2017 will go down in history as probably the most pivotal year in the chronicles of cryptocurrencies. It was the year that they transitioned from being an obsession of “geeks” into something that captured the interest of governments, Wall Street analysts, media, financial institutions, and the average joe on the street.Exactly two years since the so-called “crypto bubble,” this piece tracks the evolution of the crypto market from 2017 at the price peak, until today, with a focus on new developments relating to how common and where to buy cryptocurrencies approaches to 2020.2017: The Cryptocurrency Year to RememberBitcoin started trading in January 2017 around 3, and it enjoyed a combination of bullish tailwinds that caused its price to skyrocket to ,733 by December that year.In March

Topics:

George Georgiev considers the following as important: AA News, Binance, Bitcoin Adoption, Bitcoin Bubble, coinbase

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

2017 will go down in history as probably the most pivotal year in the chronicles of cryptocurrencies. It was the year that they transitioned from being an obsession of “geeks” into something that captured the interest of governments, Wall Street analysts, media, financial institutions, and the average joe on the street.

Exactly two years since the so-called “crypto bubble,” this piece tracks the evolution of the crypto market from 2017 at the price peak, until today, with a focus on new developments relating to how common and where to buy cryptocurrencies approaches to 2020.

2017: The Cryptocurrency Year to Remember

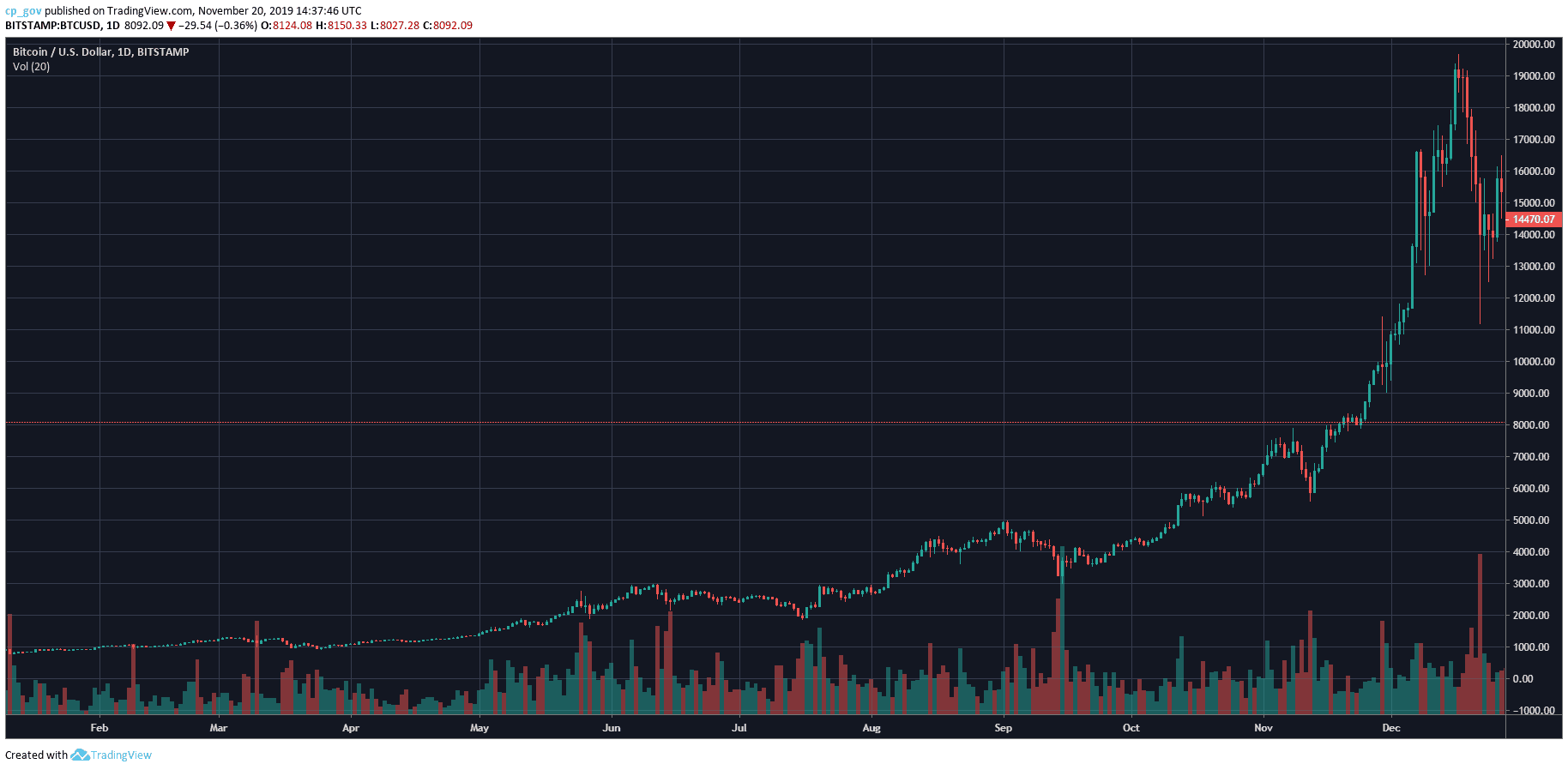

Bitcoin started trading in January 2017 around $973, and it enjoyed a combination of bullish tailwinds that caused its price to skyrocket to $19,733 by December that year.

In March 2017, Cameron and Tyler Winklevoss, who are still some of the most prominent Bitcoin proponents and investors in the crypto space, saw their Bitcoin ETF proposal rejected. This caused the market to dip, losing about 30% on the news. However, it rebounded fairly quickly, and the price was once again above $1,000. By May, the price was already around $2,000 and weeks after it went past $3,000.

