Bitcoin rose 10% in less than 10 minutes, causing million worth of shorts to be liquidated.The sudden liquidation of large contracts fueled a spike to ,800.Technical analysts remain cautious on the short-term trend of bitcoin.The bitcoin price surged 10% in just 10 minutes on Wednesday, lifting BTC as high as ,800. The move liquidated million worth of shorts on BitMEX in one of the strongest short squeezes in recent months. The bitcoin price jumped as high as ,800 today. | Source: TradingViewPrior to the abrupt upside movement, both bulls and bears seemed to be fighting for short-term control over the market. As orders continued to stack up, bitcoin held stable at ,300 for nearly three days, before it broke below ,100.As it tested a strong support level at ,085, bitcoin

Topics:

Joseph Young considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

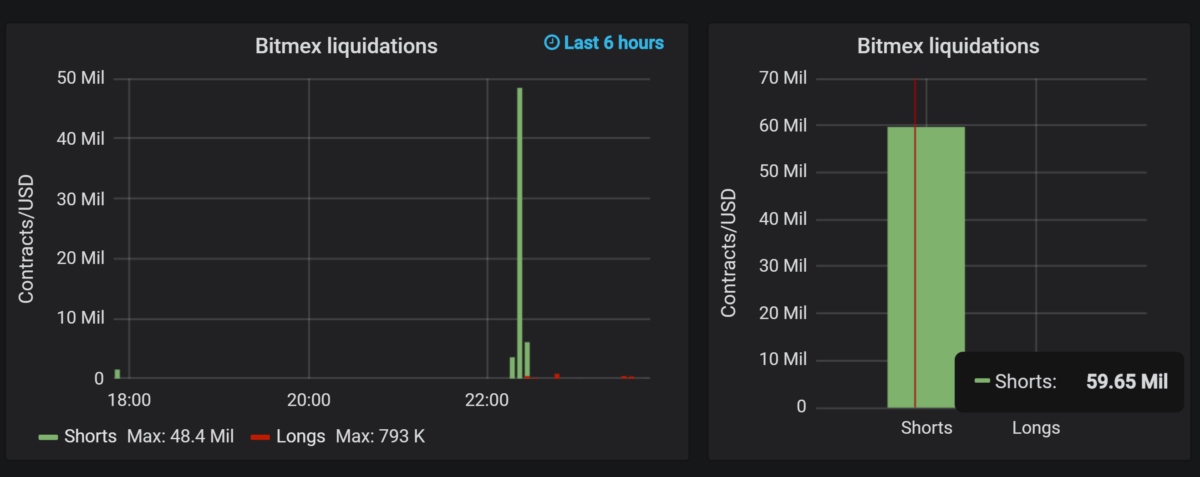

- Bitcoin rose 10% in less than 10 minutes, causing $60 million worth of shorts to be liquidated.

- The sudden liquidation of large contracts fueled a spike to $7,800.

- Technical analysts remain cautious on the short-term trend of bitcoin.

