There’s never a dull moment in crypto, as Bitcoin has once again shown that it is highly volatile. The leading coin, whose price has consolidated in the ,000 region since late September and traded as low as ,300 within the last three days, has made a bullish reversal, racing as high as ,350 on Bitstamp in just one day.This came as a surprise to many, as some analysts had predicted a Bitcoin Death Cross, which was thought to portend a dip to ,000 before a possible bull turn, but as usual, Bitcoin didn’t care.At the time of writing, BTC was trading around ,400, indicating a 25% increase on the daily chart. This bolstered the rest of the markets, pushing the industry’s total market cap beyond 0 billion.While day traders and HODLers are all excited about the market uptrend, many

Topics:

Mandy Williams considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

There’s never a dull moment in crypto, as Bitcoin has once again shown that it is highly volatile. The leading coin, whose price has consolidated in the $8,000 region since late September and traded as low as $7,300 within the last three days, has made a bullish reversal, racing as high as $10,350 on Bitstamp in just one day.

This came as a surprise to many, as some analysts had predicted a Bitcoin Death Cross, which was thought to portend a dip to $6,000 before a possible bull turn, but as usual, Bitcoin didn’t care.

At the time of writing, BTC was trading around $9,400, indicating a 25% increase on the daily chart. This bolstered the rest of the markets, pushing the industry’s total market cap beyond $250 billion.

While day traders and HODLers are all excited about the market uptrend, many are also curious as to the cause of the surge. Let’s examine some of the factors that might have affected the Bitcoin price.

China

Anyone who has been in the crypto space long enough will be aware that China has a vast influence on the crypto market. This dates back to 2013, when China’s state broadcaster, CCTV, aired a story on Bitcoin for the first time. The cryptocurrency’s price quickly rose from $150 to an ATH of around $1,180 by year’s end.

Yesterday during the 18th Collective Study of the Political Bureau of the Central Committee, China’s president, Xi Jinping, expressed great support for blockchain technology and its benefits, urging the country to increase its investment in the sector.

This poses a threat to the USA, as Mark Zuckerberg pointed out during last Thursday’s congressional hearing. Many observers relate the parabolic run of 2019 to Facebook’s Libra announcement. They also relate Bitcoin’s recent drop to $7,300 to the congressional hearing during which politicians appeared hostile to Libra.

12 hours after the major “Xi Pump”

1. “Blockchain” headlined on People’s Daily print version today

2. Top Universities in China start “Blockchain” course offering overnight

3. Expect to see massive blockchain initiatives from local municipal soonThe ripple effect is strong pic.twitter.com/2E2Be6RHol

— Dovey Wan ? ? (@DoveyWan) October 26, 2019

Bitcoin Whales Working on Weekends

To be sure, the crypto market is very hard to predict. While it makes sense that the BTC price action might have been caused by the latest comments from the Chinese president, history has shown that Bitcoin whales also affect price movements. Some observers may think the big moves are caused only by whales, or are at least driven by them.

According to that theory, because the majority of traders are always wrong, whales are able to push the market in whichever direction they wish at the most unexpected moment. More evidence for this is provided by the fact that such price action typically takes place during the weekend. This is when many traders are on vacation and the CME Bitcoin futures market is closed, making it a lot easier to move the markets.

What do those whales know? This tweet from Looposhi is telling. Notice the date of the tweet. A manipulated market, perhaps?

BITCOIN BOTTOM 24 OCT 2019

— Looposhi (@22loops) January 4, 2019

The Man Behind the Mask and Snowden

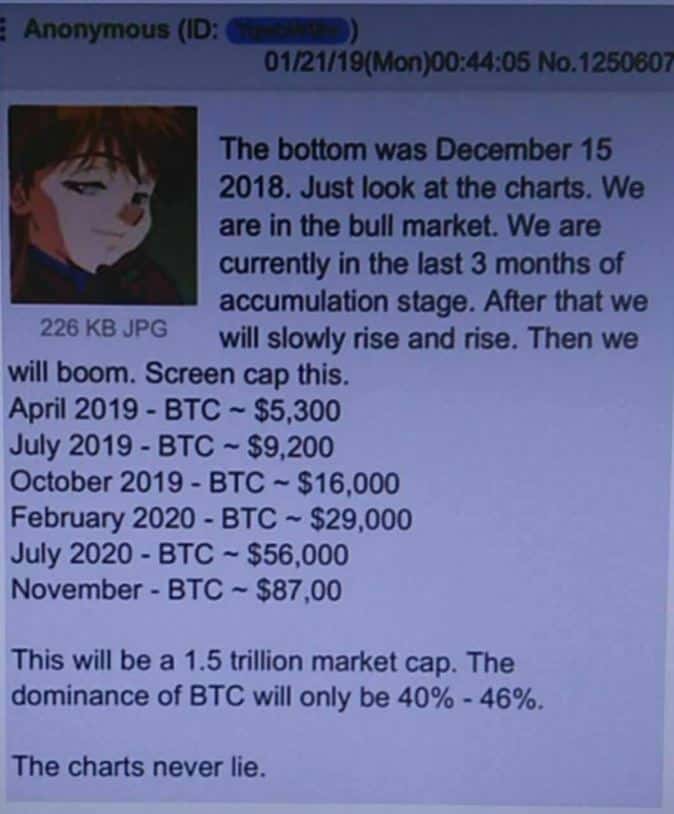

Speaking of which, the most famous anonymous prediction to date popped up on 4chan in January 2019, accurately identifying the 2018 bear market’s bottom. The first two of their six predictions have been correct so far – $5,300 in April and $9,200 in July. The next forecast on the list is $16,000 by the end of October. With less than five days left until the end of the month, following this huge move, going 3 for 3 is still possible.

Interestingly, American journalist and whistleblower Edward Snowden today tweeted the same avatar used by the anonymous poster on 4chan, thus raising a lot of questions. Was this mere coincidence? Or does Snowden, who currently resides in Russia, know something that we don’t? Has he been secretly following the anonymous 4chan predictions and the crypto industry in general?

Only time will tell if Bitcoin’s price hits $16,000 in the next few days, or if the first two correct predictions were lucky guesses.