On Thursday, March 26th, the volatility in the BTC remains high. However, today the prices for the leading cryptocurrency are declining slightly, generally trading at 45, while yesterday’s peak was 50.BTC price todayQE in the USA is good for the BTCBitcoin price “will be okay” – Novogratz and PompilianoOn W1, Bitcoin demonstrates a significant pullback after a drastic decline. The market is still declining, and the nearest aim of the main trend is the fractal low of 21.90 USD. The MACD and Stochastic lines remain descending, confirming further decline.Photo: Roboforex / TradingViewOn D1 of BTCUSD, the correctional growth reached 38.2% Fibo and is trying to reverse the quotations downwards. This might be a short-term inner pullback, after which a leap to 50.0% (25.00 USD) might

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, btcusd, Cryptocurrency News, Currencies, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

On Thursday, March 26th, the volatility in the BTC remains high. However, today the prices for the leading cryptocurrency are declining slightly, generally trading at $6645, while yesterday’s peak was $8350.

- BTC price today

- QE in the USA is good for the BTC

- Bitcoin price “will be okay” – Novogratz and Pompiliano

On W1, Bitcoin demonstrates a significant pullback after a drastic decline. The market is still declining, and the nearest aim of the main trend is the fractal low of $3121.90 USD. The MACD and Stochastic lines remain descending, confirming further decline.

Photo: Roboforex / TradingView

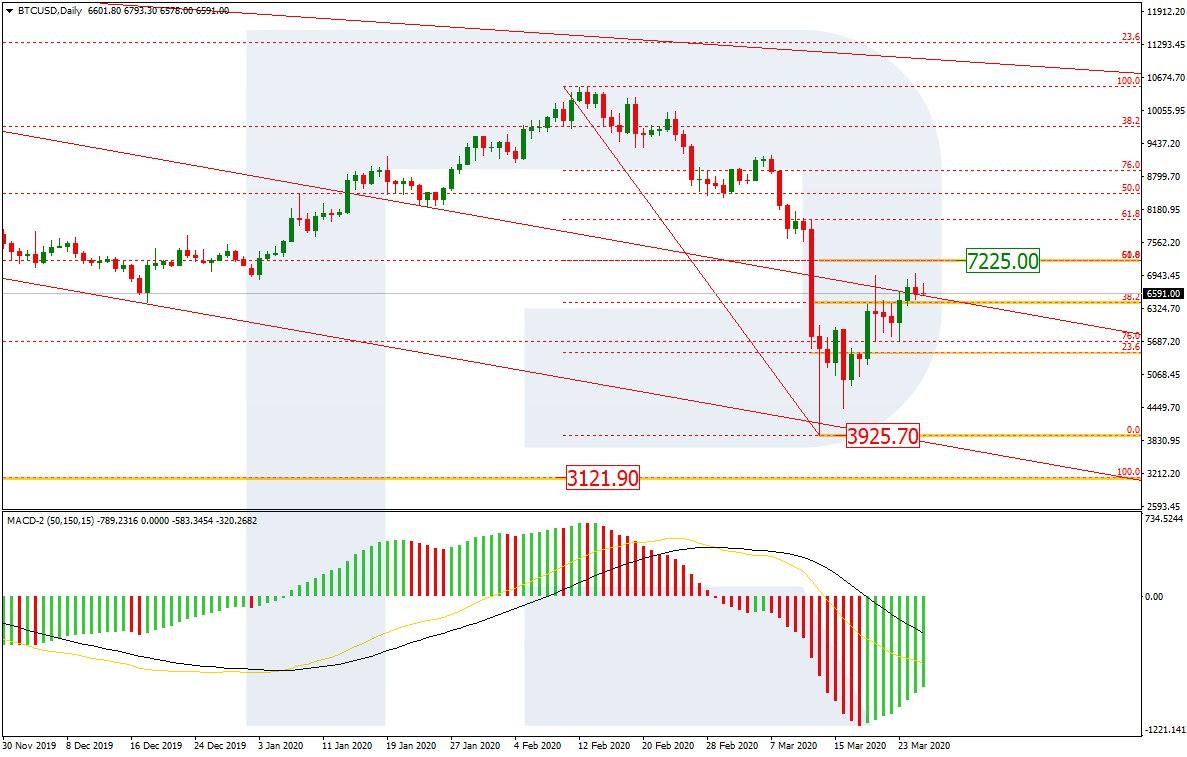

On D1 of BTCUSD, the correctional growth reached 38.2% Fibo and is trying to reverse the quotations downwards. This might be a short-term inner pullback, after which a leap to 50.0% ($7225.00 USD) might happen. After the correctional phase is over, another wave of a decline to the current low of $3925.70 USD may follow – which is confirmed by the MACD dynamics.

Photo: Roboforex / TradingView

On H4, the ascending correction is displayed in more detail. Note that after an insignificant renewal of the high the quotations are descending to the support line. A test and breakout of $6300.00 USD may signal the end of the correctional phase and aiming to the low. The Stochastic, entering the overbought area, is preparing a reversal of the short-term trend, however, we should wait for a Black Cross to form and confirm the signal.

Photo: Roboforex / TradingView

According to Michael Novogratz, the head of Galaxy Digital, the measures taken by the U.S. government to stimulate and support the economy will positively influence the price of both gold and the BTC. He is talking about the program of complex support, implemented by the Senat yesterday. Its volume will amount to 2 trillion USD that will be aimed at stabilizing the coronavirus situation in households and businesses.

Novogratz thinks that gold may soon renew all-time highs because it keeps testing the peaks. The price of gold will, in perspective, be higher than the price of the BTC, and the cryptocurrency has nothing to do but chase it.

The head of the Binance exchange Changpeng Zhao also states that such colossal supporting measures of the US government will increase the price of the leading cryptocurrency. He sees it possible that the BTC will grow to 100 thousand USD, while the capitalization of the crypto market might rise to 2 trillion USD, not today, of course, but in the future.

Many are busy forecasting the future of the BTC. Anthony Pompiliano, a partner of Morgan Creek Digital, is sure that in a couple of years the BTC price may be between 20 and 100 thousand USD.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.