This was precisely when major Wall Street analysts began to give their price predictions for Bitcoin. One of the first to speak on it was Sheba Jafari from Goldman Sachs, who managed to predict the move above $4,000. Later on in October, Bitcoin was trading above $5,000, and in November and December, the cryptocurrency was already making major headlines.

Bitcoin’s performance dwarfed that of traditional financial assets such as equities, precious metals, and real estate, among others. Many people were selling their stocks, selling their homes, and taking loans to buy Bitcoin to get a piece of the bullish crypto pie. After all, it’s not every day you get to see an asset gain almost 2,000% in just a year.

But it wasn’t just Bitcoin that was increasing, and altcoins were also making a killing. Some of them saw eveb more notable gains than Bitcoin, percentage-wise.

Ethereum (ETH), which is currently the second-largest cryptocurrency by market cap, began trading at a little less than $8 and finished the year at around $700, marking a staggering increase of about 9,000% throughout 2017, just like Litecoin (LTC).

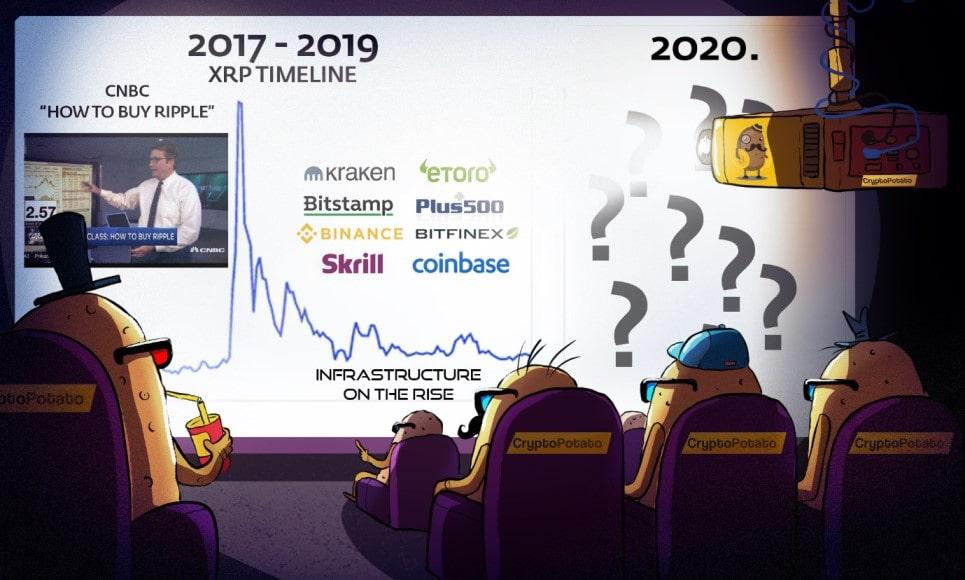

Another popular cryptocurrency that stood out was Ripple (XRP). Unlike a lot of other altcoins, Ripple went through two parabolic cycles in 2017. The first one was from March to May when it increased by more than 6,000%, going from $0.006 to about $0.40. The second one took place in November and December, when XRP surged to about 1,000%, skyrocketing from $0.25 to around $2.50.

Not surprisingly, at the peak of 2017’s bull run, one of the top trending search terms was “how to buy ripple,” as people who had never given more than a cursory glance to Bitcoin got an appetite for XRP. The desire to own the token became so great that traditional financial news outlets such as CNBC started running features on how to buy Ripple.

