On Thursday, April 30th, the leading cryptocurrency is growing quite well, trading at 00.00. During April 2020, the BTC/USD rate has grown by 32%.By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Bitcoin tech analysisWhy has the BTC price grown so abruptly?Looking at the BTC charts, many have a question: where has such growth appeared from and where is it heading for today and in the nearest future? However, the situation on W1 may calm everyone down: the quotations remain inside the actual midterm channel. The price has tested its upper border. Its breakaway will allow rising to the resistance line of the long-term trend – the level of 550.00 USD. And then the market will decide what to do next: form a new long-term bullish trend or bounce and reverse to the low of 21.90 USD. The

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

On Thursday, April 30th, the leading cryptocurrency is growing quite well, trading at $8900.00. During April 2020, the BTC/USD rate has grown by 32%.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Bitcoin tech analysis

- Why has the BTC price grown so abruptly?

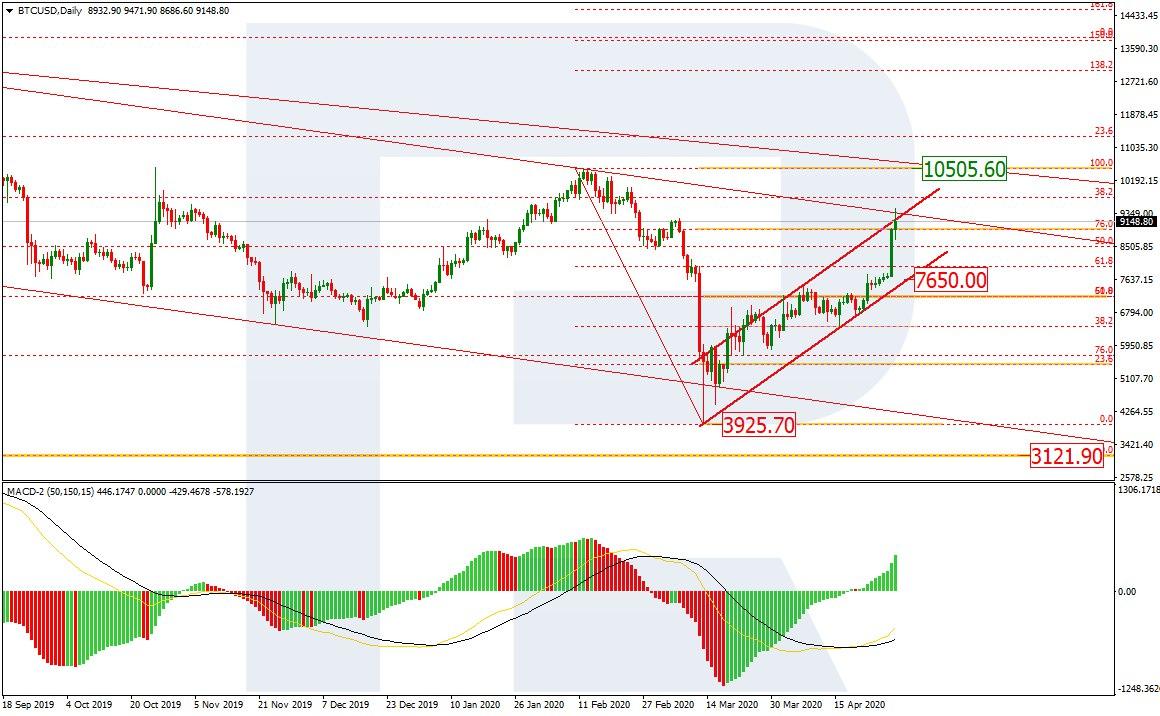

Looking at the BTC charts, many have a question: where has such growth appeared from and where is it heading for today and in the nearest future? However, the situation on W1 may calm everyone down: the quotations remain inside the actual midterm channel. The price has tested its upper border. Its breakaway will allow rising to the resistance line of the long-term trend – the level of $10550.00 USD. And then the market will decide what to do next: form a new long-term bullish trend or bounce and reverse to the low of $3121.90 USD. The dynamics of the MACD and Stochastic lines remain descending, which also supports the bears.

Photo: Roboforex / TradingView

On D1, BTC/USD is testing the resistance level of the short-term ascending channel. The MACD lines heading upwards hint on the possibility of further growth, however, a quick pullback to the support line on $7650.00 USD is neither excluded. A breakaway of this support may mean a serious probability of further descending to the last low of $3925.70 USD.

