“All the Banks Are Broke,” and they’ve only got worse. Quantitative easing forever? The threat of cryptocurrencies will disrupt the financial sector. A video from 2013 depicting a European minister’s tirade against the global banking system has recently re-emerged and gone viral. Gaining massive traction within the crypto community, the speech is now more relevant than ever — and central banks know it. “All the Banks Are Broke” Within an impassioned speech, British politician and former member of European Parliament (MEP) Godfrey Bloom thoroughly dismantles the global banking sector, proposing that banks are ‘broke” and highlighting what he calls institutional “incompetence and chicanery.” Watch: Godfrey Bloom’s tirade against the financial sector Packing in as much vitriol as one

Read More »Articles by Will Heasman

3 Ways Coronavirus May Have Affected Bitcoin

February 17, 2020Is there a correlation between bitcoins price action and the coronavirus spread?

Virus-infected yuan placed in quarantine—Bitcoin fixes this.

Bitcoin mining takes a dive following China’s coronavirus clampdown.

As coronavirus continues to spread mass panic around the globe, its impact on bitcoin is becoming more evident. Here are three critical repercussions for BTC amid the outbreak.

As the Coronavirus Spreads, Bitcoin Continues to Break Out

Bitcoin is proving its worth as a macro hedge against global uncertainty. Year-to-date, BTC has achieved a 35% boost and managed to hit a yearly high north of $10,000 last week.

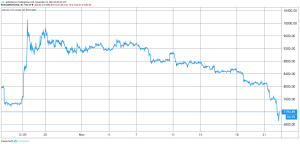

Bitcoin’s year-to-date gains seem to correlate with the coronavirus outbreak. | Source: TradingviewFor many, this is clear-cut evidence to solidify

Is There Any Truth to the Tesla-Bitcoin Parallels?

February 8, 2020Is there a bitcoin-Tesla connection?

Are BTC and Tesla truly the world’s most “disruptive” technologies?

Blockchain, not bitcoin.

Thanks to a significant uptick in Tesla (NASDAQ:TSLA) stock since the start of 2020, a new narrative has emerged: Tesla stock is—apparently—the new bitcoin. But is there any truth to this beyond a trivial analytic link?

The chronicle of Tesla’s price surge—and its kinship to BTC—is being picked apart by nearly every analyst of late. One of the most recent speculators to highlight the quasi-relationship is Bloomberg Intelligence analyst Mike McGlone.

Speaking on an episode of “Charting Futures,” McGlone observed that Tesla’s stock price seems to be mimicking its 2013 performance—a year that witnessed TSLA explode from $32 to $190 in the

Read More »Yang in the Oval Office Is Bitcoin’s Only Chance of Reaching Critical Mass

January 30, 2020Yang: cryptocurrencies need “one national framework.”

The U.S. is falling behind in crypto innovation.

Yang may be bitcoin’s only chance at mass adoption.

For bitcoin and other cryptocurrencies to unlock their full “potential,” there needs to be a holistic approach to crypto regulation. This is according to the 2020 U.S. presidential hopeful Andrew Yang, who has presented yet another bullish argument in favor of cryptocurrencies.

In a recent interview with Bloomberg, Yang remarked that cryptocurrencies have a “high potential” for success and that the U.S. should spend more time investing in them.

Regardless of his optimism, Yang caveats that the current “hodgepodge” of crypto regulation—spread as it currently is throughout multiple jurisdictions—is impeding

Tron’s Justin Sun Goes to Lunch With Apple Co-Founder, Doesn’t Know What ‘Partnership’ Means

January 22, 2020Justin Sun “partners” with Apple’s Steve Wozniak.

What could the partnership involve?

Sun has a dodgy history of “partnerships.”

Tron CEO Justin Sun, CEO has partnered with Apple co-founder Steve Wozniak. That’s according to an emphatic Tweet from Sun, who believes a recent luncheon with the “legendary Woz,” signifies the basis for a “partnership.” Unfortunately, Sun’s track record of “partnerships” suggests that he doesn’t actually know what a partnership entails. So, is the collaboration legitimate this time around?

