CME Group is the largest institutional provider of Bitcoin futures contracts. However, according to a nominee for the upcoming Board of Directors election, the company should also focus on additional operations, including mining Bitcoin and other companies, to create additional value for its stakeholders.CME Group Should Start Mining BitcoinDante Federighi is a nominee for CME Group’s upcoming board of directors election. He is also the co-founder of an investment managing firm called Fortezza Forza RMC Fund that is focused on energy products such as crude oil and short-term interest rates.Federighi has been chosen as a nominee for a director by Class B-2 shareholders along with three other people, competing for two director seats from this bracket.According to a letter to shareholders

Topics:

George Georgiev considers the following as important: AA News, CME

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

CME Group is the largest institutional provider of Bitcoin futures contracts. However, according to a nominee for the upcoming Board of Directors election, the company should also focus on additional operations, including mining Bitcoin and other companies, to create additional value for its stakeholders.

CME Group Should Start Mining Bitcoin

Dante Federighi is a nominee for CME Group’s upcoming board of directors election. He is also the co-founder of an investment managing firm called Fortezza Forza RMC Fund that is focused on energy products such as crude oil and short-term interest rates.

Federighi has been chosen as a nominee for a director by Class B-2 shareholders along with three other people, competing for two director seats from this bracket.

According to a letter to shareholders filed with the US Securities and Exchange Commission (SEC), Federighi believes that the company should create more value for its investors.

Some of our largest investors, i.e. BlackRock, are shifting investments to companies focused on creating value for all their stakeholders. The CME Group needs to get in front of this trend by building solar, wind, hydro energy plants to power our global operations. Then divert the excess energy to mine Bitcoin and other cryptocurrencies.

He also added that the company would immediately convert any newly minted cryptocurrencies into fiat. This would create an additional revenue stream for shareholders, while also providing “deep knowledge in new technologies changing the global exchange landscape for the CME.” According to him, “that’s a win-win-win.”

CME Bitcoin Futures Volume On The Rise

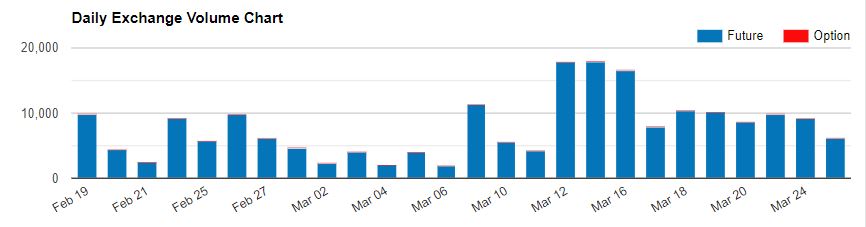

March has so far been a very tumultuous month for cryptocurrency traders across the board. Bitcoin lost a significant chunk of its value, dropping 40% in just a day. However, this also led to a serious increase in the overall trading volume, peaking at about $75 billion on March 13th.

Respectively, Bitcoin futures contracts traded on CME also saw a spike in their volume between March 12th – 14th.

It’s worth noting that one CME Bitcoin futures contract contains five bitcoins and is more or less geared at institutional investors.