The leading digital asset manager, Grayscale Investments, continues with its growth after registering its third consecutive record-breaking quarter with over billion of inflows. Somewhat expectedly, the Bitcoin Trust remained the most widely chosen company product. Billion Entered Grayscale In Q3 2020 Grayscale released its Q3 2020 report earlier, noting that the total investments into company products in those three months alone accounted for .05 billion. Adding the two previous quarters, which were also record-breaking at the time, the year-to-date inflows rise to .4 billion. Just for comparison, Grayscale had attracted about .2 billion since its inception in 2013 to 2019. This makes the YTD 2020 inflows twice as much. The total amount invested in the company

Topics:

Jordan Lyanchev considers the following as important: AA News, BTCEUR, BTCGBP, btcusd, btcusdt, Grayscale

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The leading digital asset manager, Grayscale Investments, continues with its growth after registering its third consecutive record-breaking quarter with over $1 billion of inflows. Somewhat expectedly, the Bitcoin Trust remained the most widely chosen company product.

$1 Billion Entered Grayscale In Q3 2020

Grayscale released its Q3 2020 report earlier, noting that the total investments into company products in those three months alone accounted for $1.05 billion. Adding the two previous quarters, which were also record-breaking at the time, the year-to-date inflows rise to $2.4 billion.

Just for comparison, Grayscale had attracted about $1.2 billion since its inception in 2013 to 2019. This makes the YTD 2020 inflows twice as much.

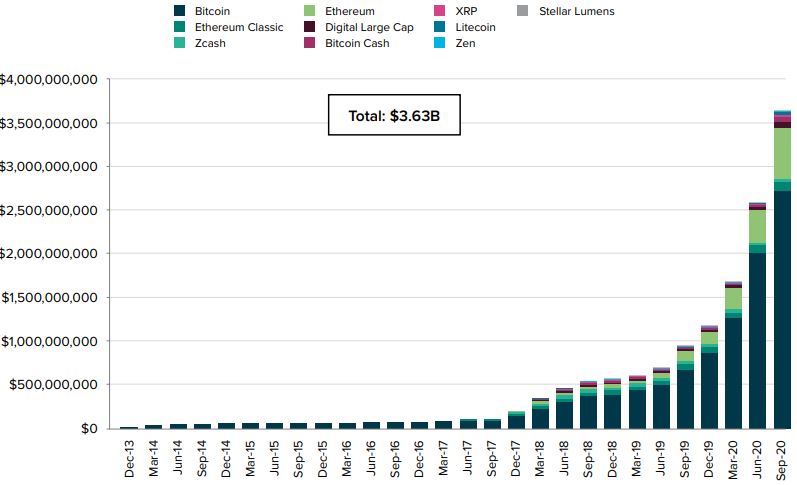

The total amount invested in the company has grown to $3.63 billion, as the graph below demonstrates.

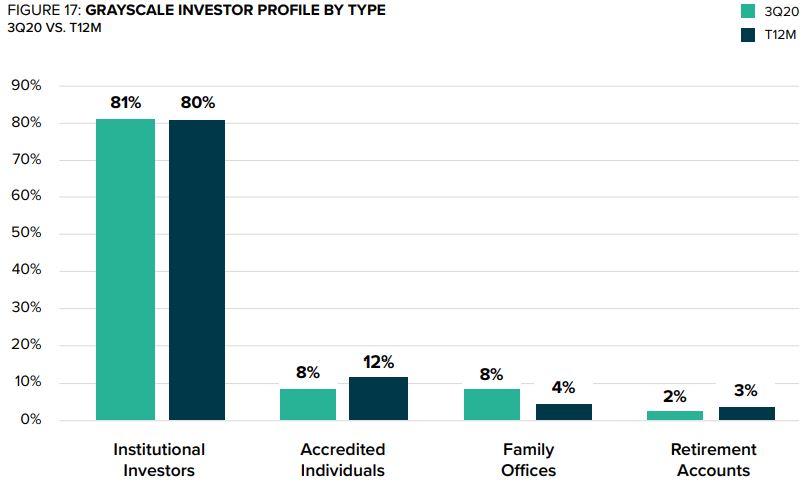

Institutional investors have continued to dominate the Grayscale landscape as they were responsible for 81% of the Q3 inflows. The main difference from previous years comes from accredited individuals and family offices.