Justin Sun meets and “partners” with Apple founder Steve Wozniak. | Source: TwitterIn all fairness, the eccentric Tron CEO was bouncing off a tweet from the Woz himself. The Apple co-founder was the first to break the news, revealing they had had

U.K. Tax Agency Offers a $130,000 Bounty on Privacy Coin Traceability

January 21, 2020The U.K’s taxman clamps down on tax evasion and money laundering.

HMRC offers $130,000 for anyone who can trace BTC, ETH, and an array of privacy coins.

Will the UK become the next crypto hub?

The U.K.’s taxman is looking to crack down on private transactions. HM Revenue and Customs (HMRC), the tax authority for the U.K., has granted a bounty of $130,000 (£100,000) for anyone that can effectively track and identify crypto criminals. But what does this mean for privacy coins and financial anonymity?

HMRC is looking for an autonomous way to analyze seven of the major cryptocurrencies, including bitcoin, Ethereum and Tether. The agency aims to glean insight on cryptocurrency users to tackle tax evasion and money laundering.

Within the bounty summary, HMRC lays out the

It’s (Nearly) Over $9,000: Is Bitcoin’s Halving Finally Being Priced In?

January 17, 2020Bitcoin may target $18,000 if past halving performance plays out.

In the immediate term, bitcoin must overcome $9,000.

BTC price briefly overtakes that level Friday.

Analysts, traders and crypto enthusiasts all over the globe are cheering on bitcoin as it looks to overcome $9,000. But is this the start of something bigger? Is bitcoin finally pricing in the next halving – or halvening, as some may call it?

The sentiment inside the cryptocurrency community is reaching epidemic proportions. All over Crypto Twitter, Vegatta memes are being pulled out and readied for painfully derivative tweets. Yep, bitcoin is almost over $9,000 again.

It’s hard not to get swept up in the tide bullishness of late. In the mere 17 days since 2020 sprang forth, BTC has posted a 25% gain.

Time to Short Bitcoin SV? Analyst Warns ‘Proceed With Caution’

January 16, 2020BSV “flash dump” may occur soon.

Is it time to short BSV?

Crypto volatility is back, baby!

While 2020 is scheduled to be the year bitcoin blows-up, it seems a few traders didn’t get the memo—opting instead to pump derivative rival, Bitcoin SV. The bitcoin cash spin-off has posted a 291% year to date increase, but has its luck run dry? Is BSV about to come collapsing down? And is it time to go short?

That’s the opinion of most BSV critics today, of which there seems to be no lack of. The resounding consensus appears to be something along the lines of, ‘short it into the ground.’

One pseudonymous analyst, known as CryptoGainz, has advised exactly this, arguing that BSV bagholders are incapable of selling due to network congestion.

Despite the gigameg blocks, BSV

Adam Back: $10 Million Bitcoin Prediction Is ‘Closer Than It Sounds’

January 13, 2020Bitcoin’s $10 million dollar price prediction hits Twitter.

Is bitcoin a reserve currency?

Some analysts believe U.S. dollar inflation will push bitcoin higher.

According to Blockstream founder and cypherpunk, Adam Back, Hal Finney’s $10 million price point for bitcoin isn’t so far fetched, though, the reasons behind these levels may not be as apparent as you may think.

When it comes to price predictions, crypto analysts often tout the most hyperbolic and over-inflated projections imaginable. From the more modest end of the spectrum at around $10,000, toward the virtually inconceivable heights of $10 million, valuations within this space can vary wildly.

Regardless, some augers of these seemingly aggrandized price points do sometimes offer a reasonable explanation

Crypto’s Richest 1% Fail to Hoard a Whole Lot of Bitcoin

January 10, 2020Bitcoin is more fairly distributed than altcoins.

Cardano may be dangerously centralized.

Whales are still a significant issue for BTC.

When contemplating crypto whales, the knee jerk reaction is to automatically think, “lotsa bitcoin;” However, according to statistics from Intotheblock—a crypto intelligence company—BTC ownership may actually be less concentrated than most altcoins.

Tracking numerous cryptocurrency addresses holding more than 1% of the supply of Bitcoin; Ethereum; Bitcoin Cash; Litecoin; BitcoinSV; Cardano and Tether, the analytics firm discovered that bitcoin distribution is actually fairer than many altcoins.

