The past week was concerning for Bitcoin bulls, as the BTC price plunged below ,000. The volatility around this price level and the technical behavior observed on the charts gave traders plenty of room to work with.Fears of a potential return to the bear market also increased this week as the price continued to fall. There are, however, optimists who think that the correction is healthy for the market. In addition, the saga involving Tether and big market manipulation also added to the tension.Altcoins are a mixed bag. There are some like Chainlink which rose around 30% and XRP which gained 7%. At the same time, their declines against Bitcoin halted, and some altcoins have even shown signs of bottoming out. In any case, 2019 has so far been rather bad for the altcoin markets.Telegram’s

Topics:

Jonathan Berger considers the following as important: Market Updates

This could be interesting, too:

Jordan Lyanchev writes Stellar (XLM) Explodes by 30% in 2 Days, Bitcoin (BTC) Stable at K (Weekend Watch)

Jordan Lyanchev writes Bitcoin Recovers K Following Dump Below K, Ripple Gains 8% (Weekend Watch)

Jordan Lyanchev writes Crypto Markets Shed Over 0B as BTC Slumped to K (Weekend Watch)

Jordan Lyanchev writes BTC Rejected at 0K After .5B Bybit Hack, SEC to Halt Coinbase Lawsuit: Your Weekly Crypto Recap

The past week was concerning for Bitcoin bulls, as the BTC price plunged below $8,000. The volatility around this price level and the technical behavior observed on the charts gave traders plenty of room to work with.

Fears of a potential return to the bear market also increased this week as the price continued to fall. There are, however, optimists who think that the correction is healthy for the market. In addition, the saga involving Tether and big market manipulation also added to the tension.

Altcoins are a mixed bag. There are some like Chainlink which rose around 30% and XRP which gained 7%. At the same time, their declines against Bitcoin halted, and some altcoins have even shown signs of bottoming out. In any case, 2019 has so far been rather bad for the altcoin markets.

Telegram’s cryptocurrency is also set to be launched soon, which could bring in fresh money and new hype. The hype surrounding Decentralized Finance (DeFi) is also gaining momentum as cryptocurrency moves towards a new fundraising model. However, it’s unclear whether this model will succeed or if it constitutes another bubble.

October started slow, and we are entering the last quarter of 2019. Three months is a lifetime in the cryptocurrency market, however.

Market Data

BTC Longs (BFX): 25.1K BTC

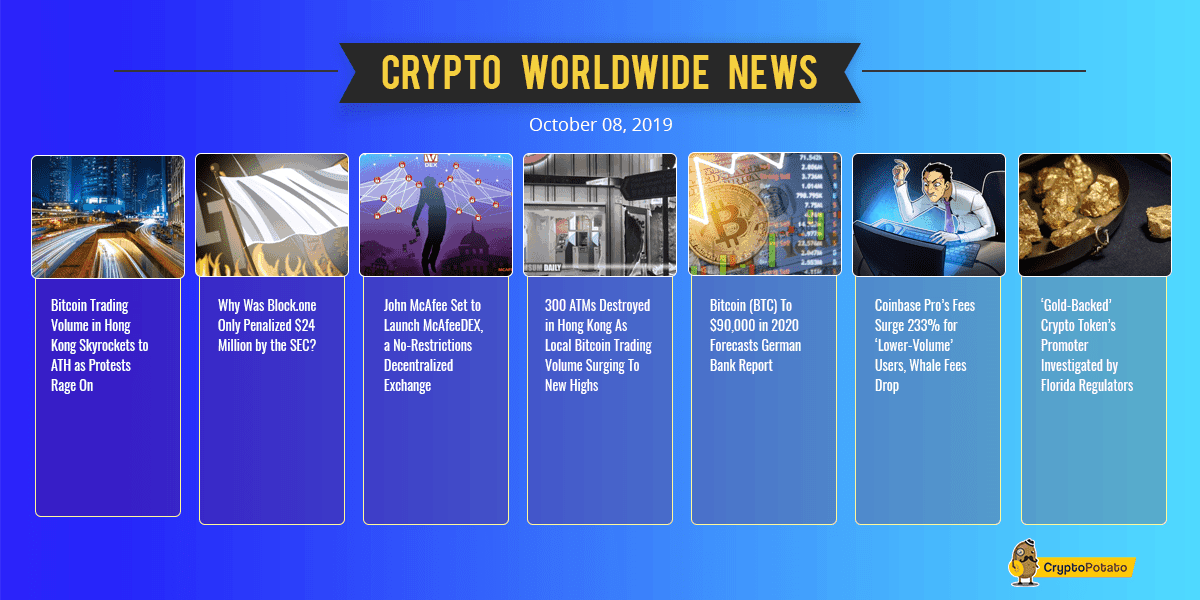

Bitcoin Trading Volume in Hong Kong Skyrockets to ATH as Protests Rage On. The political turmoil in Hong Kong continues to rage despite recent developments involving the protesters and the local government. Amid these times of economic and social uncertainty, Bitcoin’s trading volume on P2P exchange LocalBitcoins has surged to an all-time high.

Why Was Block.one Only Penalized $24 Million by the SEC? The SEC has fined Block.one, the publisher of EOS, $24 million for violating security offering regulations. An industry expert has weighed in on the matter, explaining why the fine was only $24 million, given that EOS raised upwards of $4 billion in its initial coin offering (ICO).

John McAfee Set to Launch McAfeeDEX, a Decentralized Exchange. The popular tech entrepreneur and cryptocurrency commentator has launched McAfeeDEX, a decentralized exchange. The platform’s beta version is already live. The move fits McAfee’s rebellious profile perfectly, especially considering that he hasn’t filed a tax return in 8 years.

300 ATMs Destroyed in Hong Kong as Local Bitcoin Trading Volume Surges To New Highs. As the protests in Hong Kong continue, 300 ATMs have been destroyed. For its part, Bitcoin has seen a significant increase in trading volume on peer-to-peer exchange LocalBitcoins.

Bitcoin to $90,000 in 2020, Forecasts German Bank. Bitcoin will hit $90,000 next year. At least, that’s what the seventh-largest financial institution in Germany thinks. Bayern LB’s report on Bitcoin utilizes the popular stock-to-flow ratio and notes that Bitcoin is a harder form of commodity money than gold.

Coinbase Pro’s Fees Surge 233% for ‘Lower-Volume’ Users, Whale Fees Drop. The leading US-based cryptocurrency exchange Coinbase has announced that it will increase trading fees on Coinbase Pro, its professional platform. Maker trading fees for low-tier trades below $10,000 will increase by as much as 233%.

‘Gold-Backed’ Crypto Token’s Promoter Investigated by Florida Regulators. Regulators in Florida are investigating a German company that has been promoting a token tied to a cryptocurrency bank in Miami lacking a banking license in the state. Prior to entering the crypto space, the company sold gold products online.

Paypal Exits Libra – Mastercard and Visa May Follow. PayPal has announced that it won’t go on supporting Facebook’s cryptocurrency and that it will leave the Libra Association. Reportedly, Visa and Mastercard are also uncertain about their connections to the project.

Charts

This week we’ve analyzed the Bitcoin, Ethereum, XRP, Chainlink, and Decred markets – click here for the full price analysis.