By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.BTC/USD tech analysisBTC miners earned billion in 2019In the Bitcoin network, a .1 billion transaction took placeOn W1, the Bitcoin quotations return to the previously broken resistance level of 50.0% Fibo. Such a pullback should be interpreted as short-term, meant just for testing the positions taken from above. In the mid-term, the quotations are growing to the resistance line of long scale at 500.00.At the same time, the Stochastic and MACD are looking down, which means bearish prevalence. The aims of the decline are as before: 76.0% (00.00) Fibo and the fractal minimum of 21.90.Photo: Roboforex / TradingViewOn D1, the Bitcoin price is declining to the previously broken resistance level of the short-term channel of growth.

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, Cryptocurrency News, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

Bilal Hassan writes Crypto Becomes a U.S. ‘Weapon,’ Says CryptoQuant CEO

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis

- BTC miners earned $5 billion in 2019

- In the Bitcoin network, a $1.1 billion transaction took place

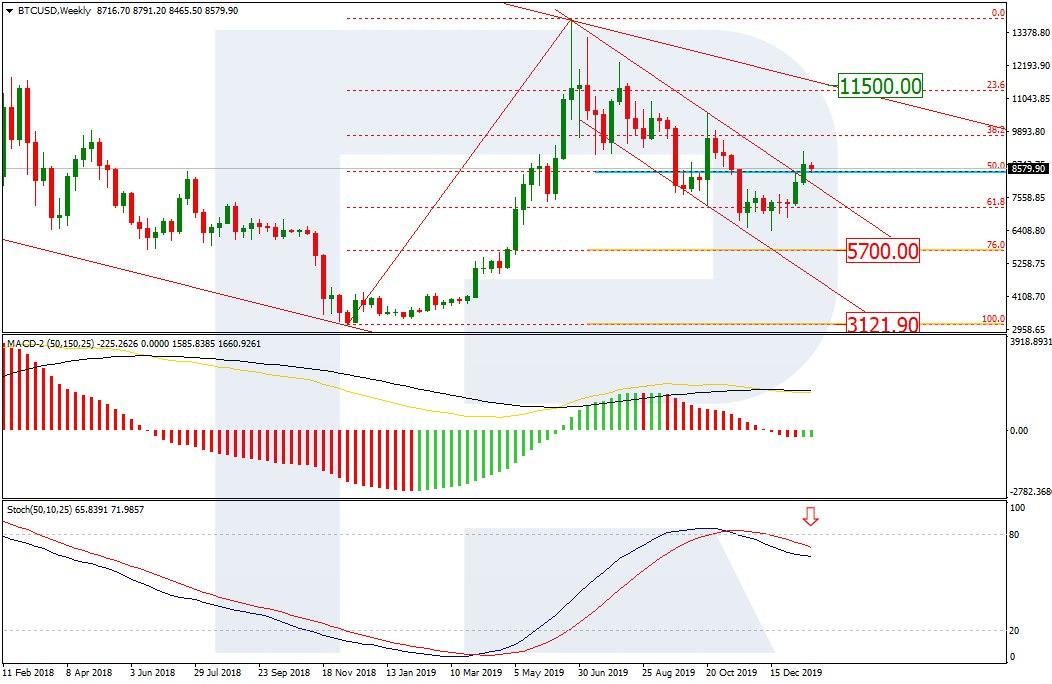

On W1, the Bitcoin quotations return to the previously broken resistance level of 50.0% Fibo. Such a pullback should be interpreted as short-term, meant just for testing the positions taken from above. In the mid-term, the quotations are growing to the resistance line of long scale at $11500.00.

At the same time, the Stochastic and MACD are looking down, which means bearish prevalence. The aims of the decline are as before: 76.0% ($5700.00) Fibo and the fractal minimum of $3121.90.