39 bitcoin addresses boast, holding a relatively meager 11% of the total supply of BTC. By sheer contrast, 154 addresses own 40% of all

Bloomberg Says Bitcoin Will Hit $14,000 in 2020 Thanks to Gold

January 9, 2020Bitcoin equals digital gold, according to Bloomberg report.

Altcoins set to suffer in 2020.

The futures market will aid mass adoption.

Bitcoin is going to boom this year. That’s the verdict, according to Bloomberg’s crypto’s outlook for 2020.

Within the recently published report, Bloomberg market analyst Mike Mcglone outlines exactly how BTC can attain its 2019 high. Spoiler alert: it’s mostly to do with a correlation to gold.

The bitcoin-gold relationship is on the rise. | Source: BloombergBitcoin isn’t called “digital gold” for nothing. Its association with the precious metal has been religiously quoted by cryptocurrency experts and enthusiasts alike for years—and for good reason. The flagship cryptocurrency holds innumerable qualities that mimic the yellow

Bitcoin Is Back: 4 Bullish Signs in Favor of a Huge Santa Claus Rally

December 19, 2019Bitcoin volatility makes a stunning return. The “extreme fear” countertrade is back on the table. Bakkt futures record all-time highs. Bitcoin’s recent rise has sparked new hopes for BTC just in time for the holidays. Here are several signs that may indicate a Santa Claus rally is on its way. Bitcoin has been anything but bullish recently. Since it’s tantalizing reprisal back in June, the pioneer crypto has refused to advance anywhere but south, retracing by as much as 47%. Rather than any technical or a fundamental issue, many are blaming the price lull on the PlusToken scam. According to a report by bitcoin analytics firm, Arcane research, the $3 billion Ponzi recently cashed out $34 million via Huobi, causing BTC to landslide down into the $7,000 region. Nevertheless, on Dec. 18,

Read More »Matic Dramatically Collapses 70% in ONE Hour; Inside Job or Investor Panic?

December 10, 2019Matic drops 70% in an hour after weeks of positive gains. The cryptocurrency was up nearly 200% in two weeks before the plunge. Was it an inside job? Matic — one of the first tokens to originate upon Binance Launchpad has witnessed one of the harshest dumps in crypto history, falling a massive 66% in the space of an hour. Crypto, Twitter is screaming today. Altcoins left, right, and center are dropping like stones. Still, one cryptocurrency is hurting more than any other, Matic. On December 10, the cryptocurrency — which has an impressive price history — plummeted from its all-time high of $0.042 to a low of $0.011. Analyst Alex Kruger points out Matic’s 70% crash | Source: TwitterIronically, Matic was on a slow and steady incline in the weeks prior to this, climbing 180% to its price

Read More »VeChain (VET) Jumps a Whooping 26%, Thanks to an Iconic Retro Game Remake

December 2, 2019VeChain is up 26% today.

Microsoft and VeChain Thor collaborate on a retro game project.

It’s been a good few months for VET.

While the rest of the market continues to torment investors, one cryptocurrency is covering some significant ground. VeChain (VET) is up 26% today and showing no signs of slowing down, but what’s driving the token?

Impressively, the token is back to price highs not seen since May this year.

VeChain up 26% | Source: CoinmarketcapIt seems a trifecta of partnerships, progress, and listings still make the biggest difference in this market. There has been no lack of the aforementioned for VeChain of late, citing several bullish coalitions, all of which look to drive the project further.

A Retro Collab with Microsoft

By far, the biggest propellents thrusting VeChain

Crypto Exchange Admits ‘Missing’ CEO Has User Funds Access Amid Exit Scam Fears

November 29, 2019IDAX’s many problems continue to stroke suspicion.The exchange finally admits “the truth”.Is this all a cover-up for an exit scam?In a story reminiscent of the QuadrigaCX scandal, crypto exchange platform, IDAX Global, has no idea where its CEO is, plus, he holds the exchange’s private keys… Oh boy, it’s been a pretty lousy week for crypto exchanges; first Upbit reveals a $50 million hack, and now it turns out that IDAX might be in trouble as well.IDAX: The Story So FarThese past few weeks haven’t been kind to IDAX. An ongoing crusade against the exchange has been forming. Angry users citing worsening withdrawal issues have continued to demand a response. On November 24, they finally got one. IDAX blamed the problems on increased withdrawal requests, stating:The channel that causes the

Read More »This Cryptocurrency Is Up 11310% in a Week. Legit Scam or Just Legit?

