The number of bitcoin addresses with any balance exceeded its January 2018 high. Even though the metric is not perfect, it provides a rough estimate of bitcoin’s adoption rate. The synchronicity in the growth of this metric and the explosion of dormant bitcoin addresses suggests accumulation. Most people only refer to the price of bitcoin to gauge the health of the top cryptocurrency. If there’s a brutal sell-off, critics are quick to assume that the digital asset is dying. A minor bitcoin rally later, and almost everyone is tweeting about getting a Lamborghini. Sure, the price is a visible marker of an asset’s pulse. But bitcoin’s market capitalization is so small compared to other traditional assets that its price often fluctuates wildly. A big buyer or seller can easily dictate

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

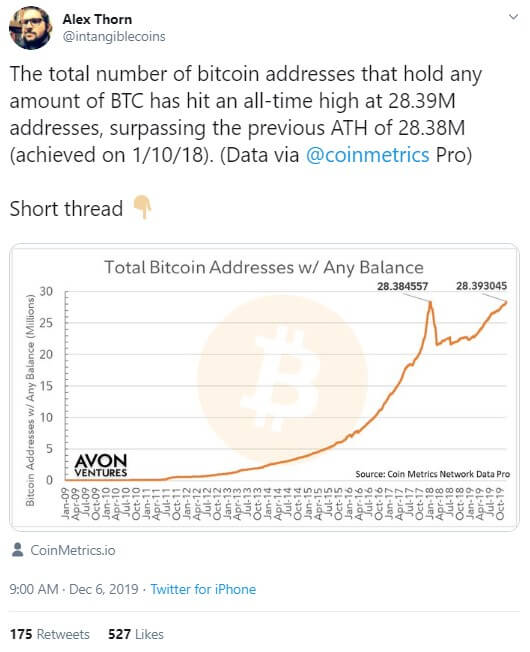

- The number of bitcoin addresses with any balance exceeded its January 2018 high.

- Even though the metric is not perfect, it provides a rough estimate of bitcoin’s adoption rate.

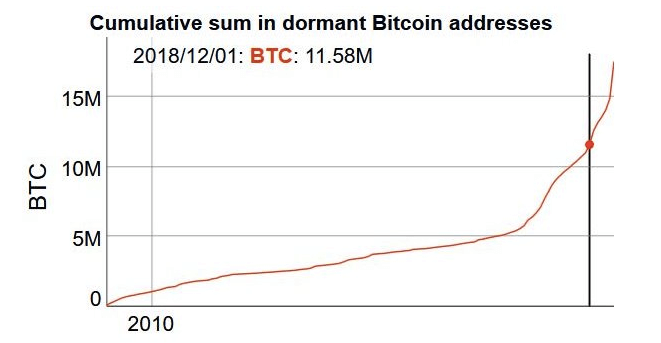

- The synchronicity in the growth of this metric and the explosion of dormant bitcoin addresses suggests accumulation.

