Bitcoin has had a rough week of trading. Roughly about eight days ago, the cryptocurrency was hovering above ,000, causing many to believe that the bull run will take it above the current yearly highs and push forward.The entire community was ecstatic, and there were little to no signs of bearish sentiment. As it’s commonly the case, however, things took a turn for the worst as peak euphoria usually leads to maximum pain, according to a popular cryptocurrency analyst.A Trading Lesson to ConsiderOn September 1st, 2020, Bitcoin was trading at above ,000, and the entire cryptocurrency community was cheering. Bears were nowhere to be seen as the positive sentiment prevailed.However, a day later, BTC’s price dropped to about ,160 on Binance, causing some to worry. Still, the worst was

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin has had a rough week of trading. Roughly about eight days ago, the cryptocurrency was hovering above $12,000, causing many to believe that the bull run will take it above the current yearly highs and push forward.

The entire community was ecstatic, and there were little to no signs of bearish sentiment. As it’s commonly the case, however, things took a turn for the worst as peak euphoria usually leads to maximum pain, according to a popular cryptocurrency analyst.

A Trading Lesson to Consider

On September 1st, 2020, Bitcoin was trading at above $12,000, and the entire cryptocurrency community was cheering. Bears were nowhere to be seen as the positive sentiment prevailed.

However, a day later, BTC’s price dropped to about $11,160 on Binance, causing some to worry. Still, the worst was yet to come. The following day, on September 3rd, the asset tanked to a low of $9,960 and has been trading at around $10,000 ever since, losing over $2,000 or roughly about 20% of its dollar value in about a week.

Commenting on the matter was the prominent cryptocurrency analyst and popular trader, Scott Melker, better known in the space as The Wolf of All Streets.

Market psychology is incredible.

Earlier this week we arguably reached collective peak euphoria.

No surprise that it was followed with maximum pain.

— The Wolf Of All Streets (@scottmelker) September 5, 2020

Is High Interest Indicative of Market Tops?

Market psychology is indeed a tremendous part of trading and one that is oftentimes overlooked. The legendary investor Warren Buffett has been quoted saying:

Be fearful when others are greedy and greedy when others are fearful.

To an extent, this relates a lot to what happened in the cryptocurrency market during the following week.

Buffett’s statement, despite being a somewhat contrarian view on the markets, has a direct relation to the price of an asset.

When people are greedy, prices typically boil over, meaning that investors should be wary unless they’re willing to overpay. On the other hand, when others are fearful, this may provide for a good opportunity for getting in on the action.

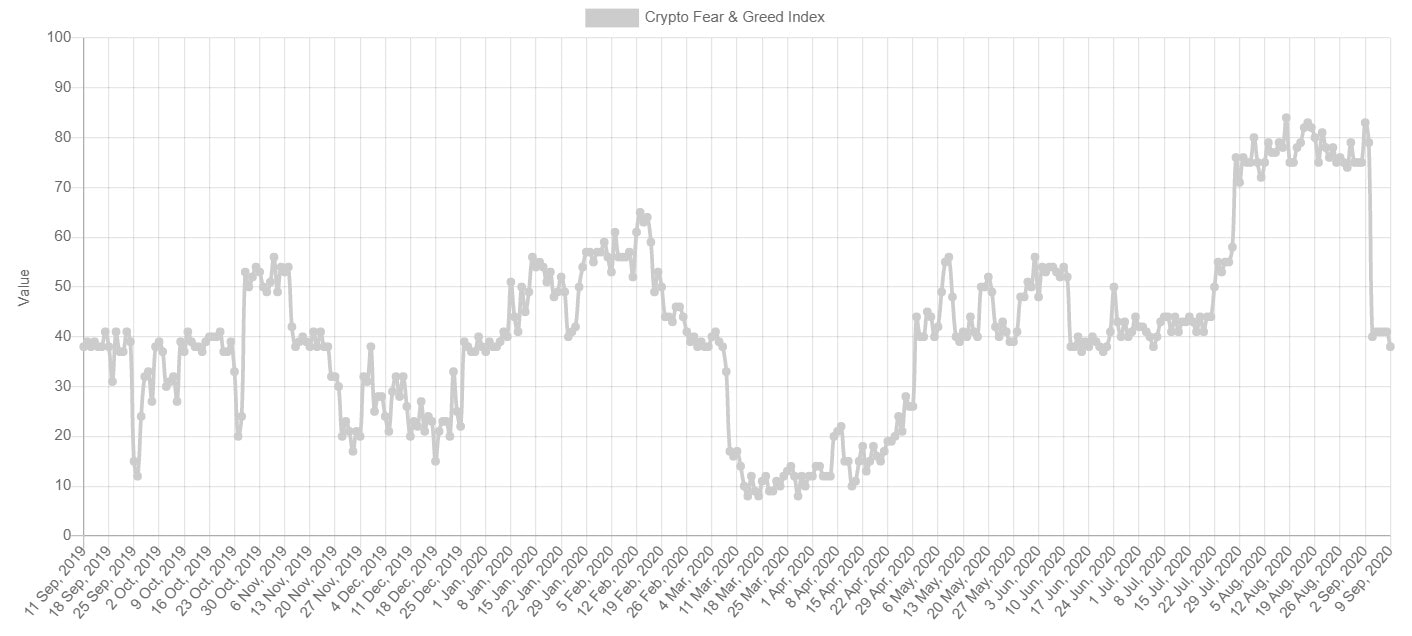

One indicator to consider when ‘measuring’ market psychology is the Crypto Fear and Greed Index. It’s a metric that tracks volatility, market momentum and volume, social media sentiment, surveys, trends, and dominance.

The above chart perfectly illustrates the behavior of market participants and shows that there’s almost always a serious crash when the index is in “extreme greed” territory. Case in point – on September 2nd, the index was at a factor of 83, displaying extreme greed right before the market tanked.

Trading is a zero-sum game, and market psychology is undoubtedly something to keep in mind when tailoring a strategy.