November 26, 2019Storeum (STO) gains over 11000% out of nowhere.

What is this enigmatic project?

Another day another pump and dump.

While the rest of the crypto market slowly bleeds away, one cryptocurrency – dubbed Storeum – has sprung out of nowhere, citing improbable gains. But what is this cryptocurrency, how did it get here, and is it a scam?

Recently, Coinmarketcap (CMC) has been a fairly dire, mournful reminder of the recent carnage witnessed within the cryptocurrency markets. Various charts, strewn with squiggly lines pointing downward, depicting prices that are more in keeping with the mid-bear market of 2018. Nevertheless, one outlier remains. Poking its unfamiliar little head above the rest is Storeum (STO).

A Steep Climb for Storeum

In the past week, the cryptocurrency has seen ungodly

Cardano Creator Sets $100K Price Target for Bitcoin

November 22, 2019Charles Hoskinson remains ultra bullish on bitcoin.FUD takes over the cryptocurrency markets.Now might be a good time for long term BTC acquirers.Despite a recent bout of fear, uncertainty, and doubt within the cryptocurrency community, Charles Hoskinson – the creator of Cardano – has set a bullish $100,000 price target for BTC.Bitcoin is dying, or so it would appear if you lurk around any corner of Crypto Twitter. This dour sentiment is somewhat understandable given the current price performance of BTC.In the space of a month, bitcoin has been on a sad slope down to $7,000, where it currently resides.Some hope was regained at the end of October when the flagship crypto broke free of the bears. Following China’s widespread adoption of blockchain, BTC attempted to surmount the $10,000 mark.

Read More »China Vows ‘Immediate Disposal’ of Crypto Exchanges As Bitcoin Plummets

November 22, 2019China continues its crackdown on crypto exchanges. Binance and Bithumb raid rumors cause widespread FUD. Will China’s U-turn on crypto impact the market? The Peoples Bank of China (PBOC) has reiterated its position on crypto trading, vowing the immediate disposal of cryptocurrency exchanges. For weeks China’s strict attitude towards cryptocurrencies has seemingly morphed into something less stringent. Blockchain technology has been championed within the country, and a lighter touch was implemented in regards to bitcoin mining. This inconceivable 360 on crypto – which has been responsible for a considerable increase in overall sentiment – has come full circle. In a classic case of blockchain, not bitcoin, China is now looking to reinstill its uncompromising stance on cryptocurrency

Read More »China May Use Crypto to Incentivize its Army: Pump Incoming?

November 18, 2019China may use blockchain to organize and incentivize its military

Could China’s embrace of blockchain cause another pump?

The people’s republic softens its stance on crypto.

China’s latest blockchain initiative could see its army rewarded in cryptocurrency tokens.

Just as the blockchain hype in China appeared to be simmering down some, The People’s Liberation Army (PLA) Daily – a state-sanctioned newspaper of the Chinese army – proposed a blockchain-focused overhaul of the country’s military.

According to the report, personal data management may be shifted to the blockchain to increase efficiency. Further, crypto tokens could be used to incentivize soldiers to heighten performance in both missions and training. Information pertaining to military personnel such as training

Bitcoin’s Difficulty Falls As Miners Capitulate; Will They Survive the Halving?

