchain analysis firm

The Associated Press Has Leveraged Ethereum For Recording US Election Data

November 4, 2020Blockchain adoption has just achieved a major milestone. The Associated Press has chosen the Ethereum blockchain to publish calls for the latest US Presidential election.

The nearly 200-year-old New York-based non-profit news agency has been counting votes since its inception in 1848 and will do the same this year too by collecting, verifying votes, and declaring winners in 7000 contests. This comes as the ETH 2.0 deposit contract was just launched.

The Associated Press Takes To Ethereum For Recording US Election Data

It’s official. The Associated Press (AP) is leveraging the Ethereum blockchain system for recording vote count from the ongoing US Presidential election. This is the first time that a decentralized computing system is being used to maintain records of one of

Will Ethereum 2.0 Deposit Contract Release Help ETH Outperform Bitcoin Again?

November 4, 2020Ethereum’s creator officially announced the release of the Ethereum 2.0 deposit contract a couple of hours ago. ETHUSD markets responded with a large green candle that has pushed the network’s native cryptocurrency past the $400 mark. The question is, will this latest update help ETH outperform bitcoin once again?

Ethereum 2.0 Deposit Contract Officially Released

Ethereum’s creator Vitalik Buterin took to Twitter to announce the launch of the Ethereum 2.0 deposit contract. This is a ‘v1.0 spec release,’ as mentioned on the official website. And it will have a ‘MIN_GENESIS_TIME of 1606824000’. The real-world time for the same is December 1, 2020, at 12 pm UTC.

For ETH2 to undergo genesis at the aforementioned time, validators need to collectively make 16384 deposits of 32

No, Miner Capitulation Isn’t Why Bitcoin Dropped Yesterday (Opinion)

November 3, 2020Bitcoin, after a massive rise to last year’s high, trimmed gains in a sudden selloff yesterday. YouTube-based BTC commentator Carl Martin a.k.a The Moon, opined that the cryptocurrency is experiencing selloff from miners.

But is that actually true? Is bitcoin dipping because of miner capitulation? Nope, there’s no tangible proof to corroborate the same.

Carl ‘The Moon’ Martin Thinks That Bitcoin Miners Are Capitulating

In a tweet, Carl Martin, who also goes by the name of ‘The Moon,’ claimed yesterday that bitcoin has entered into a ‘miners capitulation’ zone. Indeed, bitcoin miners are more than tempted to liquidate their mining rewards, given the epic price rush that catapulted BTC to last year’s highs.

The Moon, while explaining his bitcoin miner capitulation stance,

Opinion: After Massive Gold Selloff, Central Banks Should Buy Some Bitcoin Now

November 1, 2020For the first time in a decade, central banks around the world are selling off their bullion stocks. Economists have opined that this is a direct result of the coronavirus pandemic led fiscal stress. If the trend continues, gold prices are in for some serious freefall rides. The question is, will central banks start stockpiling on bitcoin now?

Central Banks Dumping Gold For First Time in 10 Years

In a surprising report published by Bloomberg, central banks for the first time in a decade, have become sellers of the yellow metal as opposed to their conventional trend of buying XAU. Gold producing nations were the ones to set off the massive dumping spree to offset the financial damage caused by the pandemic. Speaking on the development, a financial expert associated with a

Bitcoin and DeFi Rally Led Crypto Hedge Funds To Log More Than 100% Gains in 2020

October 31, 2020Owning to the Bitcoin and the aggregated cryptocurrency market’s recent roaring rally, BTC, and crypto hedge funds have reportedly registered profits upwards of the 100 percent mark. This comes amid the rising sentiment of sidestepping banks to avail quick loans through digital assets. What does this say about the cryptocurrency industry?

Bitcoin And Cryptocurrency Hedge Funds Raked In A Lot Of Moolah

As per Reuters’ latest report, Christmas for digital currency-based hedge fund owners will be 100 percent ‘merry’. Why? Well, bitcoin’s recent explosive price rally has led them to log near 100 percent gains on the back of increased crypto lending and borrowing transactions.

Madison Avenue, New York-based crypto hedge fund and asset management firm Vision Hill Group clocked