On Thursday, November 26th, Bitcoin is correcting after its rally reached a peak this week. It is generally trading at 16,733 USD with a high of 19,490 USD.By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Technical analysis of Bitcoin (BTC) price.MicroStrategy earned 350 million USD on BTC.WSJ made a publication with BTC on the front page.On W1, BTC is correcting from 100.0% Fibo. The aim of the pullback is currently 13,207 USD. The MACD histogram remains positive, providing another signal for the price growth. The signal lines of the indicator are forming a Black Cross, increasing the chances for the ascending dynamics. The Stochastic is heading for the overbought area, suggesting a major correction in the nearest future. Judging by all the factors, the crypto asset is likely to correct

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

On Thursday, November 26th, Bitcoin is correcting after its rally reached a peak this week. It is generally trading at 16,733 USD with a high of 19,490 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Technical analysis of Bitcoin (BTC) price.

- MicroStrategy earned 350 million USD on BTC.

- WSJ made a publication with BTC on the front page.

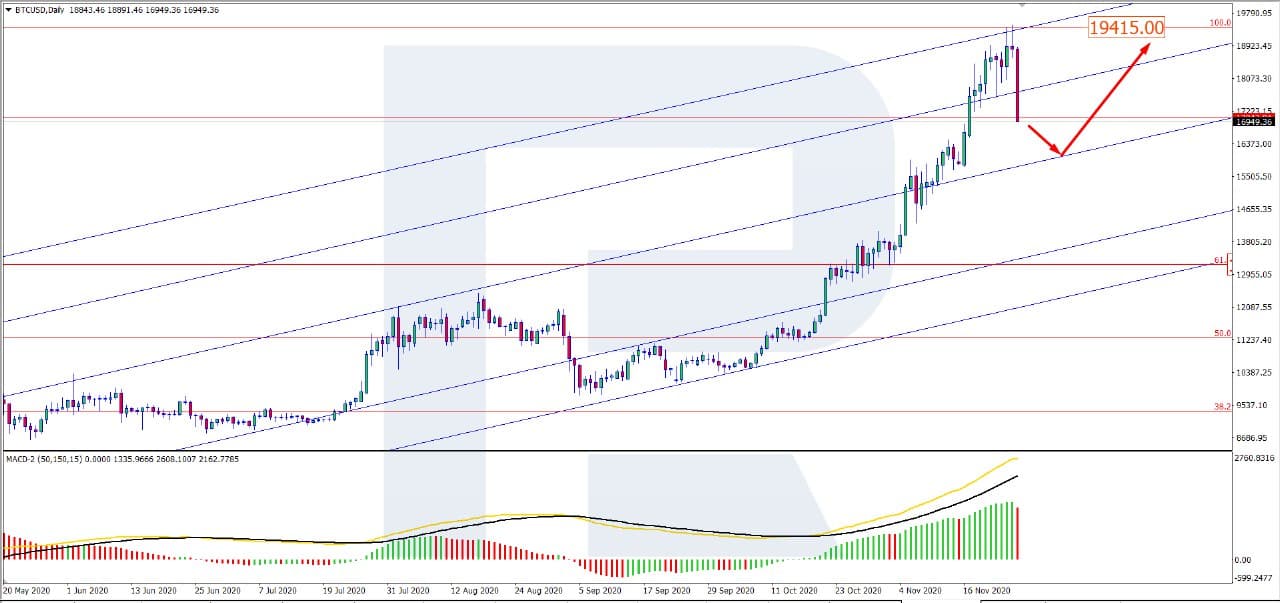

On W1, BTC is correcting from 100.0% Fibo. The aim of the pullback is currently 13,207 USD. The MACD histogram remains positive, providing another signal for the price growth. The signal lines of the indicator are forming a Black Cross, increasing the chances for the ascending dynamics. The Stochastic is heading for the overbought area, suggesting a major correction in the nearest future. Judging by all the factors, the crypto asset is likely to correct and go on with the growth then.