Photo: Roboforex / TradingView

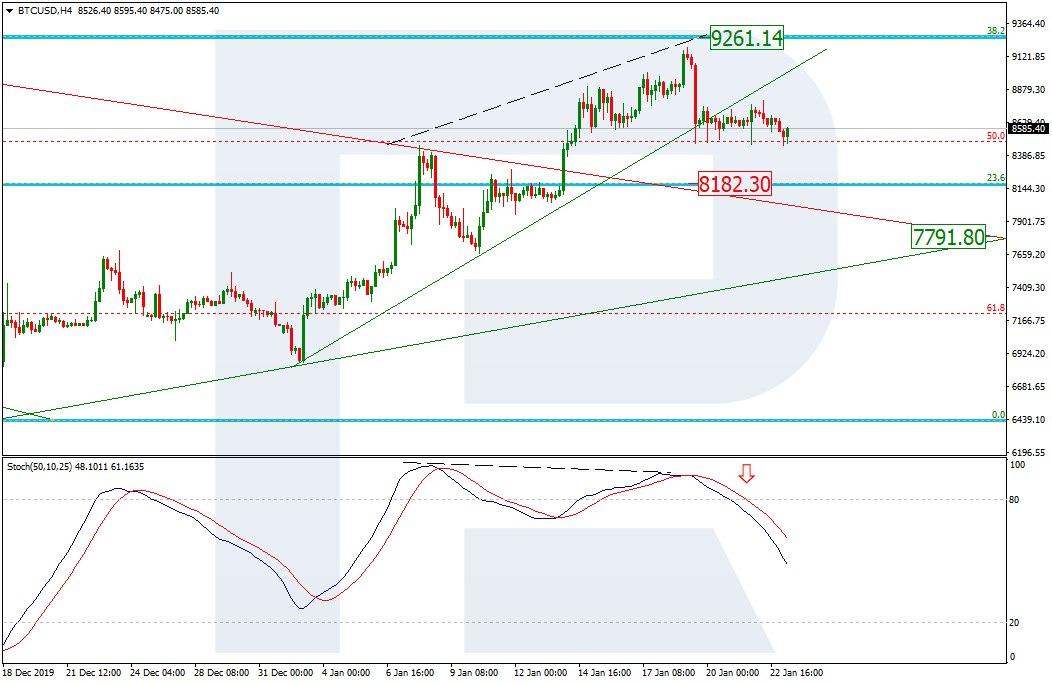

On D1, the Bitcoin price is declining to the previously broken resistance level of the short-term channel of growth. This situation means the beginning of testing and the stable development of the beginning correction. The main goal of testing is the support area near $7800.00. After a pullback testing, there may follow an impulse of growth to the short-term goal at the level of $9800.00.

Photo: Roboforex / TradingView

On H4, there is a correction phase after a wave of growth and divergence on the Stochastic. The quotations are declining to the support level 23.6% ($8182.30) Fibo but the correction may extend to $7791.80.

Photo: Roboforex / TradingView

Last year, the Bitcoin miners earned some $5 billion, mining the cryptocurrency. Around $4.89 billion from this sum was rewards for mined blocks. Until May 2020, the reward will remain without change as 12.5 BTC per each block. Later, after the halving, the sum will decrease two times to 6.25 BTC per block.

As commissions for mining, no less than $146 million was received in 2019.

Simultaneously, we can see that the income from mining is decreasing smoothly. Say, in 2018 BTC miners earned $5.26 billion. In 2017, on the contrary, the income was lower, amounting to $3.19 billion.

In the middle of January 2020, in the Bitcoin network there was carried out a transaction amounting to 124,946 BTC, or $1.1 billion. The name of the transh owner remains unknown. On the market, they say that the commission for such a transaction was no more than $83.

It is noted that the transaction could be explained by simple transferring of money from one wallet to another. Last year, such operations took place, first they seemed to be an attempt of hacking certain accounts and wallets, but later the version was rejected.

This is the appeal and the strong side of crypto transactions, as they say on the platform — it is virtually impossible to track the volumes of finance.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.