The percentage of accredited investors allocating funds into Grayscale products have dropped from 12 to 8, while family offices have increased from 4% to 8%.

Bitcoin (Still) King, Altcoins Also Rise

The Grayscale report highlighted that the Bitcoin Trust has continued to attract the most interest and, consequently, investments. During Q3 2020, the total inflow has expanded by $719.3 million.

However, it’s worth noting that the amount was higher during the previous quarter – $750 million. Grayscale has acknowledged it by saying that “while Bitcoin continues to be a major part of Grayscale investor allocations, the most notable uptick in growth comes from products that hold alternative assets. Products excluding Bitcoin accounted for 31% of inflows during Q3 2020.”

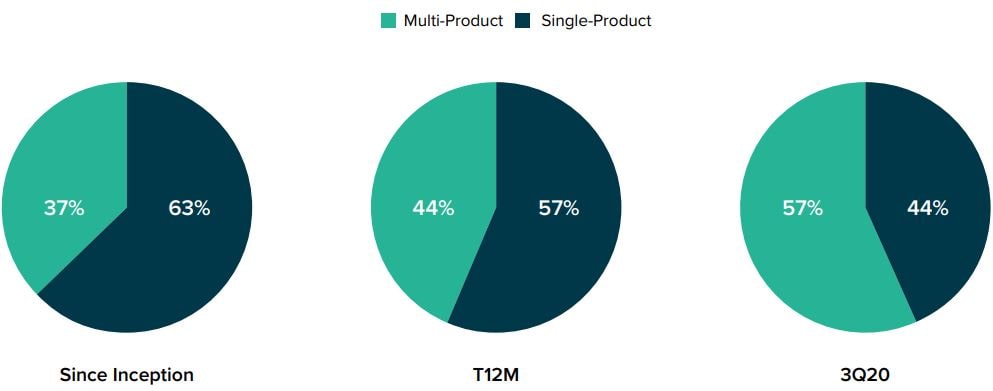

The number of investors that purchased more than one company products has increased as well.

“Since inception, approximately 37% of investors have allocated to multiple products. In Q3 2020, that proportion increased to 57%.”

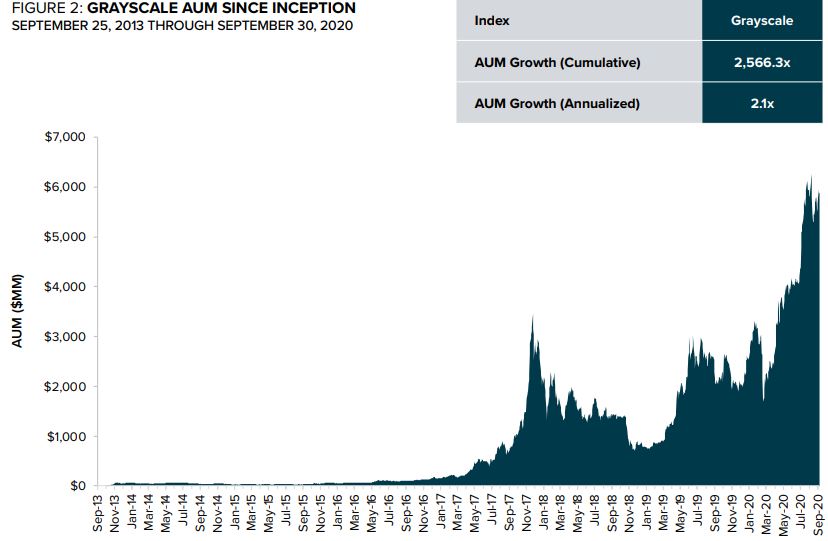

Ultimately, the Assets Under Management has surged to $5.9 billion after the impressive quarterly results. On a yearly scale, the increase is nearly 200% as Grayscale entered the new century with $2 billion of AUM.