Michael Novogratz will be launching two different bitcoin funds.Novogratz wants to bring “the wealth of America” into the crypto market.The new funds would offer cheaper services than what competitors are offering.Galaxy Digital Holding CEO Michael Novogratz is launching two bitcoin funds that target accredited and institutional investors who have been waiting on the sidelines for a cheap and secure service way to access the pioneer cryptocurrency.Bitcoin is hovering around ,000. | Source: TradingViewBitcoin Funds on the Cheap for America’s BillionairesIn a recent interview with Bloomberg, billionaire Michael Novogratz revealed that he would be starting two different bitcoin funds — Galaxy Bitcoin Fund and Galaxy Institutional Bitcoin Fund — that aim to bring “the wealth of America” into

Topics:

Ali Martinez considers the following as important: Cryptocurrency News, galaxy digital, Michael Novogratz

This could be interesting, too:

Bitcoin Schweiz News writes Bitcoin 500’000? Kommt jetzt der globale Run?

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

- Michael Novogratz will be launching two different bitcoin funds.

- Novogratz wants to bring “the wealth of America” into the crypto market.

- The new funds would offer cheaper services than what competitors are offering.

Galaxy Digital Holding CEO Michael Novogratz is launching two bitcoin funds that target accredited and institutional investors who have been waiting on the sidelines for a cheap and secure service way to access the pioneer cryptocurrency.

Bitcoin Funds on the Cheap for America’s Billionaires

In a recent interview with Bloomberg, billionaire Michael Novogratz revealed that he would be starting two different bitcoin funds — Galaxy Bitcoin Fund and Galaxy Institutional Bitcoin Fund — that aim to bring “the wealth of America” into the cryptocurrency market. According to Novogratz, the new wave of capital that will flow into the crypto market is going to come from institutional investors.

He said:

You also get more credentialed people — there are probably 20 billionaires I could name that made their money outside of crypto and are in crypto now. It’s not a stampede by any stretch, but people are all doing their work. The next wave will come from the wealth advisers, maybe with endowments and small foundations participating.

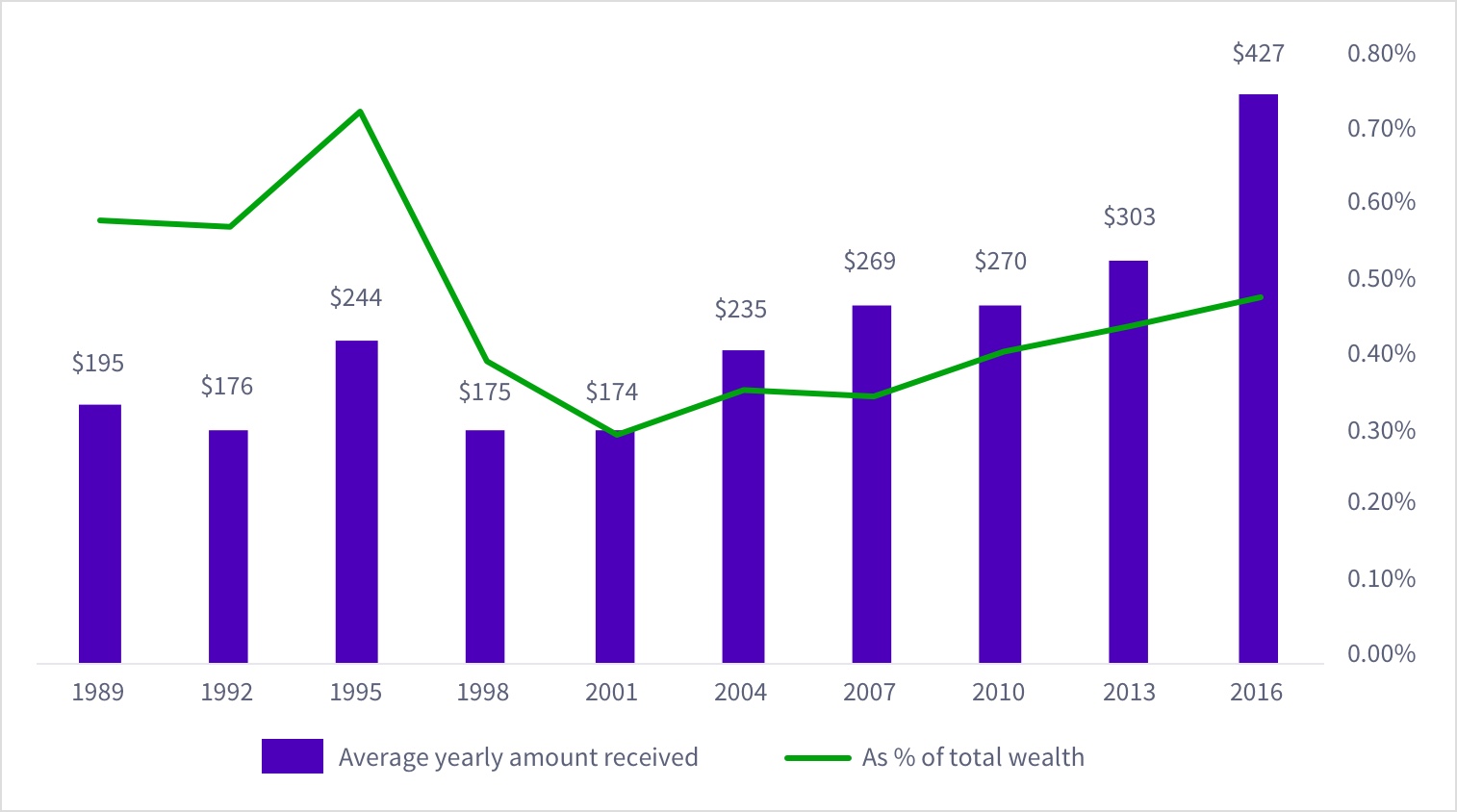

A recent study by United Income found that Americans are getting wealthier as the overall size of inheritances is growing exponentially. The total value of inheritances per year rose by 119% over the past 30 years with over $8.5 trillion transferred to individual households. The report concluded that over $36 trillion will be left to investors over the age of 50 over the next 30 years.

As a result, Novogratz plans to attract institutional investors between the ages of 50 and 80 by offering a “secure service [with] low fees [and] simple access to bitcoin” making it more attractable than competitors.

The Galaxy Bitcoin Fund will require a minimum investment of $25,000. Investors would be able to withdraw their funds at will every quarter. Meanwhile, the Galaxy Institutional Bitcoin Fund has “weekly liquidity and a higher initial threshold,” according to Bloomberg.

Bloomberg L.P. will be the pricing agent for the funds while Deloitte & Touche LLP will audit them, and Davis Polk & Wardwell LLP will provide legal counsel.

As Galaxy Digital continues to expand the range of products it offers, Novogratz shows his position towards bitcoin.

Novogratz concluded,

Galaxy continues to have high conviction in bitcoin and has made significant strides in helping to bring a more institutionalized footprint to the digital asset ecosystem. We believe this effort is an important step forward in fulfilling this mission.