Today, on Thursday, April 16th, the Ethereum price is growing steeply. The coin is generally trading at 169.70 USD.By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Ethereum price is growing today: tech analysis.The price of all assets in the ETH network has become equal to the BTC.Users will be able to check the origin of the cryptocurrency.On W1 of the Ethereum, we see that the correctional phase after a rapid decline was too “modest”. A new wave of descending dynamics did not become vast either. The market now rests within the borders of a channel between .86 and 0.00 USD. The descending lines of the MACD and Stochastic indicate bearish predominance. However, if the bulls manage to break away the resistance level near 0.00 USD, the correctional phase will extend to 23.6%

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Today, on Thursday, April 16th, the Ethereum price is growing steeply. The coin is generally trading at 169.70 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Ethereum price is growing today: tech analysis.

- The price of all assets in the ETH network has become equal to the BTC.

- Users will be able to check the origin of the cryptocurrency.

On W1 of the Ethereum, we see that the correctional phase after a rapid decline was too “modest”. A new wave of descending dynamics did not become vast either. The market now rests within the borders of a channel between $80.86 and $260.00 USD. The descending lines of the MACD and Stochastic indicate bearish predominance. However, if the bulls manage to break away the resistance level near $260.00 USD, the correctional phase will extend to 23.6% ($398.00 USD) and 38.2% ($593.00 USD) Fibo.

Photo: Roboforex / TradingView

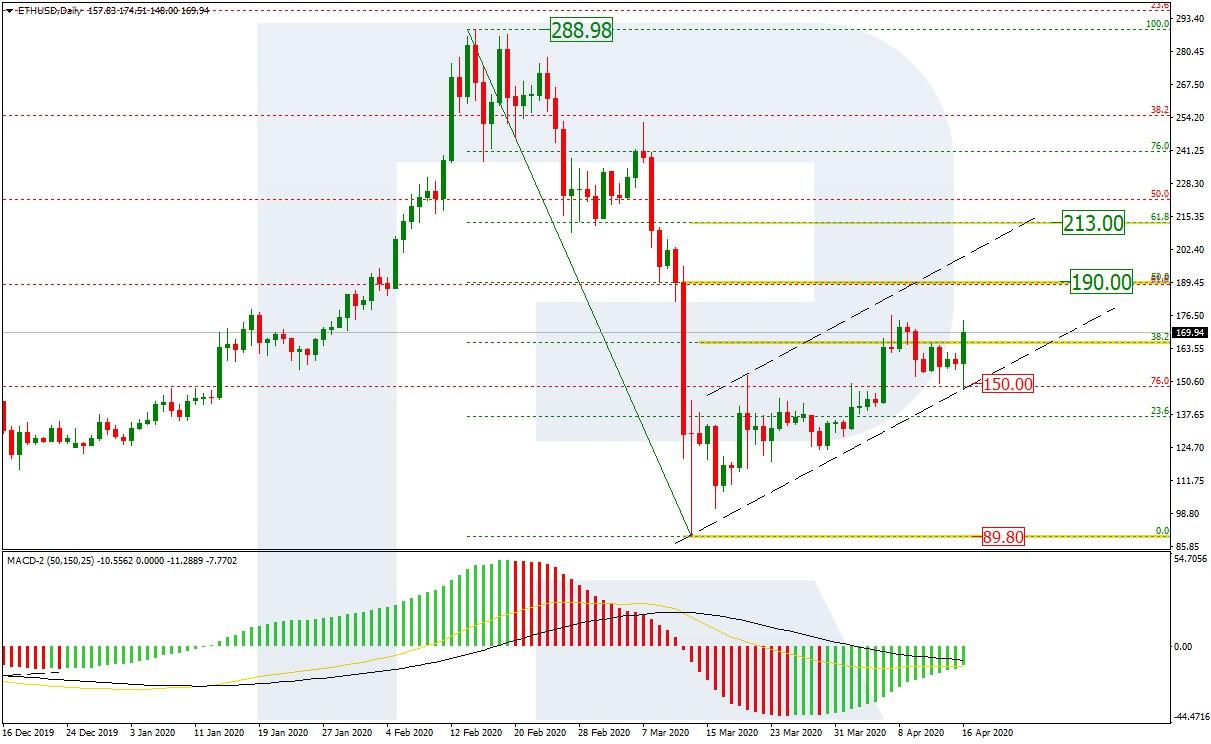

On D1, ETH/USD also demonstrates an uptrend as a mid-term correction. The quotations are moving inside a stable channel and testing 38.2% Fibo for the second time. The next goals of the growth are 50.0% ($190.00 USD) and 61.8% ($213.00 USD). The dynamics of the MACD lines remain descending, hence a breakaway of the support near $150.00 USD may become the beginning of a new wave of declining to the low of $89.80 USD.

Photo: Roboforex / TradingView

On H4, the quotations escaped a short-term descending channel upwards. The momentum of growth is aimed at overcoming the local low; then the psychologically important level of $200.00 USD may be approached. Additional confirmation of the upcoming growth will be a Gold Cross on the Stochastic.

Photo: Roboforex / TradingView

The aggregate sum of the assets transferred intraday in the ETH network has become equal to that of the BTC, amounting to 1.5 billion USD. This is explained by investors’ high demand for stablecoins. The parity with the BTC means that the demand for alternative cryptocurrencies in the first quarter of 2020 will remain high, and then the alignment of forces may change.

About 80% of the transactions in the Ethereum network involve USTD, USDS, and TUSD. Prevailing of cryptocurrencies with a fixed rate is explained by higher investors’ demand for them in the case of transferring capital.

As the latest news goes, in the Ethereum survey service Etherscan, you may now check the origin of the cryptocurrency. For this, a function called “ETHProtect: is used; the investor may collect the data on the cryptocurrency history – whether it has been noticed in some frauds, fishing, or other unlawful activities. In many cases, this information will not be extremely useful for the user but if you buy large sums, it will definitely not harm you. For example, frequent hacking of crypto exchanges has created an illegal flow of digital money, and the new function will let you know where your money has come from. However, it remains unclear what to do with this knowledge next.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.