The price is slowly breaking away from a 2-month channel as bullish action holds.While Chainlink struggles below the key resistance level, the price is currently looking indecisive on the daily chart.LINK/USD: Chainlink Remains In A Tight RangeKey Resistance Levels: .3, .5, .9Key Support Levels: .3, , .52LINK/USD. Source: TradingViewChainlink continued to maintain a sideways movement for the past weeks, leaving the market in an indecisive stage. The price failed to resume its uptrend after facing multiple rejections at .3 resistance level, marked in April.Towards the downside, Link similarly held strong support at after a failed attempt to break lower. Due to this, the price is now trapped within a tight range as it currently trades under against the US

Topics:

Michael Fasogbon considers the following as important: Chainlink (LINK) Price, LINKBTC, LINKUSD, Price Analysis

This could be interesting, too:

Chayanika Deka writes Chainlink’s MVRV Ratio Signals Selling Exhaustion: What’s Next for LINK?

Chayanika Deka writes Whale and Shark Activity Pushes Chainlink (LINK) Past For the First Time in 37 Months

Martin Young writes Chainlink Partners With Major Finance Firms on AI, Oracles, and Blockchain Data Solution Project

Dimitar Dzhondzhorov writes Top 10 Cryptocurrencies by ‘Notable Development Activity’ (Santiment)

- The price is slowly breaking away from a 2-month channel as bullish action holds.

- While Chainlink struggles below the key resistance level, the price is currently looking indecisive on the daily chart.

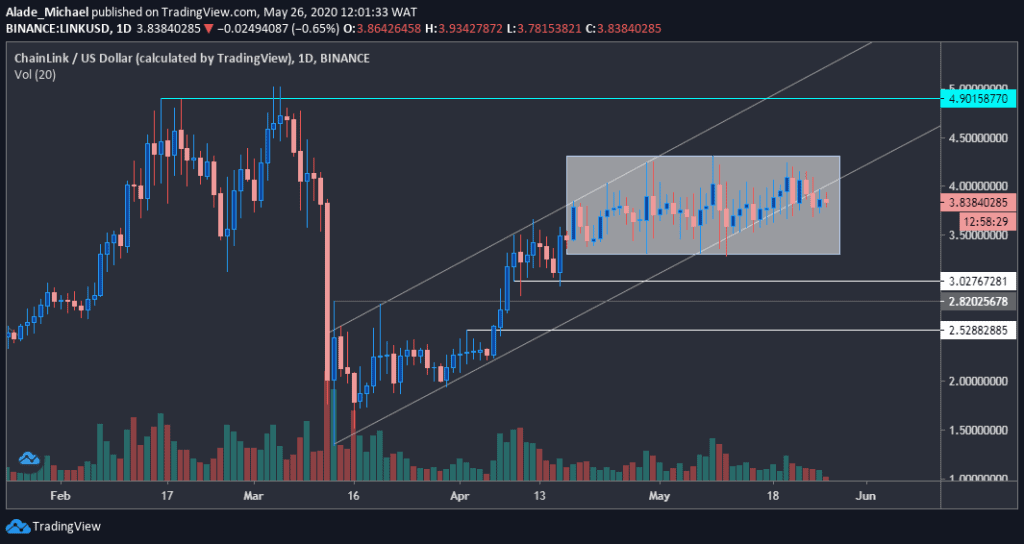

LINK/USD: Chainlink Remains In A Tight Range

Key Resistance Levels: $4.3, $4.5, $4.9

Key Support Levels: $3.3, $3, $2.52

Chainlink continued to maintain a sideways movement for the past weeks, leaving the market in an indecisive stage. The price failed to resume its uptrend after facing multiple rejections at $4.3 resistance level, marked in April.

Towards the downside, Link similarly held strong support at $3 after a failed attempt to break lower. Due to this, the price is now trapped within a tight range as it currently trades under $4 against the US Dollar.

Meanwhile, the sideway trend is stylishly validating a slow breakdown from the 2-month rising channel as this setup could lead to a serious drop if the break becomes notable. Chainlink would need to climb back above this channel to keep buyers back on track.

Chainlink Price Analysis

The slow breakout is much likely to follow a sell action considering the recent move from the $4.3 resistance. The potential support here is $3.3, which is suppressing selling pressure for over weeks now. $3 will be the next level to watch if the support fades.

Below this level lies minor grey-marked support at $2.82, followed by a key white level at $2.5.

Should the buyers find their way back to retest the $4.3 resistance, especially above the channel, Link could have a breakthrough to $4.5 and $4.9 resistance level. It would confirm a mid-term bullishness if the price surpasses $5 mark – the current yearly high.

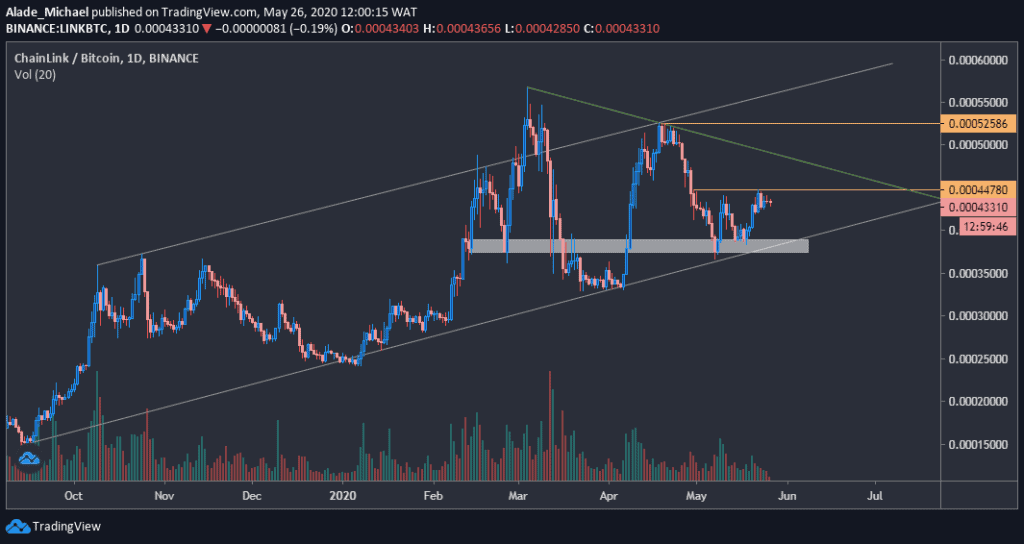

LINK/BTC: Chainlink Consolidates After Bounce Back

Key Resistance Levels: 44780 SAT, 52500 SAT, 56000 SAT

Key Support Levels: 37566 SAT, 33372 SAT, 30000 SAT

Against Bitcoin, Chainlink’s price is still respecting the ascending channel forming for the past eight months. The price recently found support around the channel’s lower boundary, activating bullishness with a double-bottom pattern.

Considering the previous highs from 56700 SAT to 52500 SAT, Chainlink could form another one around 48000 SAT if it respects the green regression line. The price may drop again! But a clear move above this line would activate a buy to the upper boundary of the channel.

Chainlink Price Analysis

As of now, Chainlink is slightly consolidating around 43000 SAT. If demand increases, the 44780 SAT resistance would be under threat once more.

A successful breach could send price to 52500 SAT and 56000 SAT, but Link is likely to face a small resistance around the green line – as mentioned above – before advancing higher.

However, Link’s price may slip back into the grey demand area of 37566 SAT if the resistance continues to hold. The support to watch below this channel is 33372 SAT and 30000 SAT.