Bitcoin bulls appear to be resting right now after ricocheting off a major Fibonacci resistance at ,390 (yellow Fibonacci levels on the daily chart). This is the first time this level has been testing in almost a year and is one of the major hurdles standing in the way of BTC prices breaking above the psychological ,000 mark. On the 1-Hour BTC/USD Bitstamp chart, we can see that up-trending momentum has stalled. Could this an early sign of a bearish reversal, or are bulls just recharging before they make another strong move? The Technicals On the daily BTC/USD chart, we can see that the leading crypto is wildly overbought right now on the RSI. This is usually a strong indication that a correction is due. The last time bitcoin was overbought on the daily RSI was back on May 11, right

Topics:

Ollie Leech considers the following as important: Bitcoin (BTC) Price, BTC Analysis, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

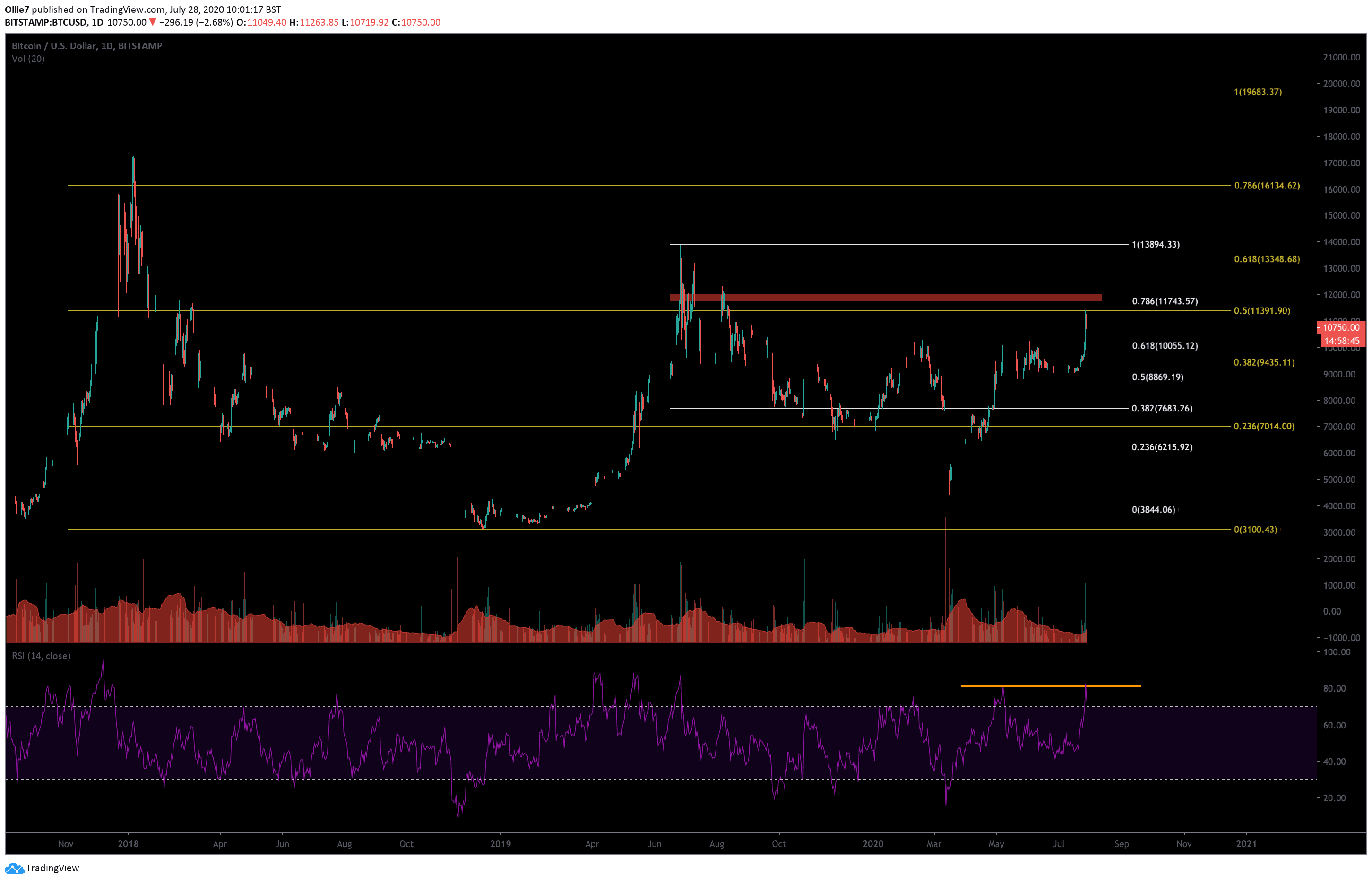

Bitcoin bulls appear to be resting right now after ricocheting off a major Fibonacci resistance at $11,390 (yellow Fibonacci levels on the daily chart).

This is the first time this level has been testing in almost a year and is one of the major hurdles standing in the way of BTC prices breaking above the psychological $12,000 mark.

