Bakkt’s arrival was supposed to be rocket fuel for the number one cryptocurrency.Even with Bakkt’s growing volume, the demand has not translated into bullish bitcoin prices.Institutions participating through Bakkt are trading on leverage instead of taking physical delivery of bitcoin.Many crypto enthusiasts saw Bakkt’s entry earlier this year as a bullish driver. The launch of the ICE-operated platform was to mark the arrival of institutional investors. With all the hype surrounding the bitcoin futures exchange contract facilitator, the supposedly industry-bending event came as a non-event. Bakkt failed to deliver as expected.A few months later, I understand why the launch of the ICE-backed company was not a bullish event. Thanks to the in-depth research of trader and economist Alex

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Bakkt’s arrival was supposed to be rocket fuel for the number one cryptocurrency.

- Even with Bakkt’s growing volume, the demand has not translated into bullish bitcoin prices.

- Institutions participating through Bakkt are trading on leverage instead of taking physical delivery of bitcoin.

Many crypto enthusiasts saw Bakkt’s entry earlier this year as a bullish driver. The launch of the ICE-operated platform was to mark the arrival of institutional investors. With all the hype surrounding the bitcoin futures exchange contract facilitator, the supposedly industry-bending event came as a non-event.

Bakkt failed to deliver as expected.

A few months later, I understand why the launch of the ICE-backed company was not a bullish event. Thanks to the in-depth research of trader and economist Alex Kruger, we can all comprehend how Bakkt is being used.

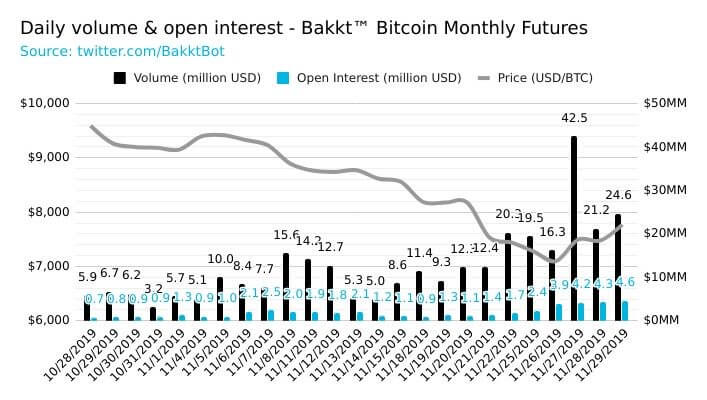

Bakkt’s Bitcoin Futures Contract Volume Is Steadily Growing but Bitcoin Is Still Dumping

The prevalent story behind Bakkt is that institutional investors now have a way to legally buy bitcoin through a reputable and regulated company. Through the futures exchange’s custodial services, institutions can buy bitcoin and store the coins in the company’s warehouse.

This sounds like a bullish narrative. Institutions can take coins out of circulation and store them in Bakkt’s warehouse. As monthly futures volume grows, one can expect that demand for the number one cryptocurrency would increase as well.

If you’re a retail investor, it is easy to make the mistake that Bakkt’s strategy is bitcoin rocket fuel. However, the ICE-operated company may not have been 100% transparent to the crypto community.

Case in point: The volume of its bitcoin monthly futures contract has been on the rise yet bitcoin remains sluggish. The theory that institutions are taking bitcoin out of circulation does not appear to be holding up.

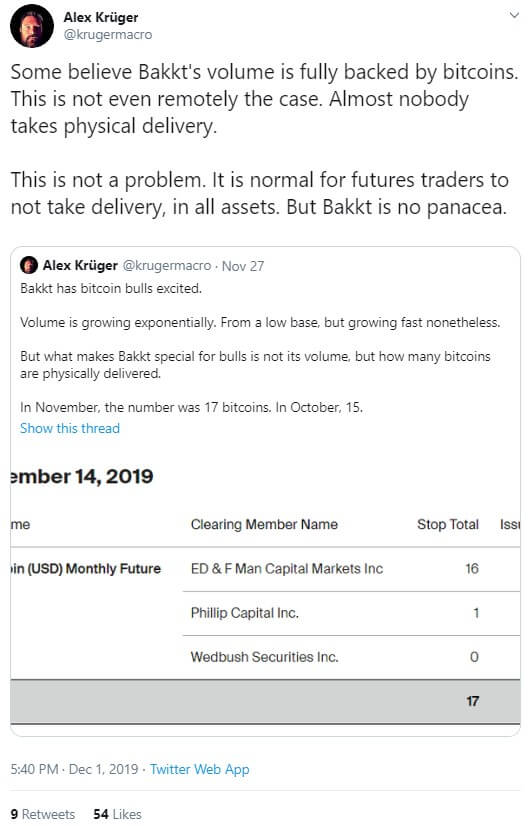

Fortunately, Alex Kruger shed some light on this issue. In a tweetstorm, the analyst explained how dollars and treasuries are backing Bakkt futures, not bitcoin.

Alex Kruger: ‘Almost No One Takes Physical Delivery’

It appears that institutions trading on Bakkt have very little interest in storing bitcoin. The growth in the monthly futures contract volume seems to indicate interest in margin trading. Alex Kruger explains how Bakkt’s volume is not backed by bitcoin.

The trader showed that in October only 15 BTCs were physically delivered. That number increased to 17 in November.

This may come as a shock to die-hard crypto fans who believed that Bakkt will change bitcoin. Nevertheless, almost all institutions participating through Bakkt are interested in trading on leverage.

Mr. Kruger explains that while traders have the option to take physical delivery, most either roll the contract to the next month or close the position. Bakkt’s services have not been bullish for the top cryptocurrency because only a handful of traders have taken physical delivery. Others are taking advantage of the opportunity to have bitcoin exposure without the risk of owning the cryptocurrency.

Bakkt Bitcoin Futures Backed by USD Cash and US Treasuries

The trader also explained that traders on Bakkt only have to shell out 37% as initial margin for each future contract.

With a minimum exposure of 10 BTCs, institutional traders deposit around $27,000 at the current bitcoin price of $7,300. That’s peanuts for offices that manage millions of dollars in assets. However, they can still make money by exploiting the volatility of the number one cryptocurrency.

In the end, it’s not Bakkt’s fault that traders are not using their services to buy and store bitcoin. The service is there but institutions are just not interested for now.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.

This article was edited by Sam Bourgi.