Bitcoin price continues to break new grounds today as bulls prepare to take on the ,900 resistance. Since the bottom of the brief dip yesterday at 08:00 UTC, billion has been added to the market with most of it being piled into BTC. Bitcoin dominance has now broken over 65.0% for the first time since June, which shows there’s currently little interest in altcoins at this moment in time. Even some of the typically strong performing DeFi tokens such as Yearn.finance (YFI) and Dai (DAI) are in the red today, down 7.89% and 0.04% respectively. It’s also worth noting that November tends to be one of the best seasonal times for Bitcoin, according to data collected by Willy Woo, and is profitable over 70% of the time. Price Levels to Watch in the Short-term On the 4-hour

Topics:

Ollie Leech considers the following as important: Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

Bitcoin price continues to break new grounds today as bulls prepare to take on the $14,900 resistance. Since the bottom of the brief dip yesterday at 08:00 UTC, $24 billion has been added to the market with most of it being piled into BTC.

Bitcoin dominance has now broken over 65.0% for the first time since June, which shows there’s currently little interest in altcoins at this moment in time. Even some of the typically strong performing DeFi tokens such as Yearn.finance (YFI) and Dai (DAI) are in the red today, down 7.89% and 0.04% respectively.

It’s also worth noting that November tends to be one of the best seasonal times for Bitcoin, according to data collected by Willy Woo, and is profitable over 70% of the time.

Price Levels to Watch in the Short-term

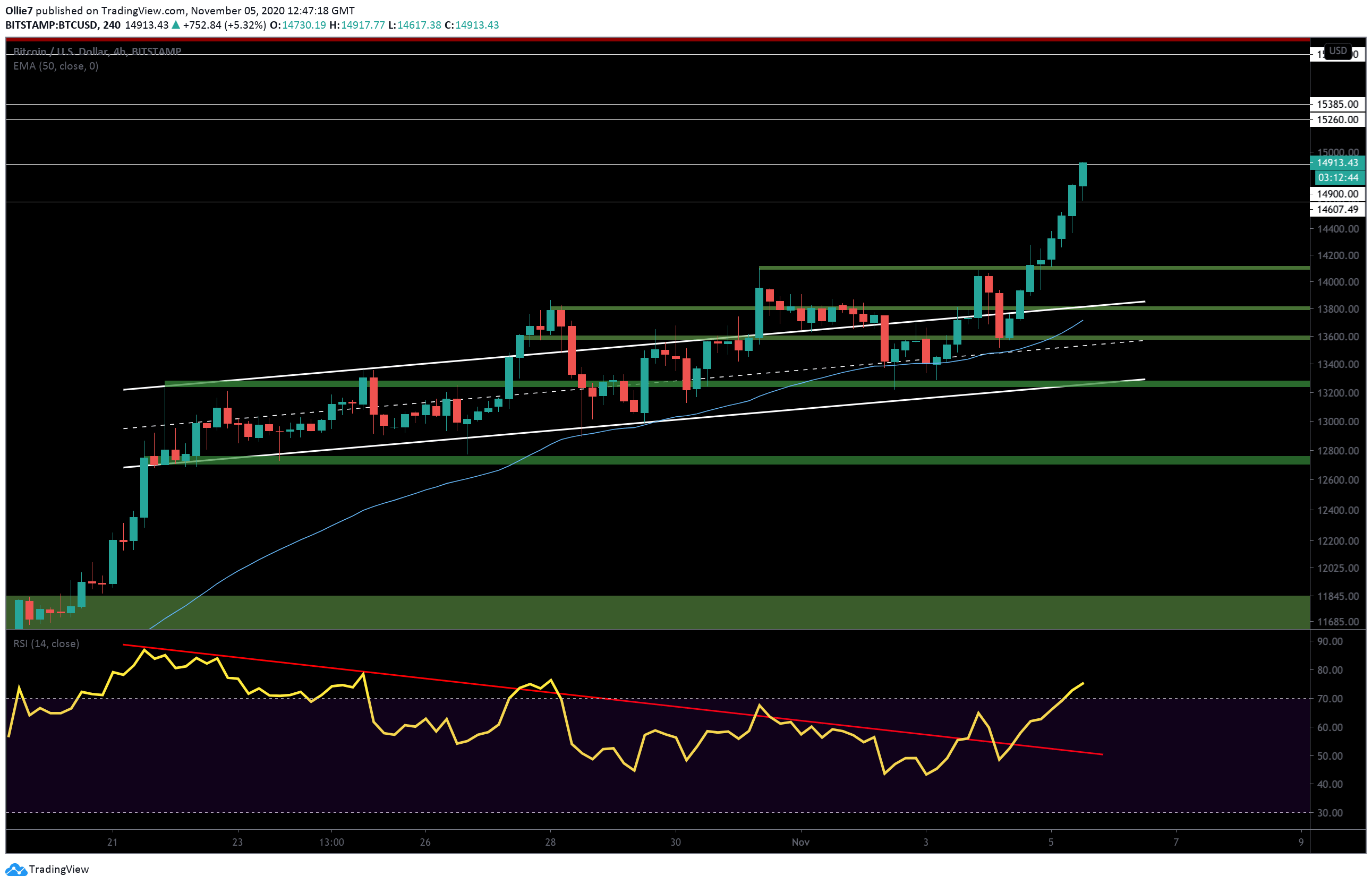

On the 4-hour BTC/USD chart, we can see that the leading crypto is flying towards the $14,900 mark where it will likely meet some selling pressure from short traders and investors taking a profit.

If bulls can overcome this level without much difficulty then it should be a good signal that there’s enough momentum in the trend to take on the psychological $15K milestone above. This was a key daily close level back on January 8, 2018, and will certainly test the confidence of BTC bulls.

Looking above this critical area, we have additional daily resistances around $15,260, $15,385, and $15,800 that could create some friction as the rally continues.

If the current leg of the uptrend runs out of steam, however, and bitcoin fails to hold above the $14,800 or $15,000 resistance levels in the short-term, then we should expect to see the $14,100, $13,800, and $13,590 (lower green shaded lines) supports play an important role in propping the asset up from further decline.

On the RSI indicator, we can see promising signs of a bullish trend reversal. The asset has successfully broken through the down-trending resistance level (red) and is printing consecutive higher lows. Over the 4-hour, daily, and weekly timeframes, bitcoin is well and truly in the overbought region but that doesn’t seem to be impacting the momentum much, which implies hype and greed are fuelling this rise as opposed to technical factors. Because of this, it’s possible that prices may fall as sharply as they have risen if the asset shows any weakness at the $15K resistance – as greed turns back into fear.

Total market capital: $427 billion

Bitcoin market capital: $275 billion

Bitcoin dominance: 64.5%

*Data by Coingecko.

Bitstamp BTC/USD 4-Hour Chart