November 13, 2019On Nov. 8, bitcoin’s mining difficulty fell for the first time in 2019, but what does this mean for the industry going forward? On Monday, bitcoin’s mining difficulty adjusted itself down by 7%, making it easier for miners to solve algorithms, and thus mine blocks. As to why this occurred, it appears to be in conjunction with bitcoin’s recent price drop. Mining difficulty is set to reconfigure itself every 2016 blocks, or roughly every two weeks. Difficulty modulates based on how long it took for miners to discover the previous 2016 blocks. If it takes longer than two weeks, the difficulty is tuned down, and vice versa. The Rain in China Falls Mostly on Bitcoin Mining Firms Dovey Wan, founder of primal ventures, suggested that the difficulty alteration may have been due to the end of the

Read More »China’s State Media Just Headlined Bitcoin to 1.4 Billion People

November 11, 2019Chinese State Media Praise Bitcoin as a “Successful Application of Blockchain” Blockchain fever overruns the people’s republic Bitcoin propaganda comes as China preps to launch digital currency in 2020 China has taken yet another step towards fully embracing Bitcoin, calling it “The First successful application of blockchain technology.” The entirety of the people’s republic has been on a blockchain hype beyond anything thing imaginable recently. However, this latest admission from Chinese state media has transcended the strange grey area between bitcoin and blockchain. Finally, despite years of denouncing, and outlawing the nascent tech, China has actually shown some support for BTC. Bitcoin, Not Just Blockchain The news came via Matthew Graham, CEO of Sino Global Capital. Graham shared

Read More »Bitcoin Price Will Moonshot $500,000 Within 10 Years After Flipping Gold, Says Bobby Lee

November 10, 2019Bitcoin to flip gold by 2028, says Bobby Lee, founder of BTCC, the world’s first bitcoin exchange. Stock to Flow model supports the prediction. A weak dollar may adversely affect bitcoin’s price point. Bitcoin bull and CEO of BTC China, Bobby Lee, has thrown down his latest forecast, suggesting that bitcoin will flip gold’s market cap and find it a way to $500,000 by 2028. The Gold Flippening The bold claim came via a Tweetstorm earlier Sunday, where the crypto veteran rattled off several reasons for BTC flipping gold. Despite gold being 50x ahead of bitcoin with a market cap of $8 trillion, Lee believes that it’ll only take BTC 9 years to overtake. After flipping the precious metal, the bull posits that bitcoin will shoot up to $500,000, giving a proposed market cap of over $9 trillion.

Read More »Here’s How Crypto Bank Silvergate Fared Day 1 of NYSE Listing

November 8, 2019Crypto-friendly bank Silvergate starts trading on NYSE after IPO approval. SI cites a 6% increase on the initial offering price of $12. SEN network continues to grow. Silvergate Capital (NYSE: SI), a cryptocurrency-focused commercial bank, made its official listing on the New York Stock Exchange on Nov 7, commanding a 6% increase on the day. But how is it doing so far? The NYSE officially listed the crypto-minded bank under the ticker SI, on Thursday. This followed a formal declaration from the US security and Exchange Commission (SEC), approving the institution’s initial public offering (IPO). According to the firm’s announcement, 3,333,333 class A shares in SI were offered within the IPO. Silvergate granted 824,605 of the common stock, with a further 2,508,728 shares offered by

Read More »Facebook’s David Marcus Sells Libra as a Currency, Because Bitcoin Apparently Isn’t

November 7, 2019Facebook Libra lead David Marcus doesn’t believe bitcoin is a currency.

Its volatility keeps it from becoming a currency, he explained.

Bitcoin is more aking to ‘digital gold’, according to the Facebook executive.

Facebook’s crypto frontman David Marcus, provided bitcoin with a backhanded compliment on Wednesday. According to the Libra lead, bitcoin is a dead ringer for digital gold, but not an appropriate currency.

Speaking at the New York Times DealBook Conference, Marcus praised BTC for its investment qualities, calling it “digital gold,” but caveated that it doesn’t work as currency:

I don’t think of Bitcoin as a currency…It’s actually not a great medium of exchange because of its volatility. I see it as digital gold.

Within his reasoning, Marcus rattled off several shared

Bitcoin Whales Are on the Verge of Extinction: Crypto Watchdog

November 6, 2019So-called “bitcoin whales” appear to have a considerable influence on the cryptocurrency market, according to a new report. At the same time, whales are a dying breed. The founder of crypto watchdog Whale Alert explains why. It’s fair to say that bitcoin whales have a reputation for running the show when it comes to the crypto markets. Whether this is an accurate account of the role whales actually play within the ecosystem remains an open question. With his eyes trained on every major transaction in the market, Whale Alert co-founder and CEO, Frank (who prefers not to use his last name), analyzed how bitcoin’s price flux may actually connect to these large transfers. He disclosed his findings in a new interview with SFOX. How Whales Move the Bitcoin Market Research suggests that

Read More »Canada Shuts Down Crypto Exchange. It Still Owes Customers $12 million

November 5, 2019What has been a fairly bad few weeks for cryptocurrency exchanges, just got a little worse? A Vancouver-based crypto trading platform, Einstein Exchange, has been closed by Candian authorities; while still owing $16 million in outstanding obligations.

