Bitcoin is now in a downtrend after Friday’s technical reversal.Analyst Peter Brandt believes that a cleansing is in order before bitcoin can start a new bull market.He says investors who refuse to be shaken out by the stomach-churning purge could reap ridiculous profits in the future.The world’s dominant cryptocurrency appears to have lost all bullish steam. The momentum that the bitcoin price generated when it printed a 2019 high of ,880 has vanished, giving way to a rapid downturn.This week, the cryptocurrency crashed through support at ,400. This triggered a technical reversal on the daily chart. As much as I hate to say it, the bitcoin hater, Peter Schiff, finally got it right.Bitcoin broke down from a head-and-shoulders top | Source: TwitterA head-and-shoulders structure is one

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News, peter brandt

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Bitcoin is now in a downtrend after Friday’s technical reversal.

- Analyst Peter Brandt believes that a cleansing is in order before bitcoin can start a new bull market.

- He says investors who refuse to be shaken out by the stomach-churning purge could reap ridiculous profits in the future.

The world’s dominant cryptocurrency appears to have lost all bullish steam. The momentum that the bitcoin price generated when it printed a 2019 high of $13,880 has vanished, giving way to a rapid downturn.

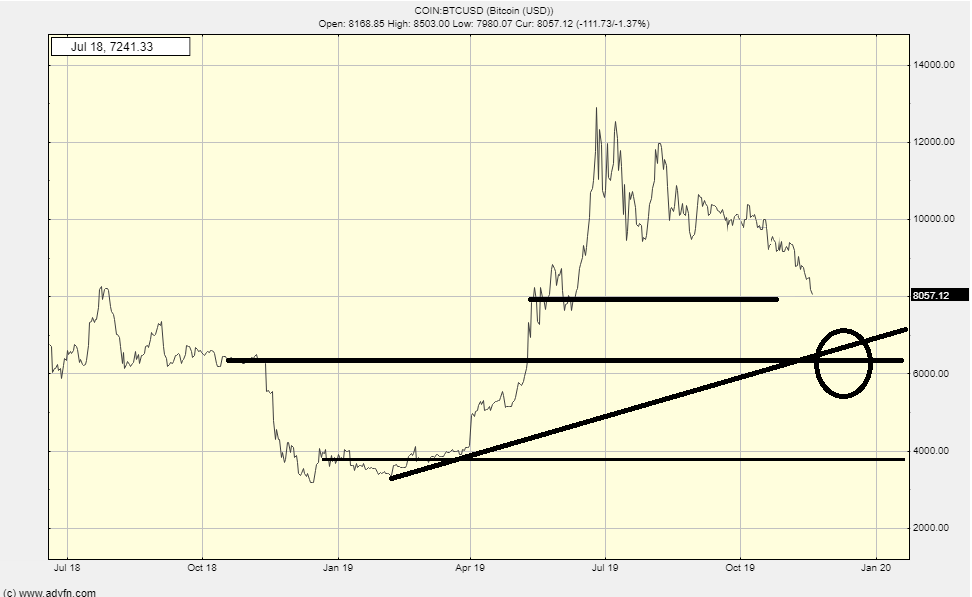

This week, the cryptocurrency crashed through support at $7,400. This triggered a technical reversal on the daily chart. As much as I hate to say it, the bitcoin hater, Peter Schiff, finally got it right.

A head-and-shoulders structure is one of the most reliable reversal patterns in technical analysis. Thus, from a technical perspective, bitcoin is now in a downtrend, and many expect that it would plummet to $6,000.

For instance, Clem Chambers, CEO of ADFN and Online Blockchain Plc, predicts that capitulation will strike at $6,000. He told CCN:

Bitcoin is entering a capitulation phase as you can more easily see when you remove the recent dump and bump from the chart.

Peter Brandt: ‘The Bulls Must Be Fully Purged’

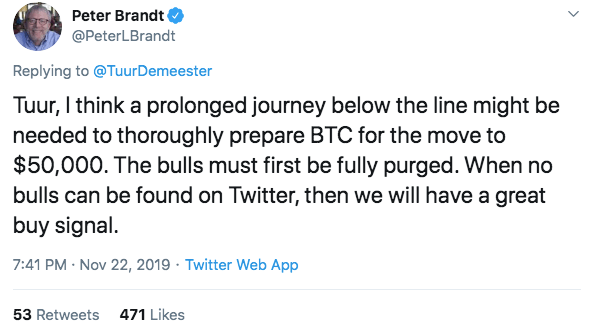

Nevertheless, Peter Brandt says that bitcoin bulls will likely face an even worse scenario, at least in the short-term. The analyst predicts a move below $6,000, which would usher in an extended bear winter.

