By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Tech analysis of BTC/USDBitcoins worth 313 million USD were withdrawn through Bittrex.The SIX platform has added a derivative on the BTCOn W1, the Bitcoin continues the descending tendency inside the previous channel and has already reached 61.8% fibo. The next downside target may be 76.0% fibo at 10.00 and the long-term low at 21.90. the resistance is close to 38.2% fibo at 60.00.On the MACD and Stochastic, the MACD histogram remains in the red area, while the second indicator, after forming a Black Cross, is trying to leave the “overbought area”. These signals together mean the predominance and stability of the current tendency in the market.Photo: Roboforex / TradingViewOn D1, BTCUSD is correcting upwards. Possibly, it’s just

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, Cryptocurrency News, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

Bilal Hassan writes Crypto Becomes a U.S. ‘Weapon,’ Says CryptoQuant CEO

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of BTC/USD

- Bitcoins worth 313 million USD were withdrawn through Bittrex.

- The SIX platform has added a derivative on the BTC

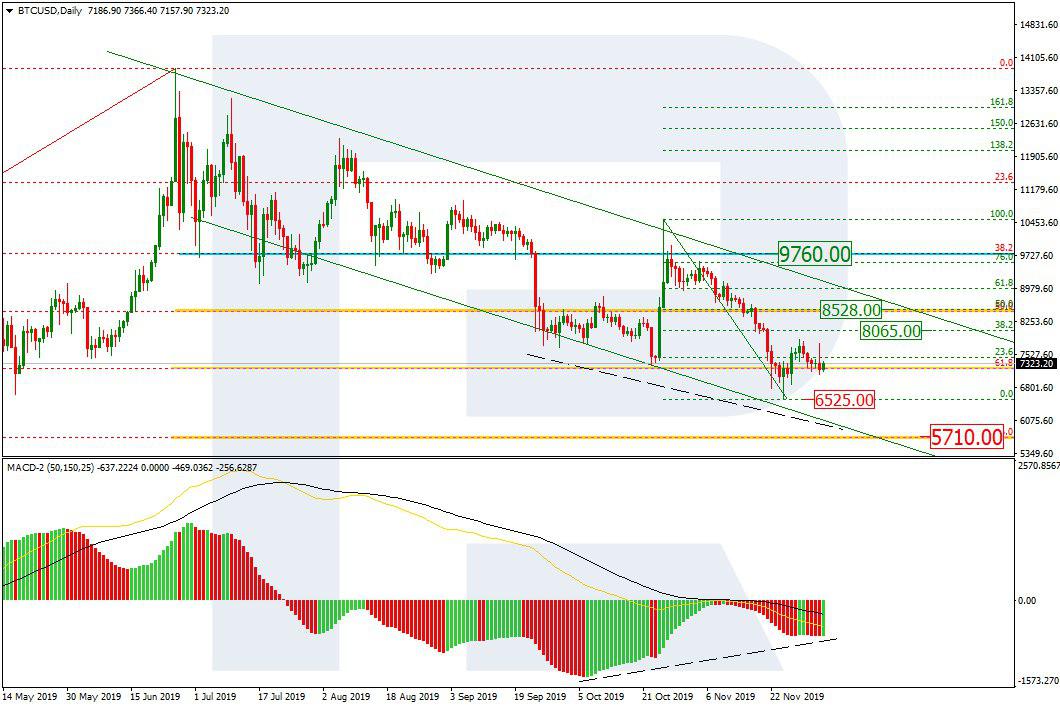

On W1, the Bitcoin continues the descending tendency inside the previous channel and has already reached 61.8% fibo. The next downside target may be 76.0% fibo at $5710.00 and the long-term low at $3121.90. the resistance is close to 38.2% fibo at $9760.00.

On the MACD and Stochastic, the MACD histogram remains in the red area, while the second indicator, after forming a Black Cross, is trying to leave the “overbought area”. These signals together mean the predominance and stability of the current tendency in the market.

Photo: Roboforex / TradingView

On D1, BTCUSD is correcting upwards. Possibly, it’s just the beginning of the growth after the convergence on MACD, but right now this growth should be considered only as a correction to the upside, which has already reached 23.6%. Later, it may continue towards 38.2% and 50.0% fibo at $8065.00 and $8528.00 respectively. After breaking the low at $6525.00, the instrument may continue falling.