Photo: RoboForex / TradingView

On D1, the tech picture is almost identical to that on W1: the pair keeps correcting. The aim of the decline is the support line of the ascending channel. The MACD histogram is above zero, which promises further growth. The signal lines of the indicator keep growing upon forming a Black Cross, supporting the growth. The indications that the two charts look similar: a correction before the development of the uptrend looks preferable. The aim of the growth after the correction is 19,415 USD.

Photo: RoboForex / TradingView

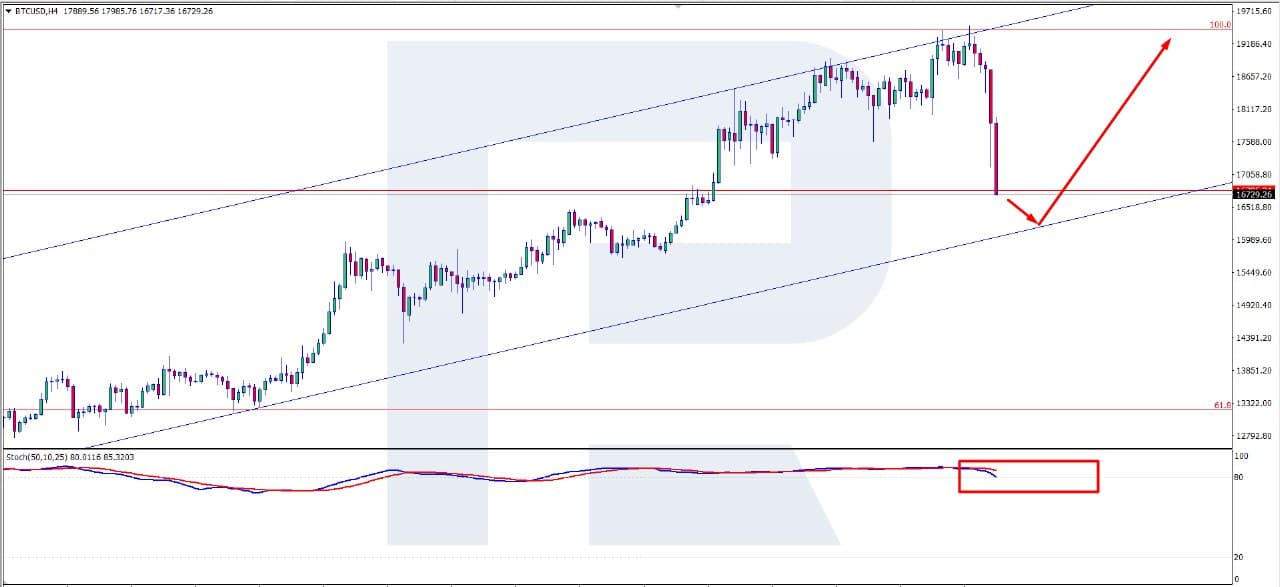

On H4, the perspectives of further growth after a correction are also bright. The Stochastic remains in the overbought area, supporting a correction before further growth. The aim of the pullback might be on the support line of 16,200 USD. The aim of the growth after the correction is the same as on the longer timeframes – 19,415 USD.

Photo: RoboForex / TradingView

In August-September, MicroStrategy invested 425 million USD in BTC, and by this week, the investment has increased by 305 million USD. The company guessed it well with the investment: its own net profit of the last 3.5 years amounted to just 78 million USD.

Not only MicroStrategy made a profit on the crypto rally. At the beginning of October, Square bought 4,709 BTC, and by now, the investment has grown from 50 million to 90 million USD.

Clearly, the whole issue could have turned out the other way round, but this time risky investors are fortunate.

BTC is the hero of the week (the last eight weeks, to be precise), but it is now that its growth attracted maximum attention. On November 23rd, the Wall Street Journal published an article about the leading cryptocurrency on the front page. In the article, it is noted that this year BTC has found billions of fans and has got noted by institutional investors, which makes its rally so stable.

Neither can we disregard the turmoil going on in the world of fiat money, which pushed investors to find alternatives. This also supports the crypto market.

For this article, we’ve used BTCUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the author's particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.