What Happened to Einstein?

On Monday, the British Columbia Securities Commission (BCSC), provided a statement noting the “action to protect customers” of the Einstein exchange.

The regulatory agency sought a Supreme Court order on November 1, designating an interim receiver to seize the exchange. The accounting firm, Grant Thornton Ltd – the same firm in charge of the Quadriga exchange proceedings – was subsequently appointed. Shortly after being greenlit by the Supreme Court, the firm stormed and secured the Einstein offices,

BitMEX Twitter ‘Hack’ Incites Ominous Warning: ‘Take Your Bitcoin & Run’

November 1, 2019Following the mammoth BitMEX user data leak, the bitcoin exchange’s Twitter account was allegedly hacked.

While under the perpetrator’s control, the account tweeted an ominous warning: “Take your BTC and run.”

BitMEX withdrawals are currently disabled, at least for some users.

Things have gone from bad to worse for BitMEX today as a mass leak of user emails has seemingly turned into a full-blown crisis for the world’s most significant bitcoin trading platform.

As CCN reported, the maligned derivatives trading platform came under intense scrutiny after it leaked thousands of users’ email addresses. The compromise was revealed by a pseudonymous Twitter user named “@sakuraricebird.”

BitMEX leaked emails | Source: Twitter (Translated)The leak was apparently due to blatant

Stellar (XLM) Spikes 8%; What’s Causing the Pump?

November 1, 2019XLM skyrockets in the wake of the President Xi-inspired pump.

Lumens gains prominent listing on Coincheck.

Stellar Foundation scraps inflation.

Ripple rival Stellar (XLM) is head and shoulders above the rest of the cryptocurrency market Friday, as it posts an 8% intraday increase.

The crypto markets have seen some bullish performance of late following the so-called Xi pump. Last week, China’s president, Xi Jinping, shilled blockchain technology, leading to a mass revival of bitcoin and the rest of the market. For the most part, the clamor of resurgence has cooled off. For Stellar’s Lumen, however, which witnessed only a modest recovery, things are only just starting to heat up.

Earlier in the day, XLM shot up by as much as 12%, knocking out a daily high of around $0.072, before

Nearly 1/3 of Americans Believe This Myth About the US Dollar

October 31, 2019Nearly one-third of Americans falsely believe that the US dollar is backed by gold, and 70% don’t know what is backing it.

That’s just the tip of the iceberg when it comes to US financial illiteracy, however.

A new study reveals just how little Americans know about how their money works.

An eye-opening new study into financial literacy reveals just how little Americans know about the US dollar – or how the monetary system works at all.

The study, sponsored by cryptocurrency firm Genesis Mining, aimed to uncover just how well the average American comprehends basic financial details about the banking system, Federal Reserve, and the dollars in his or her wallet.

Unfortunately for the reputation of the US educational system, the results weren’t all that favorable.

US Residents Don’t

Xi’s Throwaway Blockchain Quote is Sparking China’s Crypto Frenzy Again

October 31, 2019Blockchain business begins to boom in China. Bitcoin runs off the back of blockchain adoption, creating a vast grey area in the country. Provinces all over China start to heed President Xi’s call to action. Thanks to a reinvigorated stance on blockchain from China’s Premier, Xi Jinping, China may be on the brink of an entirely new crypto craze. Xi Pumps Blockchain Last week Xi shocked the cryptocurrency world by throwing the insurmountable force of China behind bitcoin’s underlying tech. Within a speech to the communist party committee, Xi touted blockchain’s ability to affect a massive change in both China’s business sector and the broader economy. Since that time, blockchain-affiliated Chinese tech stocks exploded, and the crypto markets witnessed a much-needed reprieve. This

Read More »