These days, the BTC is trying to correct after stressful sales. On Thursday, March 19th, the key cryptocurrency is trading at 00, growing 11%.By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.Bitcoin price tech analysisBinance will not let the BTC rate fall to zeroMore and more opinions are voiced about the potential of the BTC fallingThe decision of the Fed to decrease the rate supported the BTC but not for longOn W1, the Bitcoin is realizing our monthly expectations of its decline. The global coronavirus problem, as well as total sales on the financial markets, affected the crypto market and its leader, too. A breakout of 76.0% (5700.00 USD) and a decline to the low of 3121.90 USD indicate the potential of a decline to the psychologically important support of 1000.00 USD per coin. On

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, btcusd, Cryptocurrency News, Currencies, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

These days, the BTC is trying to correct after stressful sales. On Thursday, March 19th, the key cryptocurrency is trading at $5800, growing 11%.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Bitcoin price tech analysis

- Binance will not let the BTC rate fall to zero

- More and more opinions are voiced about the potential of the BTC falling

- The decision of the Fed to decrease the rate supported the BTC but not for long

On W1, the Bitcoin is realizing our monthly expectations of its decline. The global coronavirus problem, as well as total sales on the financial markets, affected the crypto market and its leader, too. A breakout of 76.0% (5700.00 USD) and a decline to the low of 3121.90 USD indicate the potential of a decline to the psychologically important support of 1000.00 USD per coin. On the MACD and Stochastic, the lines are descending, which confirms a further bearish scenario.

Photo: Roboforex / TradingView

On D1, after a minor ascending correction, the quotations returned into the borders of the previous channel and tested its support line. After a bounce off it, the market enters the phase of a short-term correction, forming a Triangle. The aim of such a correction may become the level of 6671.15 USD. The confident decline of the MACD indicates the incompleteness of the main trend. After a pullback, the market will head for 3121.90 USD.

Photo: Roboforex / TradingView

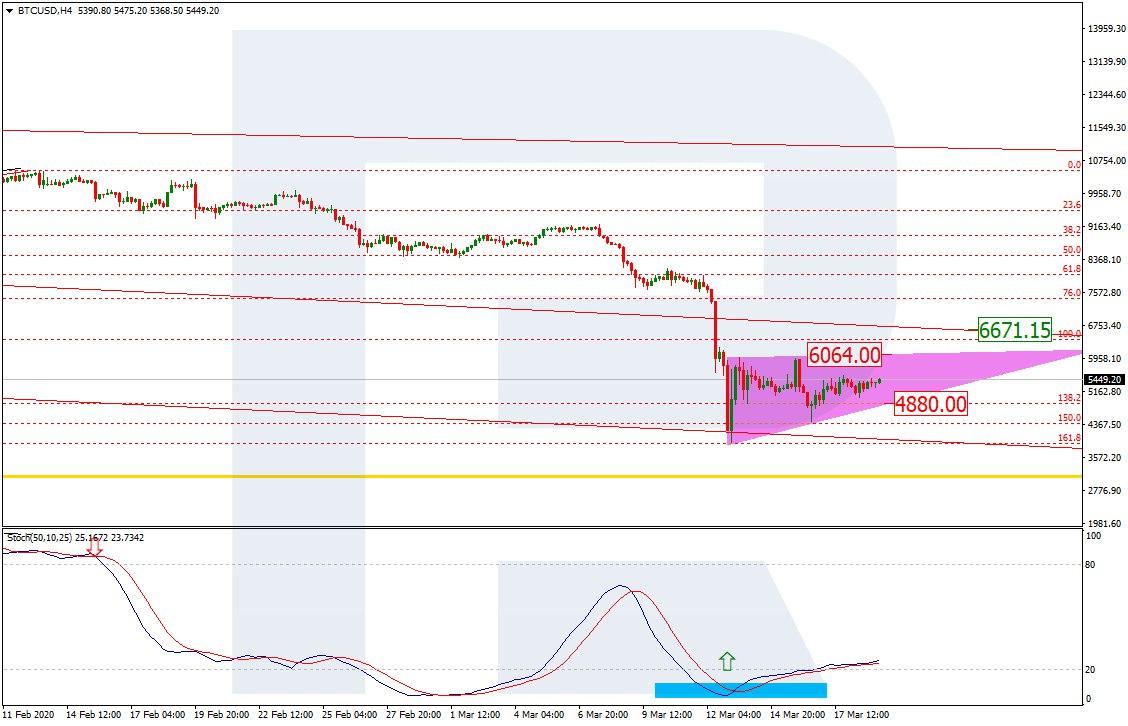

On H4, the correctional phase may be seen in more detail. Here, the quotations are squeezed between 4880.00 and 6064.00 USD. The beginning of the correction was accompanied by a Gold Cross on the Stochastic; the opposite signals may be expected here, too.

Photo: Roboforex / TradingView

The head of the Binance exchange Changpeng Zhao noted that his platform will not let the rate of the leading cryptocurrency fall to zero. This comment was given due to the spreading rumors that cryptocurrencies may seriously devaluate. In March, the BTC price fell by almost 50%, reaching 3800.00 USD at moments.

In Fact, Zhao’s comment only enhanced the panic – the same as the markets reacted to the preceding decision of the Fed to decrease the interest rate twice in a fortnight. Investors reason as follows: if those on high posts say such things, they know more than we do.

Peter Brandt, a trader famous in the crypto world, does not exclude a deeper decline of the leading digital asset. According to him, the probability of this increased after the BTC broke out 7500.00 USD on Wednesday. He says that just a short time ago he was sure of a 50% probability that the BTC will grow to 100000.00 USD. However, since the moment it fell below 7500.00 USD, he has become sure of its falling to zero.

Recently, the Fed decreased the interest rate for the second time in two weeks as urgently and unexpectedly as before. The BTC responded to the news by growth but it was short. There are too many emotions and panic on the platform for the assets to start behaving adequately and logically at last.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.