By CCN.com: Turkey likes bitcoin more than any of the other 14 nations polled in a recent survey by Dutch banking group ING. Sixty-two percent of Turks were crypto positive, while 36% said they would be happy to be paid in bitcoin. Meanwhile, Austrians were the most skeptical, with only 13% being pro-crypto.These sentiments make perfect sense given Turkey’s recent economic struggles.Turkey’s Rising Industrial WoesFresh off the collapse of the lira in 2018, Turkey is still trying to find its footing. ABN Amro economist Nora Neuteboom only expects a “modest recovery” after the brutal year.Our new #Turkey Watch• Turkey is more resilient than a year ago but we expect a very modest recovery from the current low levels• Inflation is rapidly decreasing, to an estimated 15% end-of-year and we

Topics:

Aaron Weaver considers the following as important: Headlines, Our Latest Cryptocurrency News, turkey

This could be interesting, too:

Chayanika Deka writes ISIS Crypto Fundraiser Mohammed Chhipa Faces 20 Years After Conviction in Virginia

Emily John writes Turkey Sees a Surge in Crypto Licenses as New Regulations Spark Industry Interest

Mayowa Adebajo writes Crypto Adoption in Turkey Boosted by Unending Lira Woes, Government Moves In with Tax Reforms

Mandy Williams writes Turkish Lira’s Crypto Volume Market Share Hits All-time High

By CCN.com: Turkey likes bitcoin more than any of the other 14 nations polled in a recent survey by Dutch banking group ING. Sixty-two percent of Turks were crypto positive, while 36% said they would be happy to be paid in bitcoin. Meanwhile, Austrians were the most skeptical, with only 13% being pro-crypto.

These sentiments make perfect sense given Turkey’s recent economic struggles.

Turkey’s Rising Industrial Woes

Fresh off the collapse of the lira in 2018, Turkey is still trying to find its footing. ABN Amro economist Nora Neuteboom only expects a “modest recovery” after the brutal year.

Our new #Turkey Watch

• Turkey is more resilient than a year ago but we expect a very modest recovery from the current low levels

• Inflation is rapidly decreasing, to an estimated 15% end-of-year and we foresee further aggressive cuts (425bp for 2019)https://t.co/I8SQMYqmwv— Nora Neuteboom (@naneuteboom) August 13, 2019

According to Reuters, the country’s industrial production has fallen for 10 consecutive months. Meanwhile, its manufacturing activity has decreased for 15 months in a row. Hilmi Yavas, an economist at Yatirim Finansman, told Reuters that falling demand is to blame.

“Due to the strength of exports, industrial production was balanced to a certain extent in the first half of the year but we are seeing that foreign demand is not sufficient anymore. There is already a significant slowdown in the industry sector abroad and views are increasing that this is slowly starting to affect us.”

Meanwhile, the Turkish government just posted a budget deficit of 68.7 billion Turkish lira ($12.3 billion) for the first seven months of the year.

The Bitcoin Solution

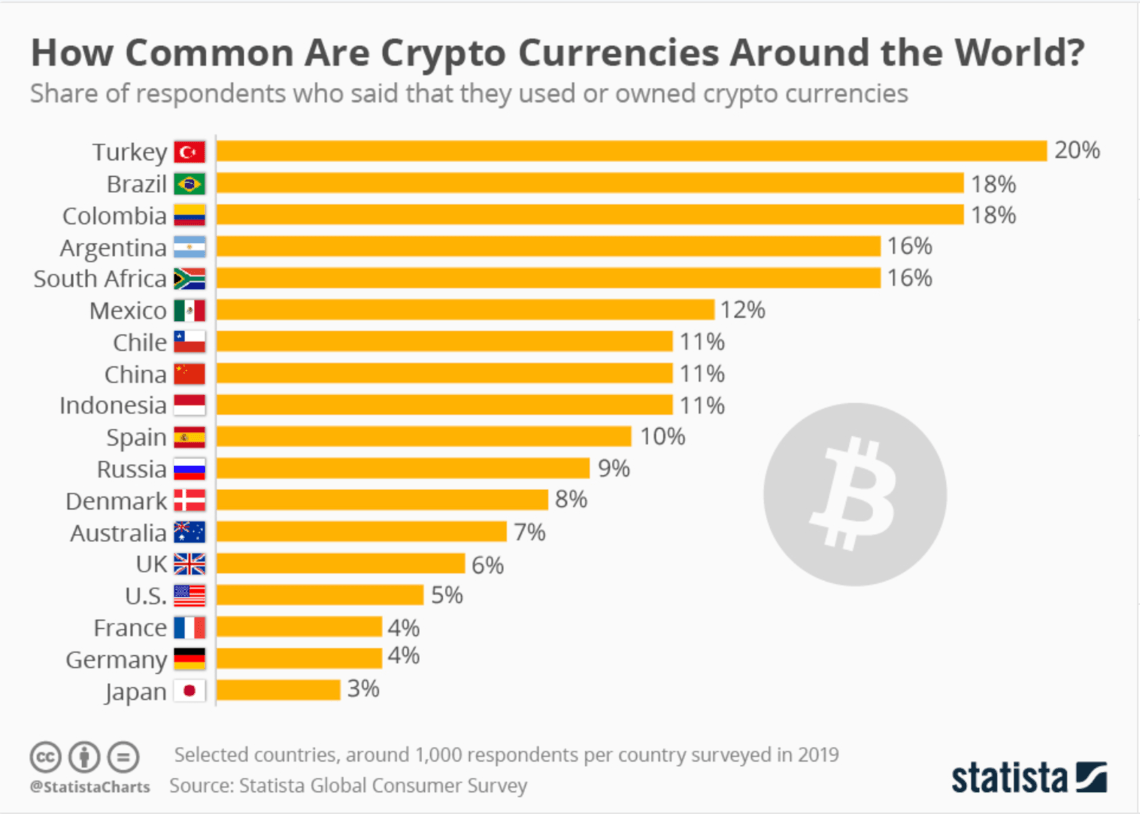

With so much economic unrest, many of the country’s residents are turning to bitcoin for stability. The lira is currently the seventh most traded national currency with the flagship cryptocurrency. In a recent survey from Statista, Turkey led all other countries in cryptocurrency usage at 20%.

They’re not alone. Other countries whose currencies have suffered from high inflation have flocked to crypto. Argentinians purchased bitcoin en masse earlier this year against the hyperinflation of the Argentine peso. Venezuelan citizens have made similar moves. Brian Fonseca, an adjunct professor at Florida International University, told inverse.com that “Venezuelans are now turning to cryptocurrencies as a way around inflation and an unstable currency.”

#Bitcoin will become a factor for Turks as Hard Money becomes hard to come by. https://t.co/bD5iw2mLMs

— Max Keiser (@maxkeiser) May 21, 2019

Crypto Exchanges Cash In

These countries are attracted to bitcoin because it can’t be controlled by the government and it’s not fully under the sway of any single country. No one understands this more than crypto exchanges, which often charge premiums to nations in currency turmoil.

Rayne Steinberg, chief executive officer at Los Angeles-based crypto hedge fund Arca, is cited by Bloomberg as saying,

“Bitcoin is becoming the asset of last resort in areas of extreme currency devaluation and political uncertainty. In the last week alone, Bitcoin is up approximately 50% against the Argentine peso and trading at a significant premium on local exchanges. And they are not alone, joining the ranks of Venezuela, Hong Kong, and Turkey who have also experienced similar shocks.”

Bitcoin was trading at $10,476.50 on BtcTurk compared to $10,446.41 overall at the time of this writing, according to coinmarketcap.com.