Bitcoin used to show a higher correlation to the stock markets, especially amid the lowest point of the pandemic. However, it has taken a different route during the last few days.Bitcoin-S&P 500 Correlation Departs from ATHTypically, Bitcoin is regarded as an independent asset that often acts as a safe haven. Its fundamentals are different from those driving the stock market. Nevertheless, the oldest cryptocurrency was caught following the American flagship index known as the S&P 500 more often this year.It all started with the COVID-19 pandemic that triggered a massive collapse in global stock markets. Bitcoin followed with a more than 40% decline within less than 24 hours. Since then, the cryptocurrency has mimicked the S&P 500 index here and there.Correlation between Bitcoin and the S&P

Topics:

Anatol Antonovici considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, nasdaq, s&p 500, United States, Wall Street

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin used to show a higher correlation to the stock markets, especially amid the lowest point of the pandemic. However, it has taken a different route during the last few days.

Bitcoin-S&P 500 Correlation Departs from ATH

Typically, Bitcoin is regarded as an independent asset that often acts as a safe haven. Its fundamentals are different from those driving the stock market. Nevertheless, the oldest cryptocurrency was caught following the American flagship index known as the S&P 500 more often this year.

It all started with the COVID-19 pandemic that triggered a massive collapse in global stock markets. Bitcoin followed with a more than 40% decline within less than 24 hours. Since then, the cryptocurrency has mimicked the S&P 500 index here and there.

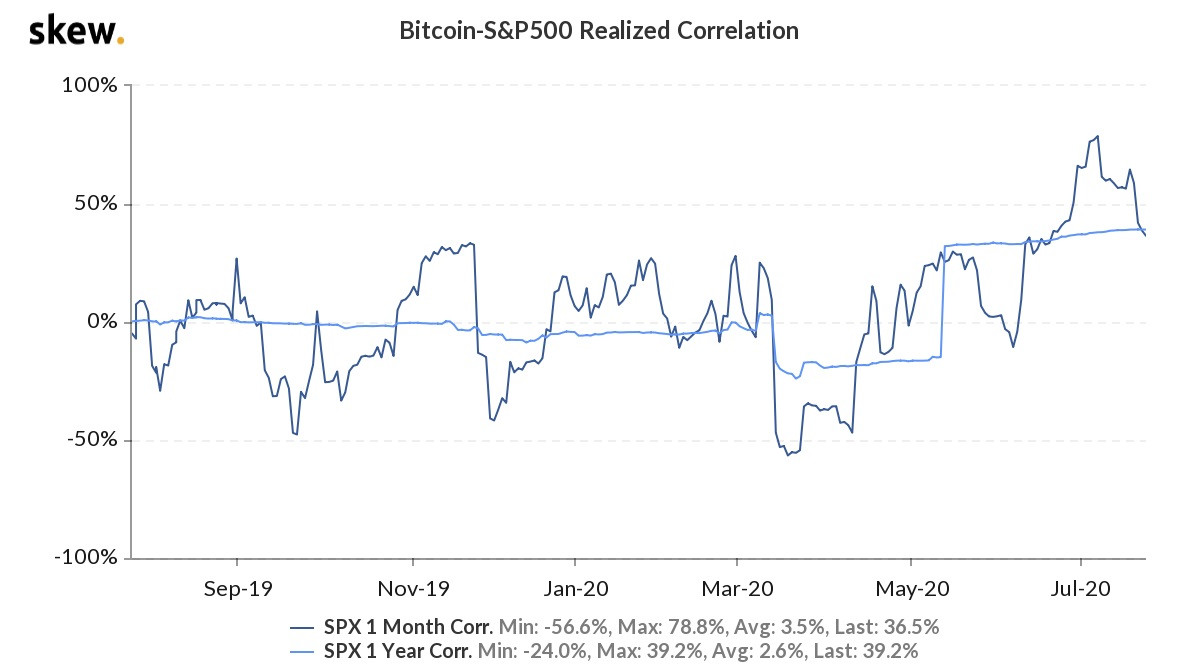

Data from Skew showed that Bitcoin-S&P 500 correlation hit the all-time high at the beginning of July.

Nevertheless, the recent pump in the Bitcoin price has helped it decouple from US equities. During the last seven days, the cryptocurrency has gained over 8% or so, while the S&P 500 index has shown a negative performance for the same period.

The Nasdaq Composite index, tracking upwards of 2,500 securities, is down even more than the S&P 500, as it charts losses of 1.5% over the same period.

US Equities Dragged Down by Fundamentals

After declining to the lowest levels in about three years in mid-March, the S&P 500 rallied for several months on the aggressive stimulus measures green-lighted by the Trump administration to address the impact of the pandemic, which left over 30 million Americans without a job. The Fed’s cash injection has boosted the stock market for a while.

At the start of the week, the S&P 500 and the other two major indices – Dow Jones and tech-oriented Nasdaq – were also boosted by the general optimism around potential COVID vaccines, with US biotech firm Moderna leading the race.

However, equities gave up on Thursday and Friday, when the S&P 500 tumbled about 2% on aggregate, which resulted in a weekly decline of about 0.60%. Meanwhile, Bitcoin has secured a gain of over 4% during the last seven days.

The US stock market has been under pressure these days as the US Congress couldn’t reach a consensus on the size of the next stimulus package. The current stimulus measures are expiring at the end of July. Meanwhile, the earnings season has started, and most companies are reporting losses, given the impact of the pandemic. On top of that, the US-China tensions are rising to dangerous levels, with Hong Kong and other topics being at the center of the debate.

Bitcoin is benefiting from the current uncertainty, trying to benefit from its safe-haven capabilities, especially when gold is about to update the record high.