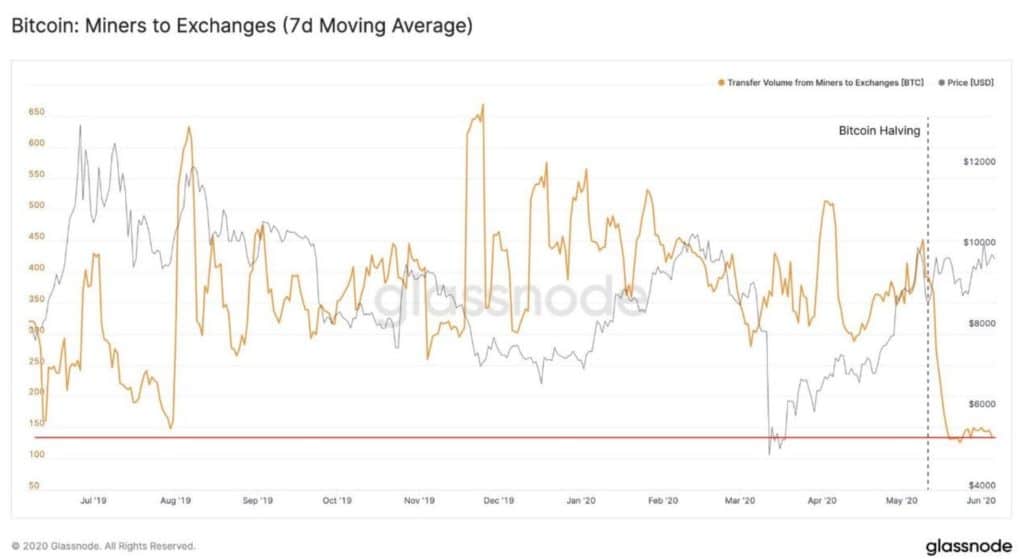

According to an analysis by the popular blockchain data company Glassnode, Bitcoin miners are selling a lot less at the current price rate. While this might look like a positive sign at a glance, it might also suggest that the current rate simply doesn’t satisfy their profitability criteria.Bitcoin Miners Selling LessData from the well-known cryptocurrency monitoring resource Glassnode reveals that Bitcoin miners have been selling substantially less BTC at the current rates.In fact, after the halving took place at the beginning of May, the amount has decreased substantially.BTC: Miners to Exchanges. Source: GlassnodeAs seen in the above image, ever since the halving, the amount of BTC miners are transferring to exchanges has dropped substantially.One possible reason is that the current

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

According to an analysis by the popular blockchain data company Glassnode, Bitcoin miners are selling a lot less at the current price rate. While this might look like a positive sign at a glance, it might also suggest that the current rate simply doesn’t satisfy their profitability criteria.

Bitcoin Miners Selling Less

Data from the well-known cryptocurrency monitoring resource Glassnode reveals that Bitcoin miners have been selling substantially less BTC at the current rates.

In fact, after the halving took place at the beginning of May, the amount has decreased substantially.

As seen in the above image, ever since the halving, the amount of BTC miners are transferring to exchanges has dropped substantially.

One possible reason is that the current price of Bitcoin might not be enough to recover the mining costs. As such, another leg up might actually cause a short-term sell-off.

There’s Another Possibility

On another note, it might also be the case that miners are just increasing their holdings in anticipation of the next bull run. The price has historically seen a substantial increase in the year following the halving, so that’s not out of the picture.

In any case, the demand for BTC seems to be increasing, while its supply was slashed in half following the halving.

As CryptoPotato reported, Grayscale is purchasing more bitcoins than the ones that are actually mined. The Grayscale Bitcoin Trust is oriented towards institutional investors, signaling stronger demand on their behalf.

Yet, Bitcoin’s price remains indecisive. It has fully recovered since the massive drop back in March, but it’s unable to break the coveted $10,000 mark definitively. Just a few days ago, there was another unsuccessful attempt as the price breached $10K briefly before losing more than $1,000 of its value and dropping back to the previous trading range between $9,400 and $9,600.