Crypto class: @BKBrianKelly tells you how to buy #ripple $XRP pic.twitter.com/CG7TsI6ij7

— CNBC’s Fast Money (@CNBCFastMoney) January 5, 2018

The frenzy to acquire Bitcoin and other cryptocurrencies eventually became overwhelming such that the leading cryptocurrency exchange Binance was forced to disable new user signups and support tickets on Poloniex started taking more than three weeks to be resolved.

The demand became higher than what exchanges were used to handling back then, and an alternate economy emerged. People bought cryptocurrencies with cash on the streets while willingly paying as much as 10% in premiums above market price.

Not Many People Got a Piece of the Pie

Most exchanges lacked the infrastructure to cope with the explosion in the number of new signups, fund deposits, and withdrawals at the height of the 2017 bull run. Some of the most popular exchanges, such as Binance, Poloniex, and Coinbase, had to stagger orders, place limits on transactions, and even suspend new signups to cope with the overwhelming demand for Bitcoin, Ripple, and other cryptocurrencies.

Apart from their inability to contain volumes and market demand, most of the exchanges mainly facilitated trading cryptocurrencies against their BTC pairs only.

To buy altcoins, you had to buy Bitcoin first. Most of the time, the exchange you could buy Bitcoin at was different from the altcoins exchange. For example, you had to buy Bitcoin from a local fiat-to-Bitcoin exchange, then transfer the Bitcoin to Bitfinex or Coinbase to buy Ethereum or Ripple.

But that is no longer the case as the improvements in this regard have been more than notable.

2019: How the Crypto Marketplace Has Evolved

2018 was mostly bearish for the vast majority of cryptocurrencies. Bitcoin reached its yearly low of $3,120 in mid-December, while many altcoins lost over 90% of their value. Those who were eager to buy near the $20K peak were now eager to sell.

2019, on the other hand, has thrown up several positive surprises for the general crypto market. Bitcoin is back in the green, and the bullish undertones of 2019 are already triggering predictions that the crypto market might record another extended bull run in 2020.

Particularly exciting is the fact that the industry has matured significantly in the last two years, and now there are more ways to buy cryptocurrencies as the market regains its bullish momentum.

A lot of the prominent cryptocurrency exchanges survived the bear market of 2018 and established themselves as market leaders. There are also a lot of newcomers, some of which even facilitate institutional involvement and adhere to high regulatory standards.

Cryptocurrency Exchanges Matured, New Ones in Town

There are now a substantial number of legitimate and reliable cryptocurrency exchanges where users can purchase both Bitcoin and altcoins. A lot of them also have fiat gateways, which makes it even easier to buy cryptocurrencies directly with a debit or credit card.

It appears that a lot of the positive development in this regard has been catalyzed by Binance, which by the way, gained its powerful momentum in the bubble of 2017.

Other established names in this field include Bitstamp, Kraken, Coinbase, OKEx, Poloniex, Huobi, and BitFinex. All of the above matured during the bubble. They hired more employees, especially customer support, and moved to bigger servers to prevent downtime during peak trading activity.

Another thing to consider is that there are a lot of newcomers in the industry. While they aren’t as well-established as the market leaders, it is evident that their teams are doing great work in providing excellent trading interfaces as well as infrastructures capable of withstanding high volumes and demand.

Crypto Custodian Solutions

Another new development in the crypto industry is the rise of custodian services. Some people do not have the time and energy to start learning about the intricacies of crypto, such as private keys, public keys, hot, and cold storage. Custodianship solutions allow investors to buy the coins directly from the custodian service, which is, in turn, responsible for their storage and security until whenever they are sold. Coinbase Custody and Skrill are two examples of custody services.

Skrill is authorized by the UK’s Financial Conduct Authority (FCA) under the Electronic Money Regulations 2011. It has been operational in the digital payments industry since 2001 as part of the Paysafe Group, a global online payment holding company with more than $1.9B in annual revenues.

Coinbase Custody, on the other hand, is the custodian arm of one of the oldest cryptocurrency exchanges and probably the most compliant one in the United States. The company holds many Money Transmitter and Payments Instruments licenses across multiple U.S. jurisdictions. Coinbase has facilitated more than $150B in cryptocurrency transactions.

Futures: Physically-Settled and Not

Perhaps one of the more exciting developments in the crypto space, and a significant differentiating factor between the overall cryptocurrency landscape today and back in 2017, is futures trading. Futures contracts represent an agreement between two parties to buy or sell an asset at a specific price on a given date. They are a well-known derivative trading instrument which is used in traditional markets.

