Social media influencers made people believe that quantitative easing is bullish for bitcoin. The recent selloff obliterated this narrative. HODLers now rely on the halving and the stock to flow ratio to ignite a bull market. Over the last few months, social media influencers on Twitter peddled that quantitative easing (QE) is bitcoin’s rocket fuel. The rationale is simple. If governments can print billions of dollars, some of it will eventually find its way to bitcoin. Additionally, QE may help people realize that governments can do what they wish with the monetary supply, whereas bitcoin has a fixed supply. The Federal Reserve pumping money into the system. | Source: TwitterPeople were led to believe that that’s how the system works. Influencers amassed likes, retweets and follows by

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Social media influencers made people believe that quantitative easing is bullish for bitcoin.

- The recent selloff obliterated this narrative.

- HODLers now rely on the halving and the stock to flow ratio to ignite a bull market.

Over the last few months, social media influencers on Twitter peddled that quantitative easing (QE) is bitcoin’s rocket fuel. The rationale is simple. If governments can print billions of dollars, some of it will eventually find its way to bitcoin. Additionally, QE may help people realize that governments can do what they wish with the monetary supply, whereas bitcoin has a fixed supply.

People were led to believe that that’s how the system works. Influencers amassed likes, retweets and follows by propagating a marketable idea. They did so with very little evidence to support their assertions.

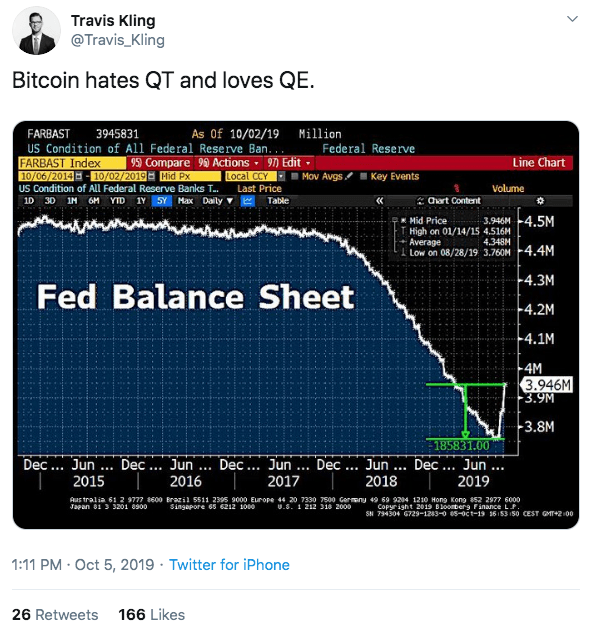

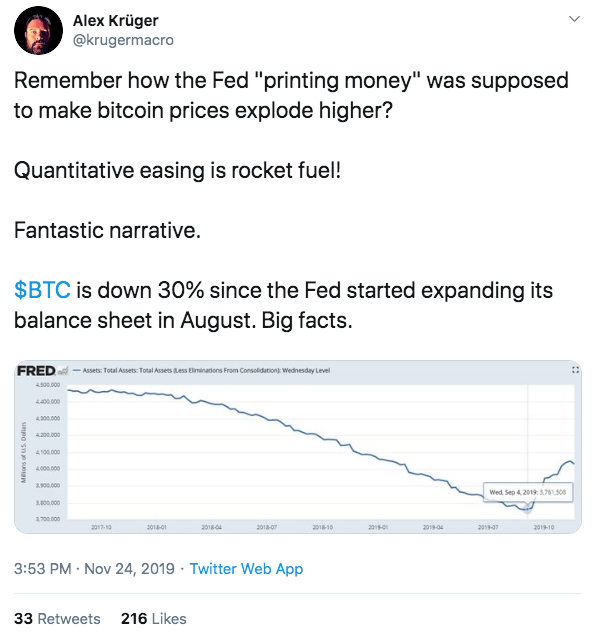

Recently, evidence regarding the correlation of QE and bitcoin price surfaced. A widely-followed economist was quick to point out that such a connection does not exist.

Quantitative Easing Forces Investors to Look for Safe-Haven Assets

Quantitative easing is a monetary policy that enables a central bank to purchase government securities, such as Treasury notes and other securities, from the market. The idea is to pump liquidity into the financial system to encourage consumer and commercial lending. The goals are to promote spending and stimulate the economy.

QE sounds good in theory, but has several drawbacks. One disadvantage is that QE drives down the value of the dollar by increasing the supply of the greenback in circulation. Thus, social media influencers argue that savvy investors will look for assets that can help protect their wealth.

A primary candidate that benefits from the Fed’s money printing is bitcoin. Though the cryptocurrency is a volatile asset, the volatility has been on the upside.

More importantly, bitcoin’s unique value proposition involves being an uncorrelated asset. The dominant cryptocurrency’s price is not dependent on central bank policies and the financial system. Hence, bitcoin appears to be the perfect hedge against fiscal irresponsibility such as another round of QE.

QE Sounds Good for Bitcoin HODLers but It Doesn’t Hold

Alex Kruger, an economist and trader, explained on Twitter that bitcoin is down by 30% ever since the Fed expanded its balance sheet in August. The recent selloff emphatically dispels the myth that QE is bitcoin rocket fuel.

The trader then explained that bitcoin is not responsive to macro factors such as QE. On the contrary, Mr. Kurger said that it takes only a handful of people to influence bitcoin’s price. Thus, the top cryptocurrency responds to micro factors and not macro.

With QE out of the picture, bitcoin HODLers can only rely on the halving and the stock to flow ratio narratives to catalyze bullish price action.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.