Eric Young and Adam Kurtz suddenly revoked their lawsuit against the Bitfinex exchange and Tether founders. The two previously claimed market manipulation and fraud.The plaintiffs said they are crypto traders who suspect that Bitfinex and Tether fed the market with fake data about their volumes, operations, and deals. However, on January 7 both filed a document saying they demand voluntary dismissal for their claims:“The Court having considered the Notice of Voluntary Dismissal Without Prejudice filed by Eric Young and Adam Kurtz, it is hereby ORDERED that all the claims set forth in the Complaint shall be dismissed against all Defendants without prejudice”The spokesperson for Bitfinex denied commenting on the issue even to the CoinDesk representatives.Bitfinex and Tether Receive One Hit

Topics:

Jeff Fawkes considers the following as important: Bitcoin Cash, Bitcoin SV, Bitfinex, Blockchain News, Companies, Crimes, crypto capital, Cryptocurrency News, EOS (EOS), ifinex, Joe Morgan, News, USDT

This could be interesting, too:

Emily John writes GRVT Launches Alertatron Trading Event and Airdrop Before TGE

Bilal Hassan writes Coinbase Expands in Nigeria with Onboard Global Partnership

Guest User writes XRP Price Faces Potential Drop: Leading KOL Warns of Imminent Correction with TD Sequential Sell Signal!

Bilal Hassan writes Bitget Expands in South Africa with Callpay Integration

Eric Young and Adam Kurtz suddenly revoked their lawsuit against the Bitfinex exchange and Tether founders. The two previously claimed market manipulation and fraud.

The plaintiffs said they are crypto traders who suspect that Bitfinex and Tether fed the market with fake data about their volumes, operations, and deals. However, on January 7 both filed a document saying they demand voluntary dismissal for their claims:

“The Court having considered the Notice of Voluntary Dismissal Without Prejudice filed by Eric Young and Adam Kurtz, it is hereby ORDERED that all the claims set forth in the Complaint shall be dismissed against all Defendants without prejudice”

The spokesperson for Bitfinex denied commenting on the issue even to the CoinDesk representatives.

Bitfinex and Tether Receive One Hit After Another?

Eric and Adam are two of several people who filed a lawsuit against Tether and Bitfinex. Particularly, their case is in the registry since November 22, and it says:

“Defendants’ control of USDT issuances and Bitfinex permitted Defendants and their co-conspirators to coordinate purchases and sales with rising and falling Bitcoin prices. When Bitcoin prices were falling, Defendants and their co-conspirators printed USDTs and artificially increased the price of Bitcoin. Once Defendants and their co-conspirators artificially inflated the price of Bitcoin, Defendants and their co-conspirators then converted the Bitcoin back into USDTs to replenish Tether’s reserves.”

However, despite the scheme described above looks legit, the plaintiffs suddenly changed their minds. Yes, the claims above based on a single study by a University Professor John Griffin. However, if the plaintiffs want to save the time for something more interesting than court wars, then why not?

Bitfinex still has lots of homework to do to defend itself from the NYOAG’s claims regarding money laundering and fraud. The companies will have to deal with more than 50 cases of their lies described in detail within the court documents.

More than that, Bitfinex is still vulnerable due to the Leibowitz/Goldstein lawsuit. It says that Bitfinex, Tether and Crypto Capital Co. performed price manipulations, money laundering, and fraud:

“The crimes committed by Tether, Bitfinex, Crypto Capital, and their executives include Bank Fraud, Money Laundering; Monetary Transactions Derived From Specified Unlawful Activities, Operating an Unlicensed Money Transmitting Business, and Wire Fraud,”

A hefty of problems to deal with, adding the fact that the Crypto Capital Co. CEO was recently arrested for money fraud. Also, Bitfinex was using a Polish bank connected with Colombian drug cartels. Polish Police seized the 400 million euro in assets and the bank’s CEO, during a harsh raid.

According to CoinDesk, Tether/Bitfinex representative Joe Morgan sent them a letter claiming the following:

“Tether and its affiliates have never used Tether tokens or issuances to manipulate the cryptocurrency market or token pricing. All Tether tokens are fully backed by reserves and are issued pursuant to market demand, and not for the purpose of controlling the pricing of crypto assets. It is irresponsible to suggest that Tether enables illicit activity due to its efficiency, liquidity and wide-scale applicability within the cryptocurrency ecosystem.”

Joe didn’t supply the proof links or facts proving the claims, which means they do not necessarily reflect the real state of things in the iFinex Inc., Bitfinex, Tether, and Crypto Capital Co. camp.