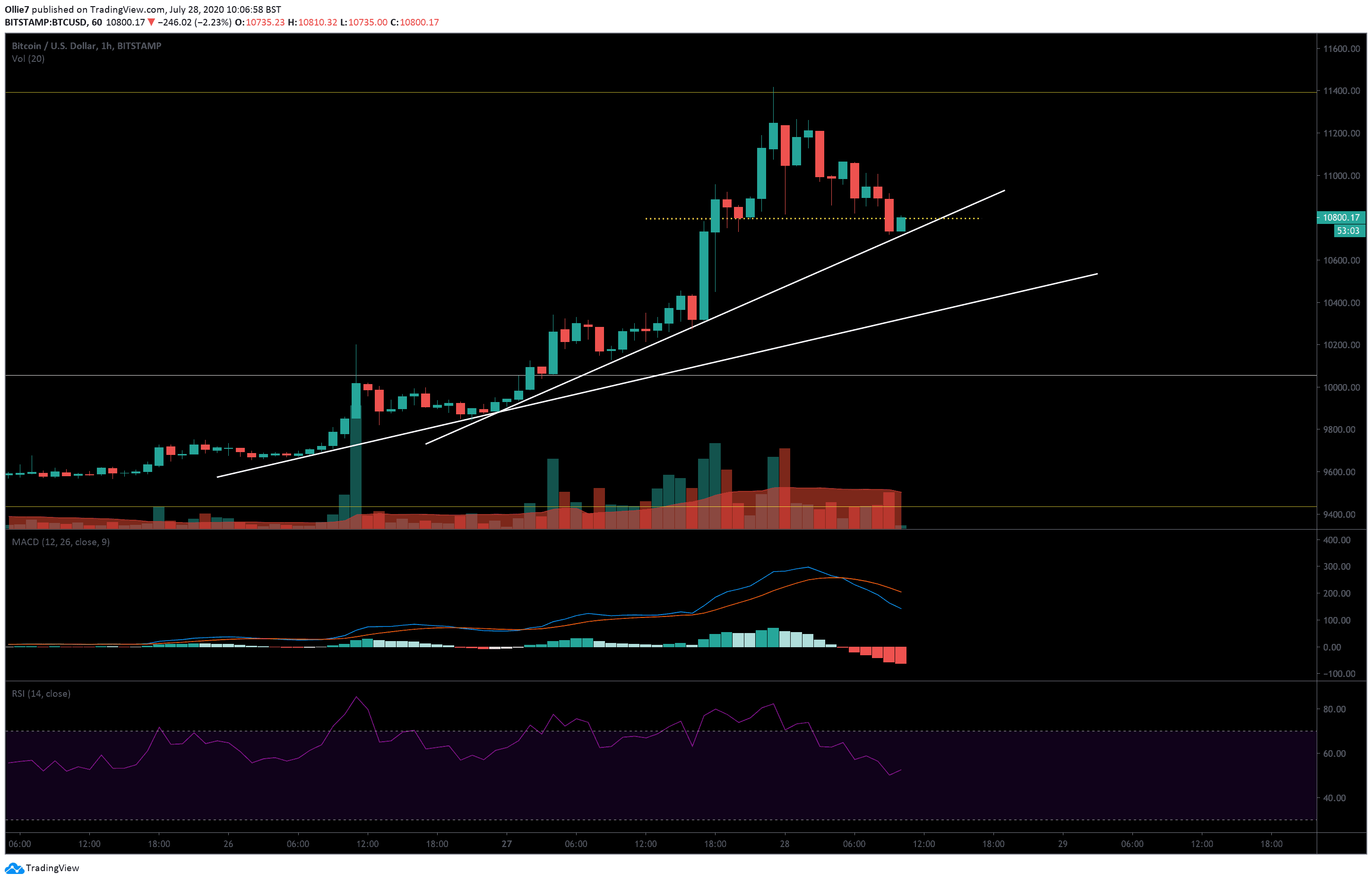

On the 1-Hour BTC/USD Bitstamp chart, we can see that up-trending momentum has stalled. Could this an early sign of a bearish reversal, or are bulls just recharging before they make another strong move?

The Technicals

On the daily BTC/USD chart, we can see that the leading crypto is wildly overbought right now on the RSI. This is usually a strong indication that a correction is due.

The last time bitcoin was overbought on the daily RSI was back on May 11, right before prices tanked 19% over three days.

On the 4-Hour MACD, it’s showing that buying volume is falling on the histogram. The 12-day moving average is also starting to arc down towards the 26-day moving average. If these two lines converge, it could be construed as an early signal of a short-term bearish reversal.

While this may all seem favorably bearish, it should be noted that the global crypto market capital has recently set a new higher high above $300 billion. This tends to be an excellent sign that we have entered into a bull market, at least in short to mid-term.

Price Levels to Watch in the Short-term

Right now, the aforementioned 0.5 Fibonacci level (yellow) at approx $11,400, is the first major target for bullish traders. This is followed by a historically key weekly resistance at $11,490, and then the psychological $12,000 target above.

Looking at the 1-Hour chart (below), we can see that the $10,798 level (yellow dotted line) is creating some intraday resistance for bullish traders. The price is, however, being supported by one of two up-trending supports (see white lines on 1H chart).

The first support is keeping bitcoin above $10,730. If this fails, then we could see prices tumble down to the second uptrending line approximately near the $10,400 mark (depending on when it breaks and meets the line).

Beneath that, we have the 0.618 Fibonacci level (white line) at $10,055, which could provide a foothold for bulls to rebound from if bears try to take over.

BTC/USD Bitstamp Daily Chart

BTC/USD Bitstamp 1-Hour Chart