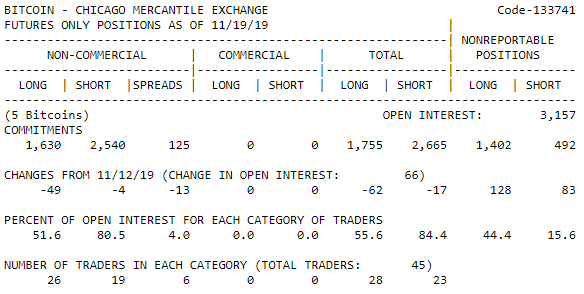

The Commodity Futures Trading Commission on Friday released its latest Commitment of Traders report for the Chicago Mercantile Exchange.Futures are derivative products typically aimed at institutional investors looking to get exposure in cryptocurrency. Published weekly, the COT highlights which way traders are positioned in the market.Here is the latest report:The latest CME COT report. | Source: BitOodaThe data may provide some insight into bitcoin’s latest tumble below ,000. According to analysis from digital asset advisory firm BitOoda, a large drop in long positions is helping push prices lower.An excerpt from the analysis read:From this data we are inferring the latest sell-off to be mostly weak longs getting out of the market pushing the price lower NOT new shorts coming in.

Topics:

Ryan Smith considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

The Commodity Futures Trading Commission on Friday released its latest Commitment of Traders report for the Chicago Mercantile Exchange.

Futures are derivative products typically aimed at institutional investors looking to get exposure in cryptocurrency. Published weekly, the COT highlights which way traders are positioned in the market.

Here is the latest report:

The data may provide some insight into bitcoin’s latest tumble below $7,000. According to analysis from digital asset advisory firm BitOoda, a large drop in long positions is helping push prices lower.

An excerpt from the analysis read:

From this data we are inferring the latest sell-off to be mostly weak longs getting out of the market pushing the price lower NOT new shorts coming in. Because of this, we believe the sell-off shouldn’t be as long and as deep as previous bear markets.

Shorting an asset that has appreciated so rapidly over a ten-year lifespan is a dangerous game. At least for any prolonged period of time.

This is possibly one reason why large investors are not adding to their short positions. The trend of reducing long exposure is set to continue in the coming weeks according to BitOoda:

We would expect the next COT report to have even greater long liquidations due to the uncertainty/rumors surrounding the space.

Not Your Keys, Not Your Bitcoin

It’s important to remember that not all crypto futures products are actually settled in the underlying product. The CME, for example, settles all its contracts in dollars and therefore no bitcoin actually changes hands.

The exchange explains:

No. You do not need a digital wallet, because Bitcoin futures are financially-settled and therefore do not involve the exchange of bitcoin.

This raises questions of the real impact that futures have on the spot Bitcoin price. It also reignites a crypto adage that has stood the test of time: “not your keys, not your crypto!”

One of the CME’s major competitors Bakkt recently announced that it would definitively provide custody, however, its product still raises some serious questions.

Where to Next?

The answer, as ever, depends on your timeframe. Shorting this market in previous weeks would have obviously netted you a healthy profit.

However, given Bitcoin’s massive first half of 2019 bull run and the dangers alluded to earlier, your timing would need to be impeccable.

One analyst reckons that Bitcoin will rip to $50,000 but only after a nauseating purge. Perhaps that purge is upon us now?

Until large futures exchanges like the CME and Bakkt can reliably deliver Bitcoin settlements, traders should probably stick to the spot market for clues on price action.

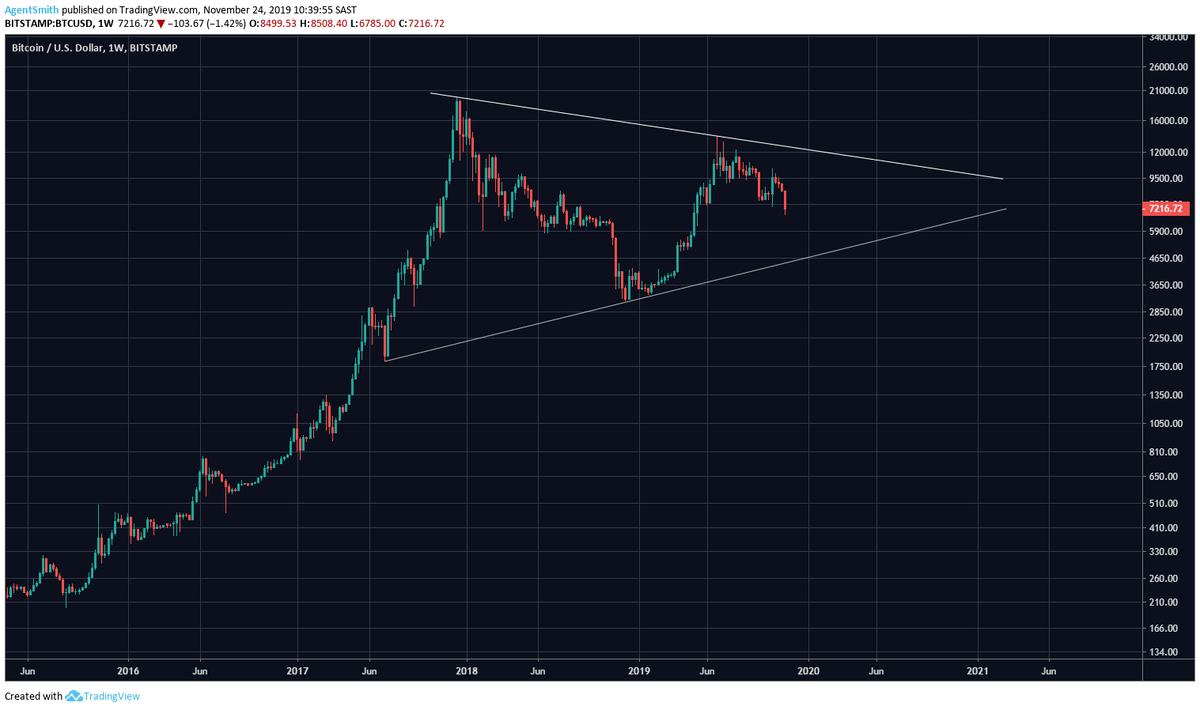

The long-term chart remains as positive as ever with Bitcoin forming a weekly bull flag. This structure will, however, take quite a while to resolve itself.

As CCN previously reported price may falter in the coming weeks, however, the long-term fundamentals remain intact.

If the above chart plays out correctly, we may only see price break this year’s high around $14,000 sometime in mid-2020.