Dark Clouds Clustering around Bitfinex, Crypto Prices Jump Up

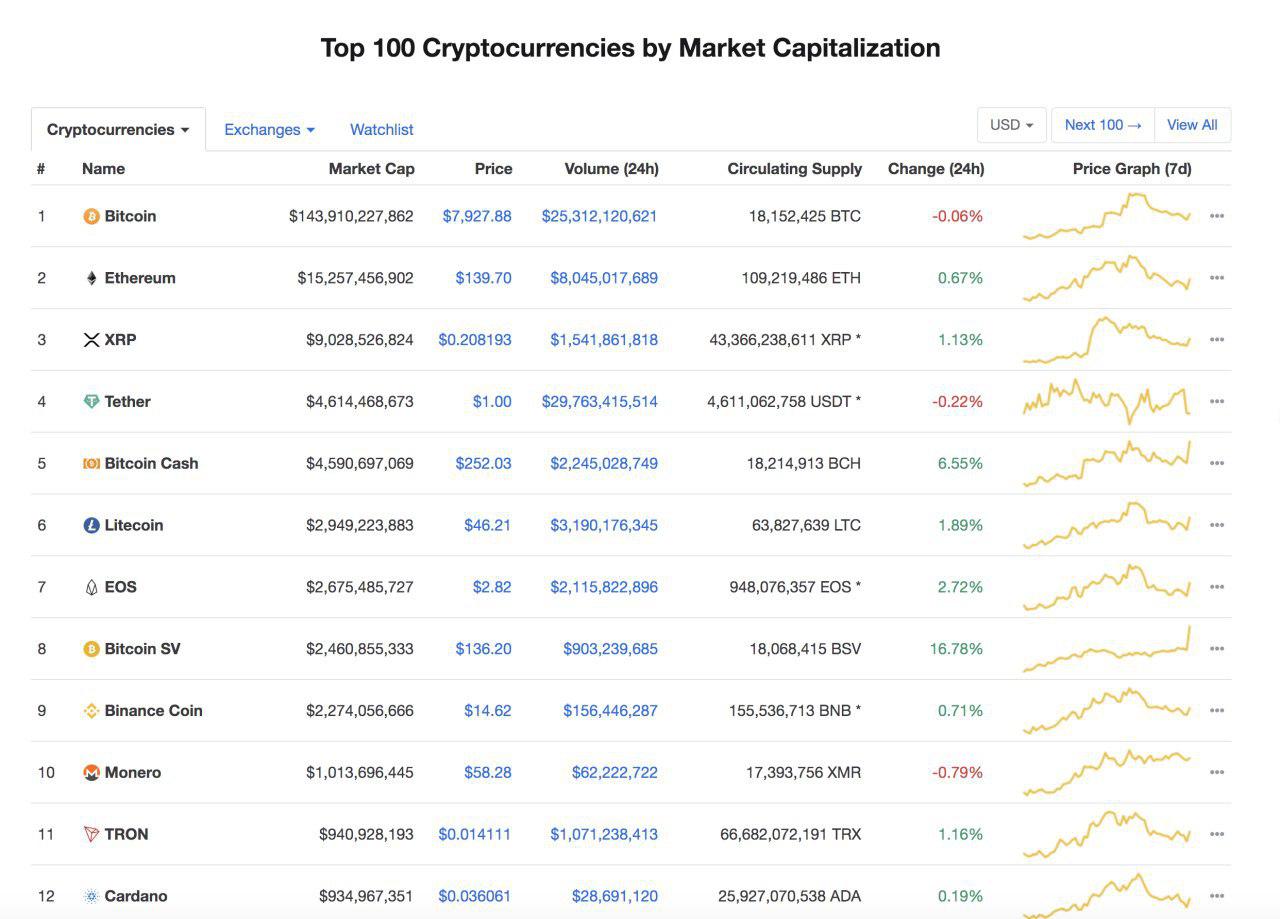

After a substantial fall, it seems that the cryptocurrencies are on the rise. Recent hours show a significant growth of Bitcoin Cash, Bitcoin SV, Litecoin and EOS. Bitcoin is slowly catching up, trying hard to recover from under the $8000 level.

Usually, negative Bitfinex news generate a price rise for the cryptocurrency market. And when the news is good for Bitfinex, the cryptocurrency prices fall. This time, the trend got a reversal. Market shows the price rising. Whether its the people changed their understanding, or the bots changed manipulation algorithms?

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.