Photo: Roboforex / TradingView

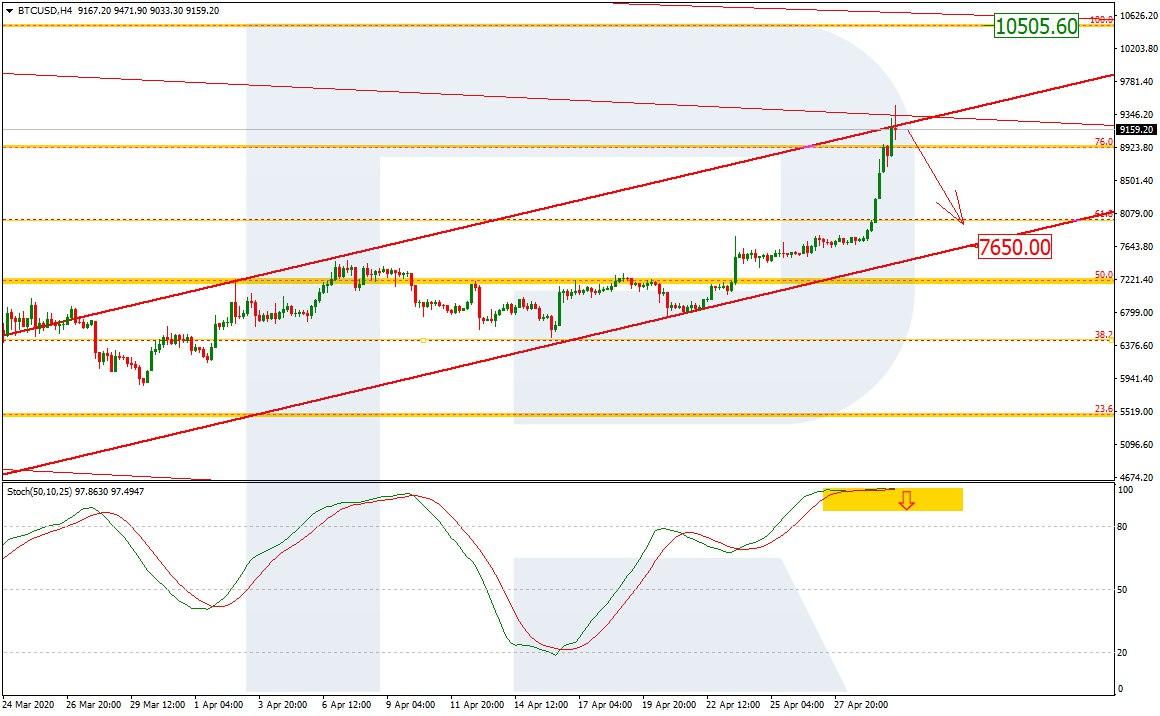

On H4, the quotations have sky-rocketed after consolidation in a narrow range. We may suppose that such an active rise is a temporary and short-term reaction to the accumulation of positions in the flat. Hence, a pullback or even a reversal will not take long to follow. Yet another signal for a trend reversal will be a Black Cross on the Stochastic.

Photo: Roboforex / TradingView

During these last couple of days and today, the BTC price has grown significantly. It seems quite impossible to single out one and the only reason for such growth. However, we may name several factors.

Firstly, the BTC halving expected soon may have become a catalyst. According to preliminary data, it is due on May 13th at 1 a.m. Moscow time. As we know, by the halving the reward per each mined block will be reduced two times – to 6.25 BTC from the current 12.50 BTC. It is planned that BTC mining will become less interesting, thus, the number of coins mined will decrease, which will affect the BTC price positively.

However, not everyone is so optimistic. For example, a trader under the nickname Joe007, who is the leader of the crypto traders’ rating of Bitfinex, is sure that the potential of halving for enhancing the BTC rate is significantly overestimated.

Secondly, the growth of the BTC rate during the last 24 hours may be connected to the actions of the U.S. Fed. In its April session, the Fed promised to support the economy by some new financial measures as it sees a serious threat of a decrease in the economic system. Most probably, the Fed means a new block of support measures, i.e. it will switch on the printing machine again. The probable increase in the money stock in the USA (in addition to the current state) may have sent the investors to look for alternative income sources – such as the crypto market. However, we absolutely must not think that the crypto sector is becoming safe for fiat money – several market slumps this year have proved it.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.