Photo: Roboforex / TradingView

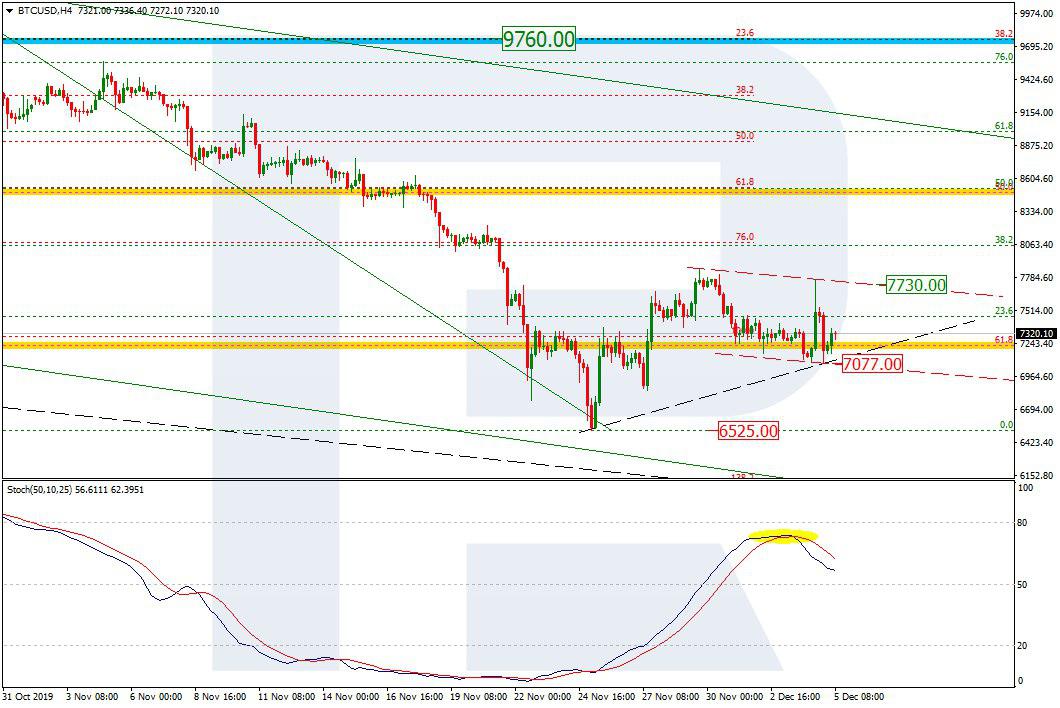

On H4, the pair is forming a short-term descending channel to correct the previous rising wave. The price is moving inside the channel between the support at the resistance at $7077.00 and $7730.00 respectively. Breakout of the upside border will finish the local correction and indicate further growth. Another signal to confirm the “ascending tendency” scenario is a possible formation of a Golden Cross on the Stochastic above 50.

Photo: Roboforex / TradingView

Recently, the word got round that Bitcoins worth 313 million USD were withdrawn through Bittrex, it’s about 43,000 coins. The cryptocurrency was transferred to an unknown wallet, but users say that such transfer looks pretty much like a fraud scheme involving unauthorized access to the exchange.

Another argument to confirm this theory is the fact that the wallet where the cryptocurrency was transferred to was created very recently and had only one transaction. Bittrex hasn’t commented on this, although the transfer amount is nearly one-third of the total cryptocurrency reserve it possesses.

The Swiss exchange SIX launched Bitcoin-ETP. To start trading a new derivative, users must acquire WBTC and then they will gain the right to own a coin. The asset will be stored in the WisdomTree funds, which works with this instrument. It is known that the nominal quote value of one WBTC will be 0.95% of the BTC price.

Like they say on the exchange, Bitcoin is not a temporary tendency, but a constant object of the market interest, that’s why the introduction of a BTC derivative is a good and promising move.

It’s not the first BTC derivative that is listed on the cryptocurrency exchange. It is already trading ETP from Amun based on several cryptocurrencies and these instruments are in demand for creating investment portfolios. Since the exchange expands the list of instruments, it means that demand for such offers is pretty much noticeable.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.