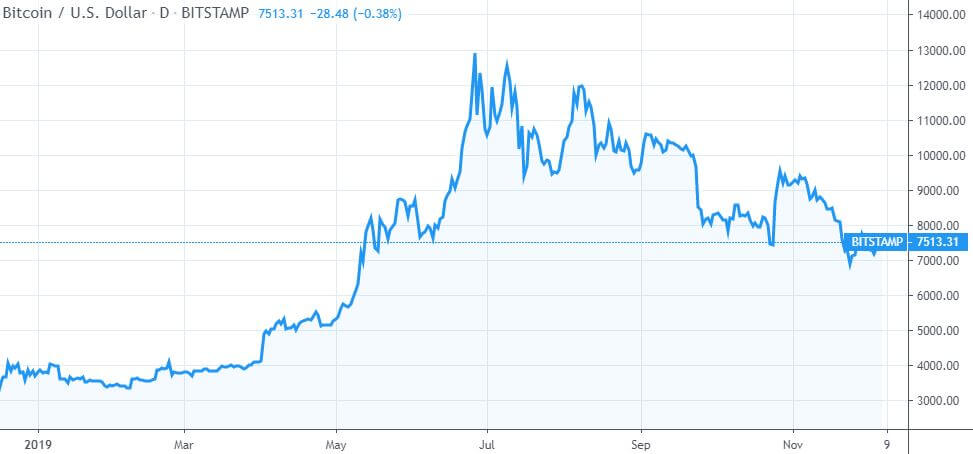

Most people only refer to the price of bitcoin to gauge the health of the top cryptocurrency. If there’s a brutal sell-off, critics are quick to assume that the digital asset is dying. A minor bitcoin rally later, and almost everyone is tweeting about getting a Lamborghini.

Sure, the price is a visible marker of an asset’s pulse. But bitcoin’s market capitalization is so small compared to other traditional assets that its price often fluctuates wildly. A big buyer or seller can easily dictate the momentum of the cryptocurrency.

That’s why for bitcoin, there’s another indicator of market health: addresses with any balance. And despite the top cryptocurrency’s recent bearishness, this metric just hit a fresh all-time high.

Total Number of Balance-Holding Bitcoin Addresses Recovered This Year

The 2018 bear market saw a massive capitulation of bitcoin users. From the high of ~more than 28.38 million addresses with any balance in January 2018, the metric fell to around 22 million in July 2018. That plunge tells us that many people got rid of their BTC during the height of the bear market.

Since then, the metric showed signs of recovery and began to soar early this year. Recently, it eclipsed the January 2018 record to print a fresh all-time high of 28.39 million balance-holding BTC addresses.

This New Bitcoin Record Suggests Increasing Adoption

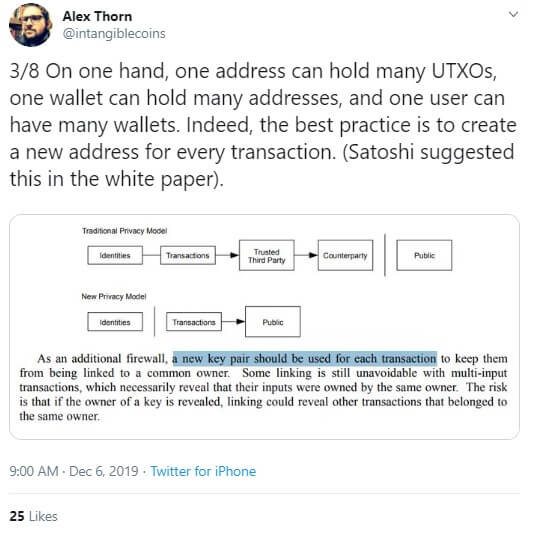

Investor Alex Thorn explained that this data-point has its limitations, mainly because one wallet can have multiple addresses, and one user can have multiple wallets. Thus, it would be inaccurate to equate the number of addresses with the number of bitcoin users.

However, Thorn also explained that many users store their funds on exchanges and in custodial platforms. These services may use a handful of addresses to secure customer coins. Therefore, one address may hold the funds of hundreds or thousands of bitcoin users.

In the end, Thorn concluded that the metric is not perfect, but it offers a decent estimate of the number of bitcoin users. The growth in the total number of BTC addresses with any balance can be seen as a positive for the cryptocurrency’s adoption. It is likely that bitcoin is fundamentally healthier if the BTC supply is spread across more addresses.

The Metric’s Surge May Also Indicate Accumulation

While Thorn’s thread focused on what the metric measured, I found it interesting that the growth in the number of balance-holding bitcoin addresses coincides with the explosion of dormant addresses.

The synchronicity of these two events points to accumulation. It tells me that people have been buying and storing their BTC over the last 12 months, hence the growth of addresses holding balances.

Also, it seems that this trend is growing even though bitcoin’s price has taken a nosedive. That could be a bullish indicator.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.

This article was edited by Josiah Wilmoth.