Amongst bitcoin and cryptocurrency fund management firms, Grayscale takes the top spot. And so it has proved again by now becoming the owner of 500,000 BTC worth .5 billion. This roughly equals 2.4 percent of the cryptocurrency’s total programmed supply. Grayscale Investments Owns Bitcoin Worth .5 Billion A few hours ago, Barry Silbert’s crypto fund management firm Grayscale dropped an update regarding its bitcoin stash, now amounting to a massive 500,000 BTC. Grayscale Bitcoin Trust now holds more than 500,000 $BTC. Yes, you read that right. Learn more about the world’s largest #Bitcoin investment product. #GoGrayscale https://t.co/2sEpUdw8iN pic.twitter.com/9h8nGZ8i4t — Grayscale (@Grayscale) November 16, 2020 As per bitcoin’s total supply that Satoshi programmed,

Topics:

Himadri Saha considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, Grayscale, social

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Amongst bitcoin and cryptocurrency fund management firms, Grayscale takes the top spot. And so it has proved again by now becoming the owner of 500,000 BTC worth $8.5 billion. This roughly equals 2.4 percent of the cryptocurrency’s total programmed supply.

Grayscale Investments Owns Bitcoin Worth $8.5 Billion

A few hours ago, Barry Silbert’s crypto fund management firm Grayscale dropped an update regarding its bitcoin stash, now amounting to a massive 500,000 BTC.

Grayscale Bitcoin Trust now holds more than 500,000 $BTC. Yes, you read that right. Learn more about the world’s largest #Bitcoin investment product. #GoGrayscale https://t.co/2sEpUdw8iN pic.twitter.com/9h8nGZ8i4t

— Grayscale (@Grayscale) November 16, 2020

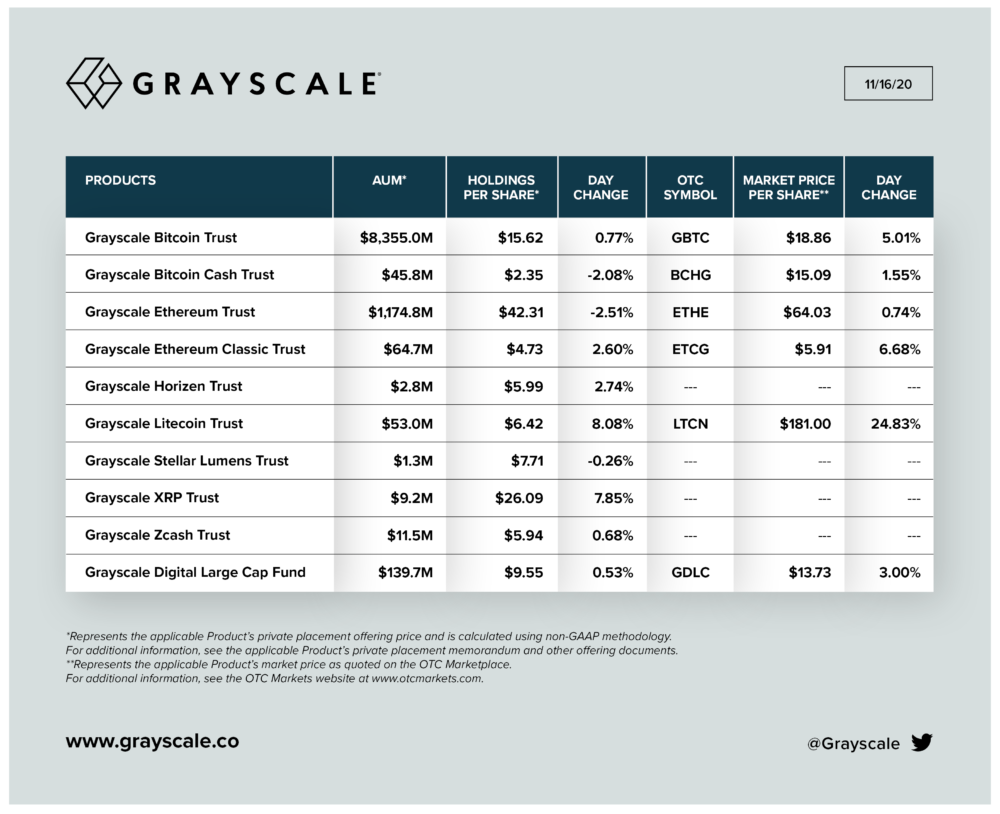

As per bitcoin’s total supply that Satoshi programmed, this number constitutes roughly 2.4 percent of 21 million. The total value of the stash is close to $8.5 billion. And as per the firm’s latest balance sheet, Grayscale now hoards a net AUM (assets under management) of nearly $10 billion.

The lion’s share of the business comes from sales of Grayscale Bitcoin Trust (GBTC) shares, as can be seen from the picture below.

Considering the size of the BTC holdings, it is implied that Grayscale’s stash is pretty significant. And this is a direct result of an aggressive accumulation move that began with the turn of this year itself.

Riding High On The Juicy Revenue Figures Of Q3 2020

Things have been adequately sunny for Grayscale this year. Firstly it’s ETH investment arm became an official SEC-reporting company. This multiplied its credibility for accredited investors who only play by the book and trust only licensed firms.

Along with this, CryptoPotato reported last month about Grayscale logging Q3 2020 as its best performing quarter. The leading digital currency fund manager registered cash inflows worth $1 billion. Out of which, GBTC was clearly the favorite amongst investors. Grayscale’s bitcoin product attracted $720 million.

As per the official report, institutional investors were the dominant market participants in the Grayscale land. The deep-pocketed folks made up for 81 percent of the Q3 inflows.

The percentage of accredited investors allocating funds into Grayscale products have dropped from 12 to 8, while family offices have increased from 4 percent to 8 percent.

Grayscale’s furious bitcoin stash growth is also due to the surging investment interest in the cryptocurrency. Thanks to the nefarious COVID-19 pandemic. According to the asset management firm’s Bitcoin Investor Study, nearly 66 percent of the BTC investors said that “the ramifications of COVID-19 were a factor in their decision to do so.”

The firm’s survey also pointed out the trend of bitcoin moving toward mainstream acceptance”. And how? 62 percent of the 1,000 participants said they were familiar with BTC. This number was slightly over 50 percent last year.