Bitcoin’s hash rate has decreased by 32% in the past few days as the revenue generated by miners is also substantially less following the halving. This is one of the biggest corrections in history, and it might pose certain security challenges for the network.Bitcoin Hash Rate Drops 32%Bitcoin’s hash rate decreased dramatically in the past five days. Since May 10th, it has dropped by more than 32%, going down from about 136.098 million TH/s to 91.265 TH/s.Bitcoin Hashrate. Source: Blockchain.comThe hash rate is a very important security metric. The more computing power the network has, the greater its security is, and the more resistant it is to a potential 51% attack. Naturally, a considerable decline of the kind makes the network more susceptible to security challenges.As CryptoPotato

Topics:

George Georgiev considers the following as important: AA News, Bitcoin-Halving, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin’s hash rate has decreased by 32% in the past few days as the revenue generated by miners is also substantially less following the halving. This is one of the biggest corrections in history, and it might pose certain security challenges for the network.

Bitcoin Hash Rate Drops 32%

Bitcoin’s hash rate decreased dramatically in the past five days. Since May 10th, it has dropped by more than 32%, going down from about 136.098 million TH/s to 91.265 TH/s.

The hash rate is a very important security metric. The more computing power the network has, the greater its security is, and the more resistant it is to a potential 51% attack. Naturally, a considerable decline of the kind makes the network more susceptible to security challenges.

As CryptoPotato reported before the halving, this was one of the risks that the event could have brought. Of course, Bitcoin remains the most secure network, but with the drop of the hash rate, it became easier for someone to attack it.

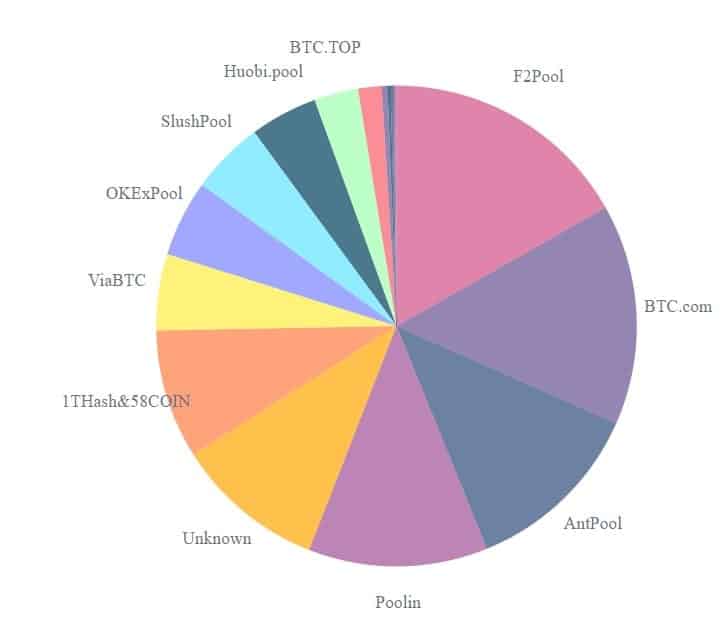

In any case, the hashing power remains widely distributed, as seen in the below pie chart. Even though BTC.com, Pooling, F2Pool, and AntPool remain the predominant leaders, none of these is even close to controlling 51% of the hash rate.

Miners’ Revenue Slashed in Half

Another direct consequence of the halving was the decrease in the revenue that miners generate. Since the block reward was reduced to 6.25 BTC/block from 12.5 BTC/block, their revenue more than halved.

As seen on the chart, the revenue dropped from about 19.253 million on May 10th to 8.245 million on May 14th.

The decrease in the block reward made it more expensive for miners to remain active. The reduced hash rate could be tied to more operations shutting down. However, Bitcoin’s network is designed to adapt and adjust accordingly, which is why a lot of experts believe that the upcoming mining difficulty adjustment will be particularly serious, and it will reduce the difficulty substantially.

With the decreased hash rate, the median confirmation time has also gone up by more than 100% since May 10th.