The majority of Bitcoin holdings are currently in a profitable position following the recent rally of the largest cryptocurrency by market capitalization, data from on-chain data provider Glassnode shows. The UTXO Realized Price Distribution (URPD) metric from the data firm puts the proportion of the moneymaking Bitcoin at 81%.What Is UTXO Realized Price Distribution and Why Does It Matter?UXTO is short for unspent transaction output. It can be simply related to the change you receive when you make a purchase. If, for instance, you want to purchase something worth 3 BTC, but your wallet balance is 5BTC, you cannot just pick 3BTC out to make the payment.It is similar to how you just like you cannot just pick out of a 0 bill. For a Bitcoin transaction, the network takes the 5BTC in

Topics:

Craig Adeyanju considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin-Halving, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

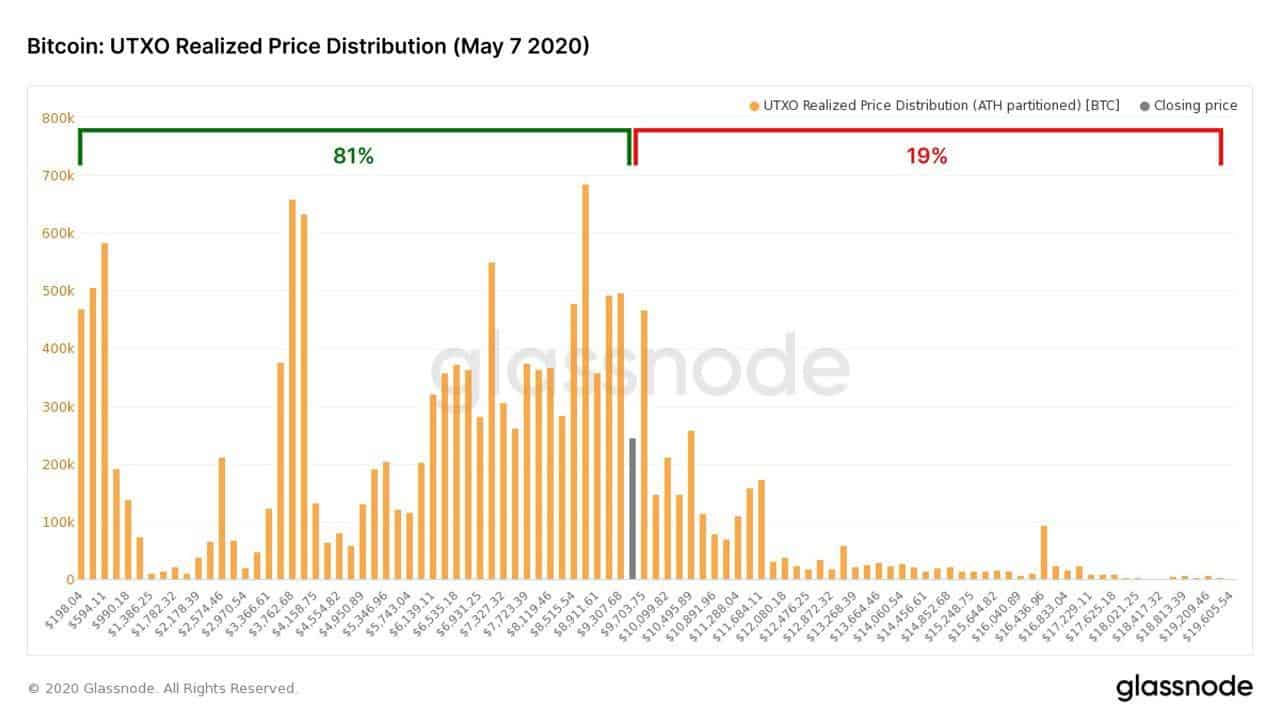

The majority of Bitcoin holdings are currently in a profitable position following the recent rally of the largest cryptocurrency by market capitalization, data from on-chain data provider Glassnode shows. The UTXO Realized Price Distribution (URPD) metric from the data firm puts the proportion of the moneymaking Bitcoin at 81%.

What Is UTXO Realized Price Distribution and Why Does It Matter?

UXTO is short for unspent transaction output. It can be simply related to the change you receive when you make a purchase. If, for instance, you want to purchase something worth 3 BTC, but your wallet balance is 5BTC, you cannot just pick 3BTC out to make the payment.

It is similar to how you just like you cannot just pick $50 out of a $100 bill. For a Bitcoin transaction, the network takes the 5BTC in your wallet, splits it into unspent Bitcoin, and credit the merchant the agreed amount while your wallet gets the 2BTC ‘change.’

Handling transactions this way helps the Bitcoin network track and account for funds movements. Interestingly, this also makes it possible to track the starting price points/ranges for each UTXO (the ‘change’ for a buyer and payment to the seller in our example). It is those price ranges that the URPD metric tracks to measure the profitability of new and current Bitcoin holdings.

Anticipation Is Building up Ahead of Bitcoin Halving

That such a large proportion of BTC holdings are currently in the green could be indicative of a bull market as the Bitcoin halving event approaches. And it represents a significant shift from the coronavirus-driven selloff in March, which saw the proportion of profitable UTXO dip to 40% on March 16, according to data from Glassnode. The UTXO profitability low of 40% reached in March was the lowest that figure had been since October 2015.

Is a BTC Selloff Imminent?

Despite the positive trend, Glassnode cautions that an extended rally could trigger a selloff driven by investors who might want to take some profits.

“With so many investors in profitable positions, significant increases to BTC’s price in anticipation of the halving could trigger some to realize gains in the short term,” the firm said in a tweet.