When it comes to investing in Bitcoin, defining a clear exit strategy is undoubtedly amongst the essential things that should be considered. Knowing when to cash out is critical for profitability. As it has been seen in the past, Bitcoin has specific market cycles, and it’s not uncommon for the cryptocurrency to surge tremendously, only to pull back shortly after. A recent Twitter thread poses this exact question, and the answers are nothing short of invaluable.The following shouldn’t be seen as investment advice.Sign 1: Tai Lopez Puts Up a Video About It On YouTubeOne of the more common answers involves the famous motivational speaker, marketer, and coach, Tai Lopez. He’s an internet sensation with millions of followers across his different social media platforms.Despite the answer

Topics:

George Georgiev considers the following as important: AA News, bitcoin price, BTC, HODL, Lamborghini

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

When it comes to investing in Bitcoin, defining a clear exit strategy is undoubtedly amongst the essential things that should be considered. Knowing when to cash out is critical for profitability. As it has been seen in the past, Bitcoin has specific market cycles, and it’s not uncommon for the cryptocurrency to surge tremendously, only to pull back shortly after. A recent Twitter thread poses this exact question, and the answers are nothing short of invaluable.

The following shouldn’t be seen as investment advice.

Sign 1: Tai Lopez Puts Up a Video About It On YouTube

One of the more common answers involves the famous motivational speaker, marketer, and coach, Tai Lopez. He’s an internet sensation with millions of followers across his different social media platforms.

Despite the answer seeming hilarious at first, it’s based on quite a lot of merit. As soon as Bitcoin gets to mainstream broadcasters and media, it’s perhaps safe to say that it’s towards the end of its current hype cycle.

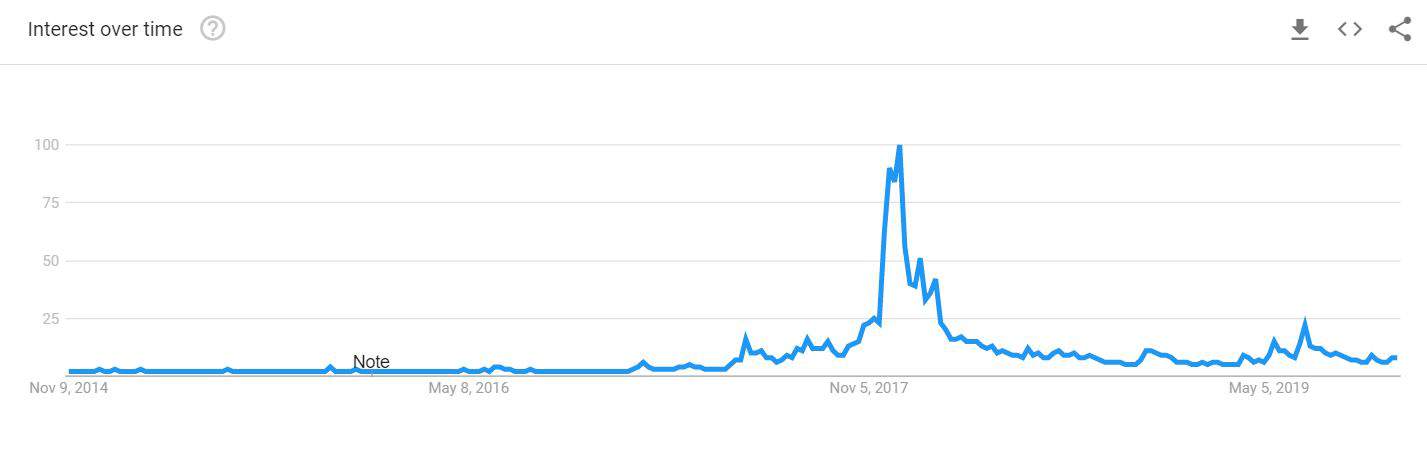

That’s what happened back in 2017. Up until November and December, the cryptocurrency was receiving a modest amount of media attention. However, as soon as it started surging with thousands of dollars each day to reach its all-time high of $20,000; ultimately, everyone was speaking about it. Data from Google Trends supports this.

And this is precisely the time when a lot of people think it’s a good idea to sell because after the hype is gone, the chances are that the price will take a beating.

Sign 2: “Cashing Out At Approx. 2.5 Lambos”

For anyone in the cryptocurrency field, the word “Lambo” definitely strikes a match. Buying Lamborghinis with Bitcoin riches back in 2017 became the visual representation of early cryptocurrency proponents who had stacked a lot of bitcoins before its ATH.

Again, the answer might sound unserious, but it could easily be interpreted as setting clear goals. This is perhaps one of the most reasonable things to do when defining an exit strategy.

Setting your goals is paramount, and it could be based on various factors, including both fundamental and technical principles. In any case, the important thing here is to make sure that the decisions are based on discipline and sufficient information.

Sign 3: Split Your Bitcoin Holdings

Another person suggested that it might be a good idea to split the Bitcoin portfolio and have different exit strategies for each stack.

For instance, it might be a good idea to predefine selling a specific portion of your portfolio when Bitcoin’s price reaches a particular milestone while keeping the rest for a longer-term period.

More advanced traders use this strategy to allocate a certain amount of their Bitcoin holdings for shorter-term trades, which allow them to capitalize on some of the short-term violent swings that Bitcoin tends to go through. For example, just a few days ago, the cryptocurrency gained over 40% in only a few hours and retraced almost immediately after that. A long-term holder wouldn’t benefit a lot from that move, but a short-term trader who might have caught it would have netted a severe amount.

Sign 4: Don’t Sell, HODL

Even though it might sound ridiculous for some people at the moment, Bitcoin maximalists support this notion, and, if you’re a faithful supporter of Bitcoin’s general idea, it makes a lot of sense.

Currently, Bitcoin is mostly used for speculative purposes – people use it to profit from its price. However, the primary designation of Bitcoin, as described by its pseudonymous creator Satoshi Nakamoto, is to be a peer-to-peer electronic cash system that would allow people to trade directly without any intermediaries.

Should this become a reality, Bitcoin’s dollar value wouldn’t matter that much because people would use the cryptocurrency to transact. Of course, it’s also safe to assume that its price would also skyrocket. It’s also worth noting that holding bitcoins has already proven itself to be more advantageous compared to stacking altcoins, for example.

In general, these are some of the main answers that the community gave to the poll, and they do have quite a lot of merit in them, looking beyond their fun side.