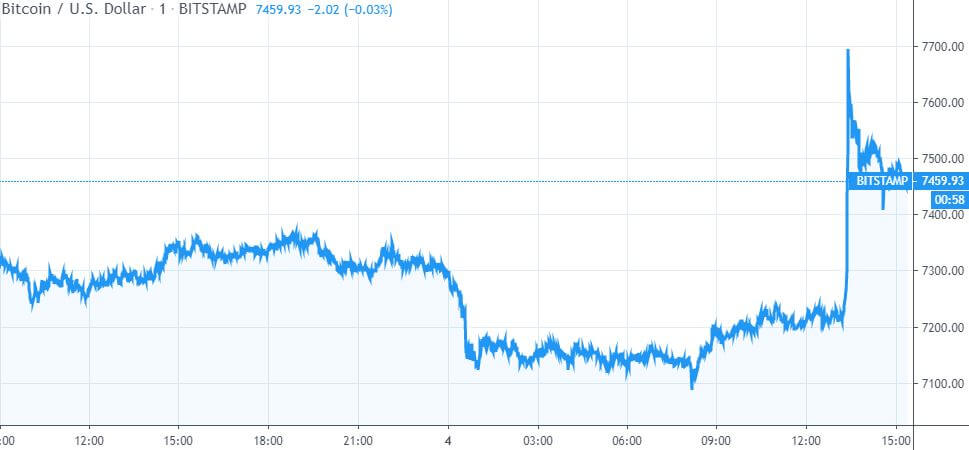

The bitcoin price surged 10% in just 10 minutes on Wednesday, lifting BTC as high as $7,800. The move liquidated $60 million worth of shorts on BitMEX in one of the strongest short squeezes in recent months.

Prior to the abrupt upside movement, both bulls and bears seemed to be fighting for short-term control over the market. As orders continued to stack up, bitcoin held stable at $7,300 for nearly three days, before it broke below $7,100.

As it tested a strong support level at $7,085, bitcoin engaged in a swift relief rally, causing a cascade of short contracts to get liquidated in the process. The domino-like effect caused BTC to spike to $7,800.

Does This Spike Define Any Major Move for Bitcoin?

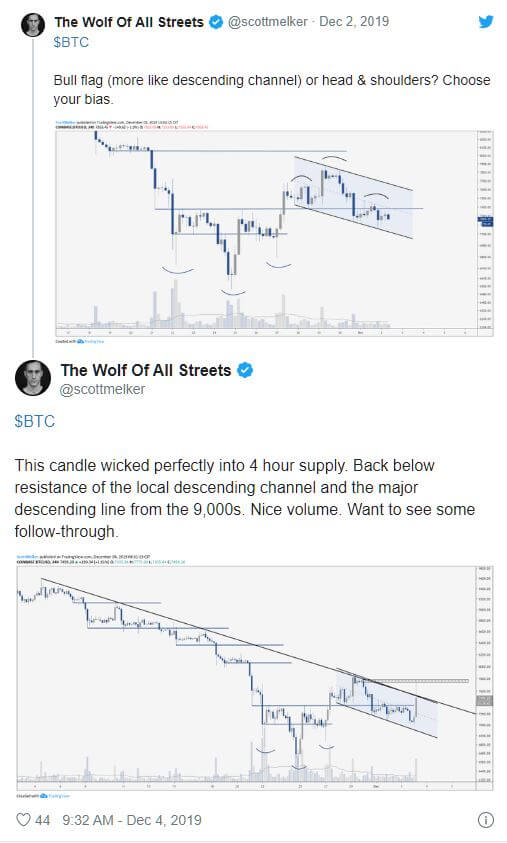

As soon as the bitcoin price broached $7,800, it quickly fell below $7,500 – right back into the wedge it has been trapped in since late November.

The recent move could merely be a strong squeeze of short contracts before BTC resumes its downtrend to lower support levels in the $6,000 area.

For BTC to use the recent short-term surge as the foundation for an extended rally, volumes would need to recover and push the cryptocurrency above $7,500 with stability.

Josh Rager, a technical analyst, said that it is too early to turn immediately bullish. The last time bitcoin made its way to the high-$7,000 region in a squeeze, it proceeded to fall below $7,000 to achieve a quarterly low at $6,600.

He said:

Where have we seen this before? Cantering Clark and I were just discussing how similar these two areas were before this 10% pop I wouldn’t get immediately bullish just yet – the last time we saw this price action, it led to lower lows – tame expectations here.

Weak Reaction from Altcoins

Despite the strong movement of bitcoin, major alternative cryptocurrencies like Ethereum, XRP, and EOS have shown no major reaction.

Ethereum increased by 5%, but most altcoins recorded losses in the range of 5 to 15% against bitcoin during the latest price spike.

Often, in an actual upside movement that is sustained throughout the short to medium-term, altcoins tend to follow the direction established by BTC.

Based on the swift pullback of BTC, the upsurge was likely triggered to provide some relief in the market after weeks of continued selling.

That said, the market has not established a new trajectory based on the 10% move of bitcoin alone.

This article was edited by Josiah Wilmoth.