Even though bitcoin’s fundamentals have been making numerous advancements, Brandt says that a strong buy signal would only come once the Crypto Twitter bulls have all but disappeared. A thorough cleansing might be required to jumpstart a full-blown bull market.

Once the nightmare is over, Brandt expects that bitcoin would be ready to soar to $50,000.

If you’re a bitcoin investor who’s hoping for the halving to catalyze the next bull market, I’ve got bad news for you.

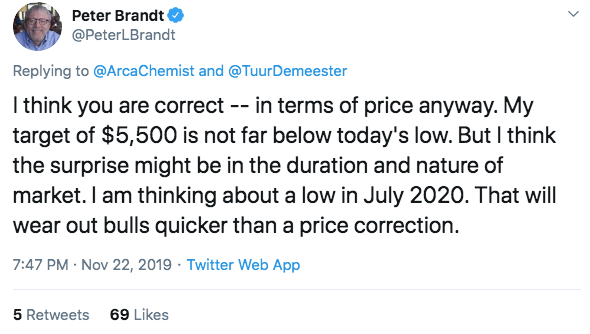

Brandt sees the purge lasting until July 2020, two months after the May 2020 halving. At that point, the analyst expects bitcoin to be trading around $5,000 – which is not far from today’s price.

If you’re accumulating bitcoin, can you see yourself holding the digital asset for another eight months while taking losses?

For most bitcoin holders, this is a dreadful scenario. Many will likely cut their losses and move on. Brandt banks on the pain of waiting rather than the pain of losses to wear out bulls.

Prolonged Purge Agrees with Bitcoin’s Stock-to-Flow Model

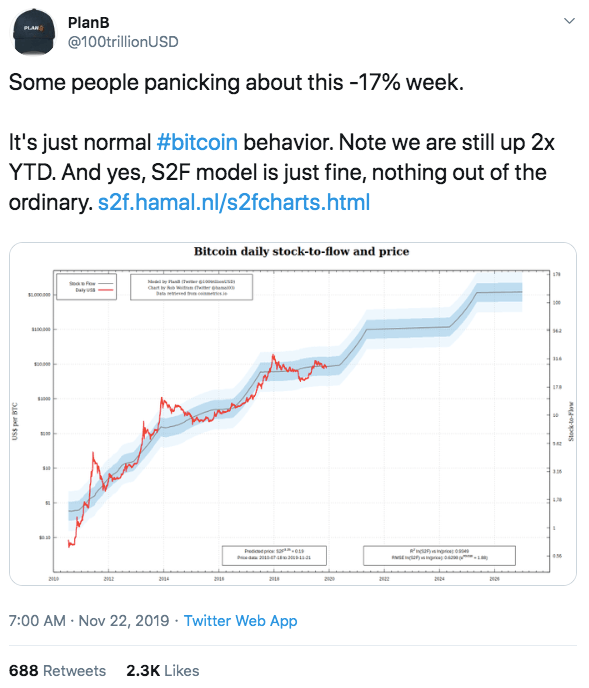

Peter Brandt’s forecast agrees with PlanB’s popular “stock-to-flow” model, which analyzes the bitcoin price according to available supply (stock) and new units entering circulation (flow).

A look at bitcoin’s stock-to-flow chart suggests that the top cryptocurrency will likely trade below $10,000 until the latter part of 2020. Consequently, investors who are looking for quick gains would be flushed out.

The good news is that this model also suggests those who HODL could be richly rewarded – eventually.

Both the stock-to-flow model and Brandt predict that bitcoin would soar to all-time highs after the prolonged purge. Brandt sees the possibility of bitcoin trading at $50,000, while PlanB’s model could see a parabolic BTC surge as high as $100,000.

But don’t get too excited. Months of pain may lay ahead before you can even hope to enjoy significant gains.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.