In December 2017, Cboe Global Markets launched Bitcoin futures contracts, and it caused a massive shift in the industry. Since their contracts are cash-settled, traders had the opportunity to gain exposure to Bitcoin without actually owning the cryptocurrency. In other words, they were given the tools needed to speculate on whether its price would go up or down.

Immediately after, CME Group, which is the world’s largest futures exchange, also introduced its Bitcoin futures contracts. Ultimately, it was the last one standing as CBOE failed to compete. According to a recent report, CME’s Bitcoin futures average around $370 million in daily traded volume, which shows the interest in this powerful trading instrument.

All of the above, however, provide cash-settled Bitcoin futures contracts. An entire shift in this regard was caused by Bakkt, the Bitcoin futures trading platform owned by Intercontinental Exchange – the parent company of the New York Stock Exchange. It launched earlier this year, and it provides physically-settled Bitcoin futures.

This means that as the contract expires, the trader will receive an actual bitcoin rather than its cash equivalent, supposedly providing more liquidity to the market. Bakkt is geared towards institutions, and it also has a regulated and state-of-the-art warehousing solution, which safeguards the assets of the users. While it started with minimum volumes, interest is picking up steadily, which could be an indicator that institutions are also beginning to get involved.

Crypto Derivative Exchanges

The absolute leader in Bitcoin futures trading, however, is BitMEX, which was already established during the crypto bubble of 2017.

Unlike CME, BitMEX uses a perpetual contract that doesn’t have an expiration date, and it can be opened and closed at will. In terms of volumes, the exchange handles well over $1.5 billion daily.

The interest in Bitcoin futures is undeniable, and as such, only over the past year, Binance also introduced the futures option earlier this year. Exchanges such as Bybit, PrimeXBT and many others of the kind are popping up to provide users with more options as well.

CFD Brokers

The crypto industry has also grown to accommodate institutional investors, family offices, and high net worth individuals who might be desirous of placing bulk orders to buy or sell cryptocurrency. Plus500 and eToro are two crypto brokerage services among many other regulated brokers who offer CFD trading.

Local Fiat to Crypto Exchanges

Usually, the first step into the cryptocurrency investment world is to buy Bitcoin. While there are quite a few options to purchase it, the most convenient way, in many cases, is to buy it with local currency from a local exchange. Over the past couple of years, people have been given a lot more options to do just that. What is more, there’s also a serious growth in peer-to-peer venues such as LocalBitcoins and Paxful.

For example, Venezuela is a country with a distressed economy, and people are turning to cryptocurrencies to hedge their investments against the constantly depreciating national currency. This is perhaps the reason for which volumes on LocalBitcoins in Venezuela are constantly skyrocketing.

The same examples come from other countries such as Argentina, for instance. However, it is also worth noting that there are a lot of local exchanges that allow people to purchase Bitcoin with their fiat currency.

Ripio is a Bitcoin platform that is based in Argentina and it accepts bank transfers from Brazil as well. Bitex is another popular exchange that services a lot of South American countries such as Uruguay, Peru, Chile, Mexico, Argentina, Brazil, and so forth.

Binance recently announced a fiat-to-crypto gateway for Turkey in partnership with a local company, and developments in this regard keep happening daily.

Will the Next Bitcoin Bubble Collapse Exchanges Like in 2017?

Naturally, the main question after all of the above is whether cryptocurrency exchanges will be able to cope with another parabolic Bitcoin price movement like the one in 2017.

First things first, it’s worth noting that the established names in the field have laid down prominent infrastructures that should allow them to cope with increased demand. It can already be seen that most of the leading exchanges are handling over $1 billion in daily traded volumes, which is something undeniably positive and a step in the right direction.

Furthermore, there are a lot of regulations and rules that have emerged since 2017, and the reputable venues do whatever they can to stay compliant and to guarantee the security and convenience of their users.

On the other hand, many people believe that the next bull run will be considerably bigger than that of 2017. There are bold predictions of Bitcoin hitting astronomical numbers, ranging from $50,000, all the way up to $1 million.

Should this turn out to be the case, the attention towards the field will probably be massive and the demand – never before seen. Hence, it could be the case that even the existing, upgraded structures might not be able to handle such increased demand.

Conclusion

Skeptics are grossly underestimating the disruptive potential of cryptocurrencies in the long term. Yet, the industry has seen impressive growth in the last two years – there’s more regulatory clarity, it is easier to buy and sell cryptocurrencies, and sovereign nations are starting to endorse it publicly.

The journey to unlock mass-market adoption for crypto has only just begun, and there’s a need to optimize the industry for an increase in the transactional use of digital currencies to accelerate their mass adoption.