The leading cryptocurrency is giving up its positions right before our eyes. On Thursday, February 27th, it is trading at ,520, though just recently it was keeping above ,000.By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Bitcoin price is falling: technical analysis.The BTC may grow to 0,000 – Herjavec Group.China postpones the development of its cryptocurrency due to coronavirus.Bitcoin Price Technical AnalysisOn W1 of the BTC, there is a clear descending candlestick, hinting at the beginning of a new declining wave. The idea is supported by the Stochastic and the MACD. If the market manages to return under 50.0% Fibo, the quotations will then decline to 76.0% (,700) and then – to the fractal minimum at ,122.Photo: Roboforex / TradingViewOn D1, the picture of a trend change

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, crypto, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Emily John writes Binance CEO Applauds Japan Crypto Rules Amid Reforms

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

The leading cryptocurrency is giving up its positions right before our eyes. On Thursday, February 27th, it is trading at $8,520, though just recently it was keeping above $10,000.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Bitcoin price is falling: technical analysis.

- The BTC may grow to $100,000 – Herjavec Group.

- China postpones the development of its cryptocurrency due to coronavirus.

Bitcoin Price Technical Analysis

On W1 of the BTC, there is a clear descending candlestick, hinting at the beginning of a new declining wave. The idea is supported by the Stochastic and the MACD. If the market manages to return under 50.0% Fibo, the quotations will then decline to 76.0% ($5,700) and then – to the fractal minimum at $3,122.

Photo: Roboforex / TradingView

On D1, the picture of a trend change is even clearer. After a breakout of the support line of the previous channel of growth, the quotation reached the projection support and are testing it. The construction of the descending dynamics indicates speeding up of the decline but the test of the projection support slows it down a bit. A bounce to the local resistance at $9,650. However, the main attention of the market is at $8,490, which is the key support level. A breakout of this level and securing below it will define the dynamics of the leading cryptocurrency for several months to come. The MACD is preparing for a Black Cross.

Photo: Roboforex / TradingView

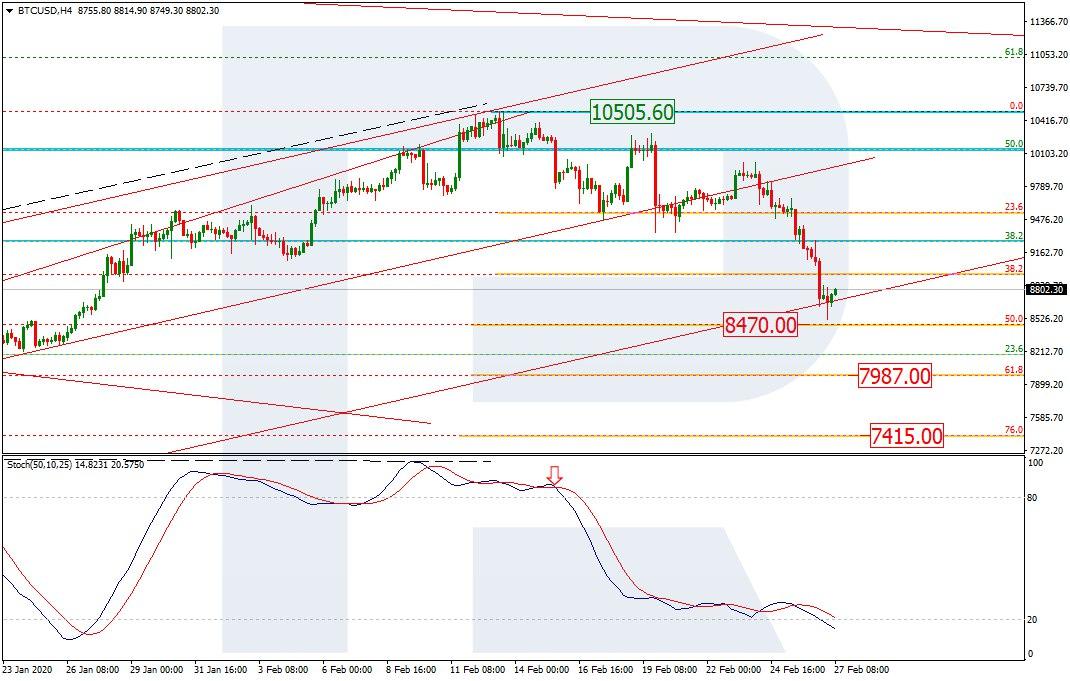

On H4, the declining wave has approached 50.0% ($8,470) Fibo in relation to the previous uptrend. This is the level near which the participants will decide whether to reverse and head for the high at $10506 or aim at the lower price levels – 61.8% ($7,987) and 76.0% ($7,415). The Stochastic, entering the oversold area, does not suggest a reversal.

Photo: Roboforex / TradingView

BTC May Grow to $100,000 – Herjavec Group

According to the head of Herjavec Group Robert Herjavec, in the long term, the growth of the BTC to $100,000 cannot be excluded. Though Bitcoin price is now falling, he states that the price of the leading cryptocurrency will grow along with the growth of the number of consumers. For them, it will be extremely important to use the BTC as a means of electronic payment. On the whole, it sounds logical: the more application options the cryptocurrency has in the real world, the wider opportunities for growth it acquires.

China Postpones the Development of Its Cryptocurrency Due to Coronavirus

The last crash of the world exchange indices and key assets, however strange it may sound, did not facilitate an inflow of fresh money to the market as it happened several weeks ago. Is it surprising? Probably, no. The thing is that the crypto world has exhausted the issue of coronavirus, and investors must have thought that the crypto segment would not serve as a safe haven this time due to the lack of liquidity.

The coronavirus epidemics hindered the work of Chinese experts on the creation of the country’s cryptocurrency. The idea of creation of the so-called “digital yuan” was to become real in the I quarter of 2020 but the program was frozen. The quarantine in the country involved several institutions participating in the program. One of them was the Bank of China, which is now functioning only partially due to the special measures. At the same time, it is announced that the halt will not influence the final date of the launch of the cryptocurrency (by the way, the date remains unknown).

For the crypto sector, the emergence of digital yuan is something completely new, and the rates of the existing currencies may depend on the interest to the new one.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.